EUR/USD eases from highs with markets calm and the US Dollar depressed

- EUR/USD eases to 1.1730 from the two-month high at 1.1762 posted on Thursday.

- The increasing monetary policy divergence between the ECB and the Fed keeps the US Dollar on its back foot.

- Technical indicators suggest that Euro bulls are starting to lose steam after the rally of the last two days.

EUR/USD posts marginal losses, trading at 1.1730 on Friday after pulling back from its highest levels in more than two months at 1.1762 reached on Thursday. The increasing monetary policy divergence between the European Central Bank (ECB) and the US Federal Reserve (Fed) is underpinning support for the pair, which has rallied nearly 2% in the last three weeks.

The Fed cut rates this week and pointed to one more rate cut in 2026. Investors, however, still expect that the US central bank will ease monetary policy at least two times, considering that Chairman Jerome Powell will likely be replaced by the more dovish-leaning Kevin Hassett. Hasset is the White House economic adviser and has repeatedly shown his inclination for significantly lower borrowing costs.

On the macroeconomic front, German consumer inflation data confirmed that price pressures accelerated in November, although the monthly inflation contracted. In the US, a batch of Fed policymakers will take the stage and might give further insight into the central bank's monetary policy.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.12% | 0.20% | -0.06% | -0.13% | -0.07% | 0.02% | |

| EUR | -0.08% | 0.03% | 0.13% | -0.14% | -0.22% | -0.16% | -0.06% | |

| GBP | -0.12% | -0.03% | 0.08% | -0.17% | -0.25% | -0.19% | -0.10% | |

| JPY | -0.20% | -0.13% | -0.08% | -0.24% | -0.32% | -0.28% | -0.17% | |

| CAD | 0.06% | 0.14% | 0.17% | 0.24% | -0.08% | -0.04% | 0.08% | |

| AUD | 0.13% | 0.22% | 0.25% | 0.32% | 0.08% | 0.05% | 0.15% | |

| NZD | 0.07% | 0.16% | 0.19% | 0.28% | 0.04% | -0.05% | 0.10% | |

| CHF | -0.02% | 0.06% | 0.10% | 0.17% | -0.08% | -0.15% | -0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily Digest Market Movers: Euro gains on US Dollar's weakness

- The Euro (EUR) continues drawing support from broad-based US Dollar weakness. The USD Index, which measures the value of the Greenback against a basket of six majors, has been trading at two-month lows near 98.00, as investors keep pricing further Fed cuts, while most major central banks are at the end of their easing cycles.

- Data from Germany released on Friday revealed that the Harmonized Index of Consumer Prices (HICP) accelerated to 2.6% in the year to November, from 2.3% in the previous month, while prices fell by 0.5% on the month. These figures confirm the preliminary numbers and, therefore, the impact on the Euro has been minimal.

- In the US, Jobless Claims data released on Thursday showed that first-time applications for unemployment benefits rose by 44,000 in the first week of December, to 236,000. This is the largest increase in more than four years and backs the idea that the Fed will be forced to lower interest rates further to support a deteriorating labour market.

- Later in the day, the focus will shift to Philadelphia Fed President, Anna Paulson, the Cleveland Fed President, Beth Hammack, the Chicago Fed President, Austan Goolsbee, and Kansas City Fed President, Jeff Schmid, who will make public comments during the American trading hours.

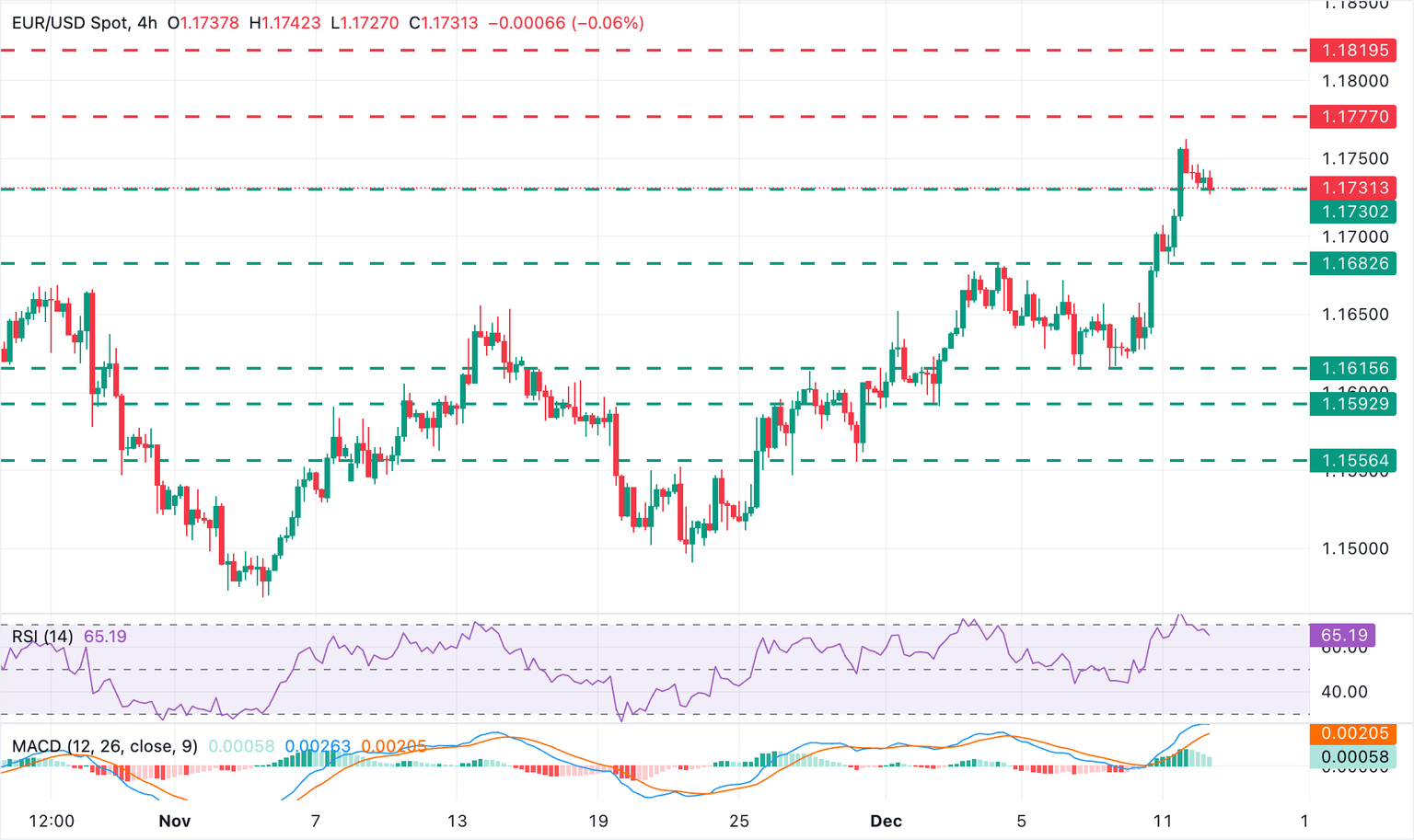

Technical Analysis: EUR/USD is reaching overbought levels

The EUR/USD technical picture remains bullish, but momentum indicators are reaching overbought levels, suggesting that the pair's rally is starting to look overstretched. The 4-Hour Relative Strength Index (RSI) is pulling back from levels past 70, and the Moving Average Convergence Divergence (MACD) indicator is turning flat, which suggests that the bullish trend might be losing steam.

Downside attempts remain contained above the October 17 high at around 1.1730. This level closes the path towards Thursday's low at the 1.1680 area and the December 9 low at 1.1615. To the upside, Thursday's high at 1.1762 and the October 1 high at around 1.1780 are likely to challenge bulls. Further up, the target is the September 23 and 24 highs near 1.1820.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.