Pound Sterling gains after upbeat UK data, hot US PPI

- The Pound Sterling recovers sharply against its major peers after the UK ONS reported robust factory data and expected GDP growth in August.

- Traders expect the BoE to cut interest rates in at least one of its two policy meetings remaining this year.

- The US annual PPI data for September grew faster than expected.

The Pound Sterling (GBP) gyrates in a tight range near 1.3060 against the US Dollar (USD) in Friday's North American session. The GBP/USD pair remains sideways despite the release of the hotter-than-expected United States (US) annual US Producer Price Index (PPI) data for September.

The Bureau of Labor Statistics (BLS) reported that the headline PPI rose by 1.8%, faster than estimates of 1.6% but slower than 1.9% in August, upwardly revised from 1.7%. Also, the core PPI – which strips off volatile food and energy prices – accelerated at a faster-than-expected pace to 2.8% from 2.6% in August, upwardly revised from 2.4%. Economists estimated the core PPI to have grown by 2.7%.

On month-on-month, the producer inflation barely grew in September. The headline PPI remained flat after growing by 0.2% in August. While the core PPI rose expectedly by 0.3%. Thursday's hot Consumer Price Index (CPI) and producer inflation data for September suggest that a victory over inflation cannot be announced in the near term.

Thursday’s CPI report showed that the annual core inflation – which excludes volatile food and energy prices – accelerated to 3.3%. The headline inflation rose by 2.4%, faster than estimates of 2.3% but slower than the August print of 2.5%.

However, traders are confident that the Fed will cut interest rates next month but at a gradual pace of 25 bps, according to the CME FedWatch tool. Also, a majority of Fed policymakers see more rate cuts as appropriate amid uncertainty over labor market strength.

On Thursday, New York Fed Bank President John Williams said at an event at Binghamton University, "Based on my current forecast for the economy, I expect that it will be appropriate to continue the process of moving the stance of monetary policy to a more neutral setting over time."

Daily digest market movers: Pound Sterling to be influenced by UK Employment and Inflation data

- The Pound Sterling outperforms its major peers on Friday after the release of the United Kingdom (UK) data. The British currency gains as the monthly factory data came in better than expected, and the Gross Domestic Product (GDP) grew expectedly in August.

- The Office for National Statistics (ONS) reported that the economy returned to growth after remaining flat in the last two months. The economy expanded by 0.2%, as expected. Month-on-month Manufacturing and Industrial Production rose at a robust pace of 1.1% and 0.5%, respectively, while economists expected them to grow by 0.2%.

- Annually, Manufacturing and Industrial Production contracted by 0.3% and 1.6%, respectively. However, the pace at which both economic data declined was slower than in July.

- Upbeat monthly factory data and an expected GDP growth have improved the UK economic outlook. This will also provide some relief to the Labor government, which is all set to announce its first fiscal budget later this month.

- Going forward, the next trigger for the Pound Sterling will be the UK Employment data for the three months ending August and the Consumer Price Index (CPI) report for September, which will be published on Tuesday and Wednesday, respectively. The economic data will significantly influence market expectations for Bank of England's (BoE) likely interest rate action in November. Financial market participants expect the BoE to cut interest rates only once in the remaining two policy meetings this year.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | -0.02% | 0.39% | 0.13% | 0.11% | 0.11% | 0.21% | |

| EUR | 0.00% | -0.06% | 0.36% | 0.08% | 0.10% | 0.07% | 0.17% | |

| GBP | 0.02% | 0.06% | 0.39% | 0.14% | 0.16% | 0.12% | 0.24% | |

| JPY | -0.39% | -0.36% | -0.39% | -0.26% | -0.26% | -0.29% | -0.25% | |

| CAD | -0.13% | -0.08% | -0.14% | 0.26% | 0.00% | -0.02% | 0.10% | |

| AUD | -0.11% | -0.10% | -0.16% | 0.26% | -0.00% | -0.05% | 0.05% | |

| NZD | -0.11% | -0.07% | -0.12% | 0.29% | 0.02% | 0.05% | 0.12% | |

| CHF | -0.21% | -0.17% | -0.24% | 0.25% | -0.10% | -0.05% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

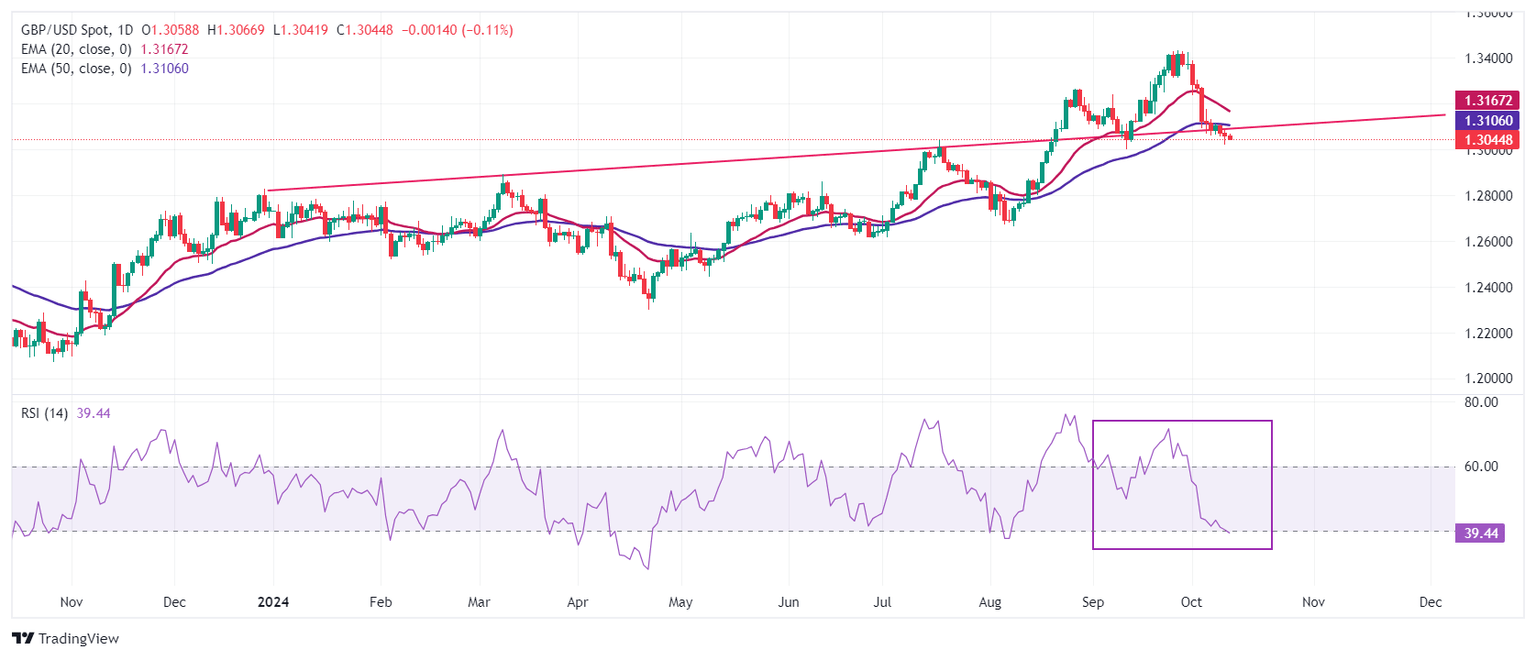

Technical Analysis: Pound Sterling strives to reclaim 50-day EMA

The Pound Sterling recovers from the monthly low of 1.3010 against the US Dollar. However, the outlook of the GBP/USD pair remains vulnerable as it has stabilized below the upward-sloping trendline plotted from the 28 December 2023 high of 1.2827.

The near-term trend of the Cable has become bearish as it trades below the 20- and 50-day Exponential Moving Averages (EMAs), which trade around 1.3167 and 1.3106, respectively.

The 14-day Relative Strength Index (RSI) declines to near 40.00. More downside would appear if the momentum oscillator falls below the above-mentioned level.

Looking up, the round-level resistance of 1.3100 and the 20-day EMA near 1.3170 will be a major barricade for Pound Sterling bulls. On the downside, the Pound Sterling would find support near the psychological figure of 1.3000.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.