Pound Sterling outperforms US Dollar on soft US PPI, upbeat UK GDP data

- The Pound Sterling gains against the US Dollar on Thursday on soft US PPI and better-than-expected UK GDP data.

- Soft US producer and consumer inflation is unlikely to drive market expectations for the Fed's monetary policy outlook.

- Manufacturing and Industrial Production declined at a faster pace on a monthly basis in March.

The Pound Sterling (GBP) jumps slightly above 1.3300 against the US Dollar in North American trading hours. The GBP/USD pair gains as the US Dollar faces selling pressure after the release of the softer-than-expected United States (US) Producer Price Index (PPI) report for April.

The data showed that the headline PPI rose at a slower pace of 2.4% on year, compared to estimates of 2.5% and the March reading of 2.7%. In the same period, the core PPI - which excludes volatile food and energy prices - grew by 3.1%, as expected, slower than the prior release of 4%, upwardly revised from 3.3%. Meanwhile, month-on-month headline and core PPI surprisingly deflated by 0.5% and 0.4%, respectively.

Theoretically, cooling growth in prices of goods and services at factory gates provides a big relief to Federal Reserve (Fed) officials. However, it is unlikely to do so as they are more concerned about elevated household inflation expectations. Additionally, the US Consumer Price Index (CPI) data has also slowed in April.

On Wednesday, Fed Vice Chair Philip Jefferson stated in his prepared remarks at a New York Fed event that current policy is “moderately restrictive,” adding that it is “well-positioned” amid elevated uncertainty on how new economic policies by US President Donald Trump will shape the economic outlook and drive inflation.

Jefferson cheered the latest softer CPI report but warned of uncertainty around the future path of inflation in the wake of tariffs imposed by Washington. "If the increases in tariffs announced so far are sustained, they are likely to interrupt progress on disinflation and generate at least a temporary rise in inflation,” he said.

According to the CME FedWatch tool, the Fed is unlikely to reduce interest rates anytime before the September policy meeting. The tool also suggests that the central bank would cut borrowing rates two times this year.

Meanwhile, the US Retail Sales data, a key measure of consumer spending, has barely grown in April. The consumer spending measure rose by 0.1% on month, while it was expected to remain flat.

Daily digest market movers: Pound Sterling rises after upbeat UK GDP data

- The Pound Sterling outperforms its peers, except second-level safe-haven currencies, on Thursday following the release of the United Kingdom (UK) Gross Domestic Product (GDP) data. The Office for National Statistics (ONS) reported that the economy grew at a robust pace of 0.7% in the January-March period, compared to the estimates of 0.6%. The economy barely expanded in the last quarter of 2024.

- Year-on-year, the UK’s preliminary GDP growth has reached 1.3% in the first quarter, slightly higher than expectations of 1.2% but slower than the prior release of 1.5%. In March, the UK economy expanded by 0.2%, while economists anticipated a flat performance after a 0.5% growth in February.

- Higher UK GDP growth reflects a strong economic health, which diminishes hopes of aggressive monetary policy easing by the Bank of England (BoE), which bodes well for the Pound Sterling.

- On Wednesday, BoE Monetary Policy Committee (MPC) member Catherine Mann commented in an interview with CNBC that the monetary policy should be kept at their current levels due to upside risks to inflation and solid labor market conditions, Reuters reported. Mann stated that the labor market is strong despite the employment data for the three-month ending March showing slower job growth on Tuesday. "The first observation is that the labour market has been more resilient. Now, yes, we’ve had some prints that are indicative of a slowing labour market, but it is not a non-linear adjustment,” Mann said.

- Meanwhile, the UK Manufacturing and Industrial Production data for March has come in weaker than expected. Month-on-month Manufacturing and Industrial Production data declined by 0.8% and 0.7%, respectively, while they both were expected to contract by 0.5%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.34% | -0.38% | -0.70% | 0.06% | 0.23% | 0.31% | -0.79% | |

| EUR | 0.34% | -0.04% | -0.36% | 0.40% | 0.57% | 0.66% | -0.46% | |

| GBP | 0.38% | 0.04% | -0.29% | 0.44% | 0.60% | 0.72% | -0.39% | |

| JPY | 0.70% | 0.36% | 0.29% | 0.75% | 0.93% | 1.00% | -0.09% | |

| CAD | -0.06% | -0.40% | -0.44% | -0.75% | 0.18% | 0.27% | -0.83% | |

| AUD | -0.23% | -0.57% | -0.60% | -0.93% | -0.18% | 0.09% | -0.98% | |

| NZD | -0.31% | -0.66% | -0.72% | -1.00% | -0.27% | -0.09% | -1.08% | |

| CHF | 0.79% | 0.46% | 0.39% | 0.09% | 0.83% | 0.98% | 1.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

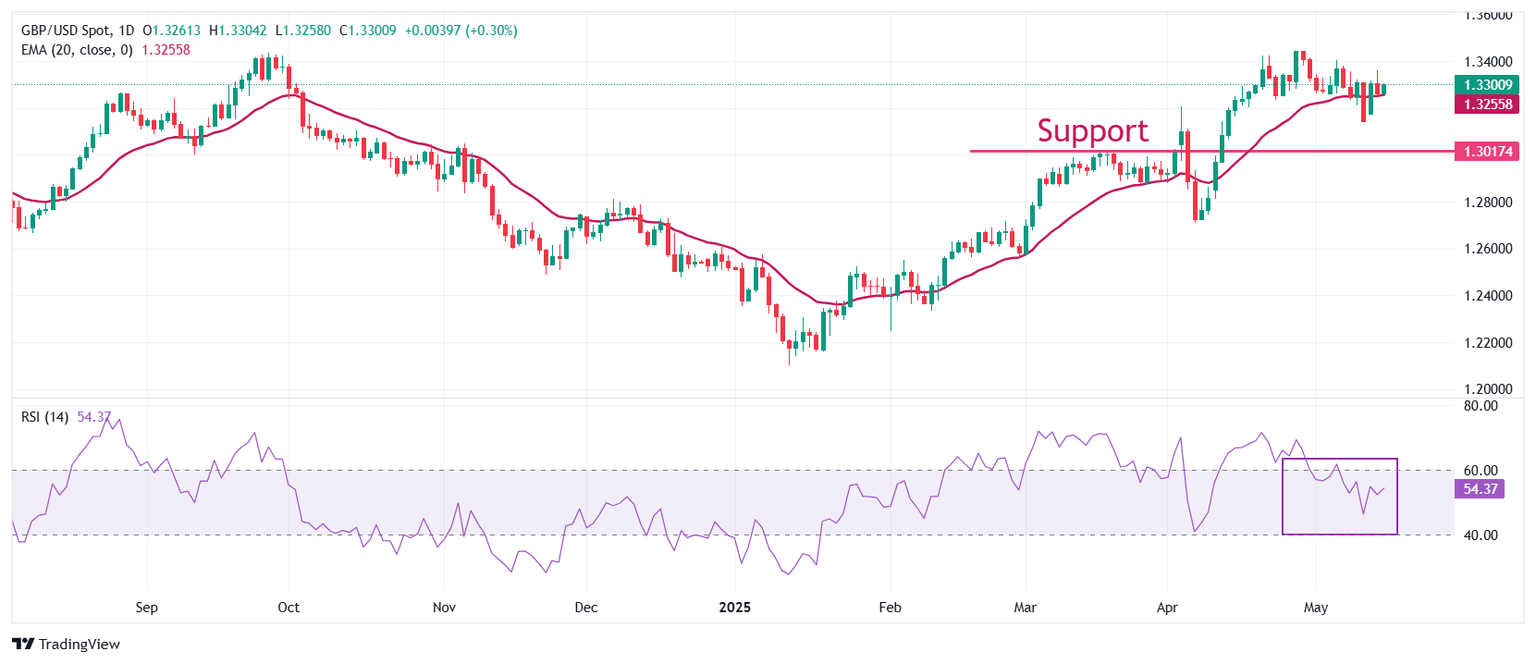

Technical Analysis: Pound Sterling stays above 20-day EMA

The Pound Sterling climbs to near 1.3300 against the US Dollar on Thursday. The GBP/USD pair holds above the 20-day Exponential Moving Average (EMA), which trades around 1.3256, suggesting that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range. A fresh bullish momentum would appear if the RSI breaks above 60.00.

On the upside, the three-year high of 1.3445 will be a key hurdle for the pair. Looking down, the psychological level of 1.3000 will act as a major support area.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.