Pound Sterling drops as UK GDP shrinks for second straight month

- The Pound Sterling drops against its peers as the UK GDP declines by 0.1% for the second month in a row.

- Shrinking UK economic activity paves the way for a BoE interest rate cut on Thursday.

- Next week, investors will keenly focus on UK-US employment data.

The Pound Sterling (GBP) faces selling pressure against its major peers on Friday following the release of the United Kingdom (UK) Gross Domestic Product (GDP) data for October. The GDP report showed that the economic growth contracted again by 0.1%, missing expectations of a 0.1% expansion.

Weak UK GDP data defies the recent economic growth upgrade from the Office for Budget Responsibility (OBR), which raised GDP projections for the current year to 1.5% from the 1.0% anticipated in March.

The continuous decline in UK GDP is also expected to further boost expectations supporting an interest rate cut by the Bank of England (BoE) at next week's policy meeting. Traders have already priced in a 25-basis point (bps) interest rate reduction that would push key rates lower to 3.75%.

The GDP report also showed that Industrial Production increased by 1.1% in October on month, beating the estimates of 0.7%. In September, the economic data declined by 2%. On an annual basis, Industrial Production contracted by 0.8% against expectations of -1.2% and the prior reading of -2.5%. Meanwhile, Manufacturing Production came in lower at 0.5% against estimates of 1%, following a 1.7% decline in September.

Next week, a slew of UK data is lined up for release, such as the labour market data for the three months ending October, the Consumer Price Index (CPI) data for November, and the preliminary S&P Global Purchasing Managers’ Index (PMI) data for December, which will influence the Pound Sterling’s outlook.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.13% | 0.19% | -0.07% | -0.09% | -0.04% | 0.04% | |

| EUR | -0.09% | 0.04% | 0.11% | -0.15% | -0.18% | -0.13% | -0.05% | |

| GBP | -0.13% | -0.04% | 0.06% | -0.19% | -0.21% | -0.16% | -0.09% | |

| JPY | -0.19% | -0.11% | -0.06% | -0.22% | -0.25% | -0.21% | -0.12% | |

| CAD | 0.07% | 0.15% | 0.19% | 0.22% | -0.03% | 0.02% | 0.11% | |

| AUD | 0.09% | 0.18% | 0.21% | 0.25% | 0.03% | 0.05% | 0.13% | |

| NZD | 0.04% | 0.13% | 0.16% | 0.21% | -0.02% | -0.05% | 0.07% | |

| CHF | -0.04% | 0.05% | 0.09% | 0.12% | -0.11% | -0.13% | -0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: US NFP to be next major trigger of US Dollar

- The Pound Sterling gives back its nominal intraday gains and flattens around 1.3385 against the US Dollar (USD) during the European trading session on Friday. The GBP/USD pair falls back after the release of the unexpectedly weak UK monthly GDP data. Despite the retreat, the outlook of the pair remains broadly firm as the US Dollar remains fragile following the Federal Reserve’s (Fed) monetary policy outcome.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, struggles to regain ground after posting a fresh seven-week low near 98.15 on Thursday.

- On Wednesday, the Fed lowered its interest rates by 25 basis points (bps) to 3.50%-3.75% and signaled that there will be one more cut in 2026. Fed Chair Jerome Powell stated that inflationary pressures would peak in the first quarter of the next year if there were no new tariffs.

- The inflation and the monetary policy guidance from the Fed turned out as a major drag on the US Dollar as it was contrary to what market participants had projected. Investors anticipated the central bank to signal that there will be no further interest rate cuts unless officials see a dramatic shift in inflation risks.

- Meanwhile, US President Donald Trump has stated after the Fed’s policy meeting that there should be more interest rate cuts going forward. “I know there was a quarter-point reduction this past week, and the President was pleased to see that, but he thinks more should be done," White House spokeswoman Karoline Leavitt said on Thursday, Reuters reported.

- Going forward, the major trigger for the US Dollar will be the US Nonfarm Payrolls (NFP) data for November, which will be released on Tuesday. The impact of the US NFP data will be significant on market expectations for the Fed’s monetary policy outlook as the key reason behind the central bank reducing the Federal Fund rate by 75 bps this year has been weakening labor demand.

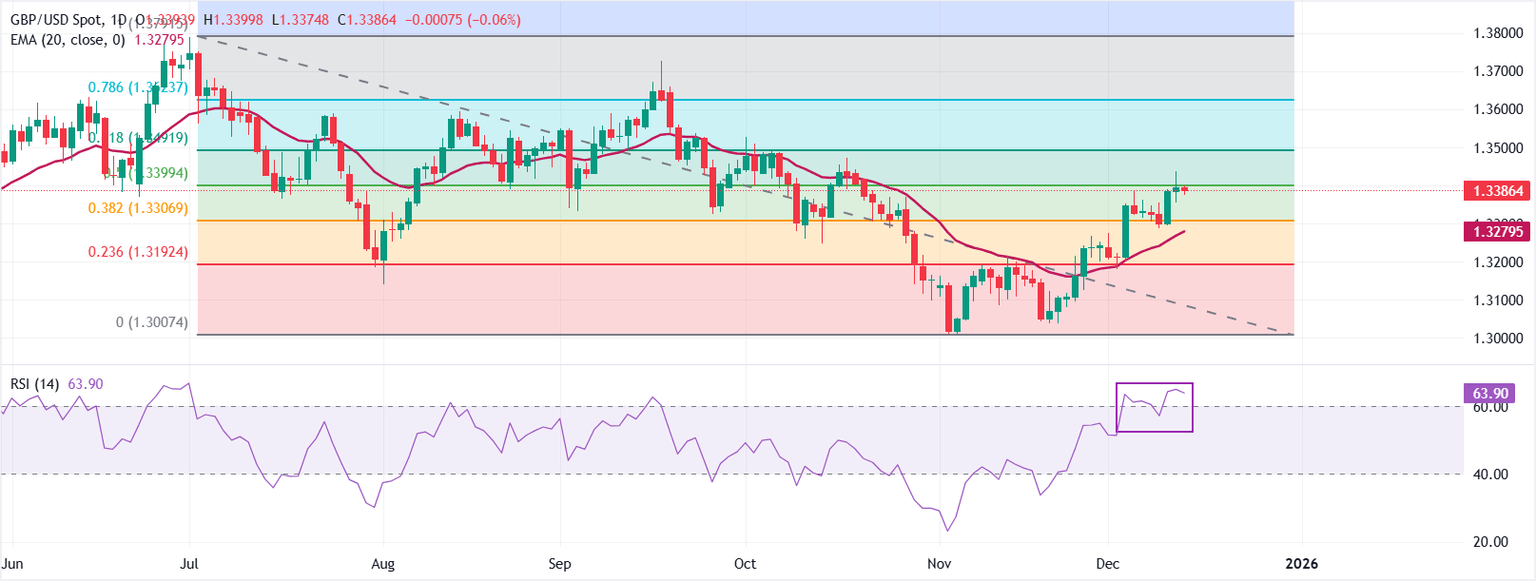

Technical Analysis: GBP/USD struggles to extend its advance above 1.3400

GBP/USD drops to near 1.3380 on Friday. The 20-day Exponential Moving Average (EMA) has turned higher and price holds above it, reinforcing a near-term upside bias.

The 14-day Relative Strength Index (RSI) at 64 is positive and not overbought, backing more upside. Measured from the 1.3791 high to the 1.3007 low, the pair cleared the 38.2% retracement at 1.3307 and is approaching the 50% retracement at 1.3399.

Further upside would emerge on a daily close above the 50% retracement at 1.3399, targeting the October high of 1.3527, whereas failure there could trigger a pullback. The 20-EMA at 1.3279 offers initial support, with its rising slope favoring dip-buying.

(The technical analysis of this story was written with the help of an AI tool)

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.