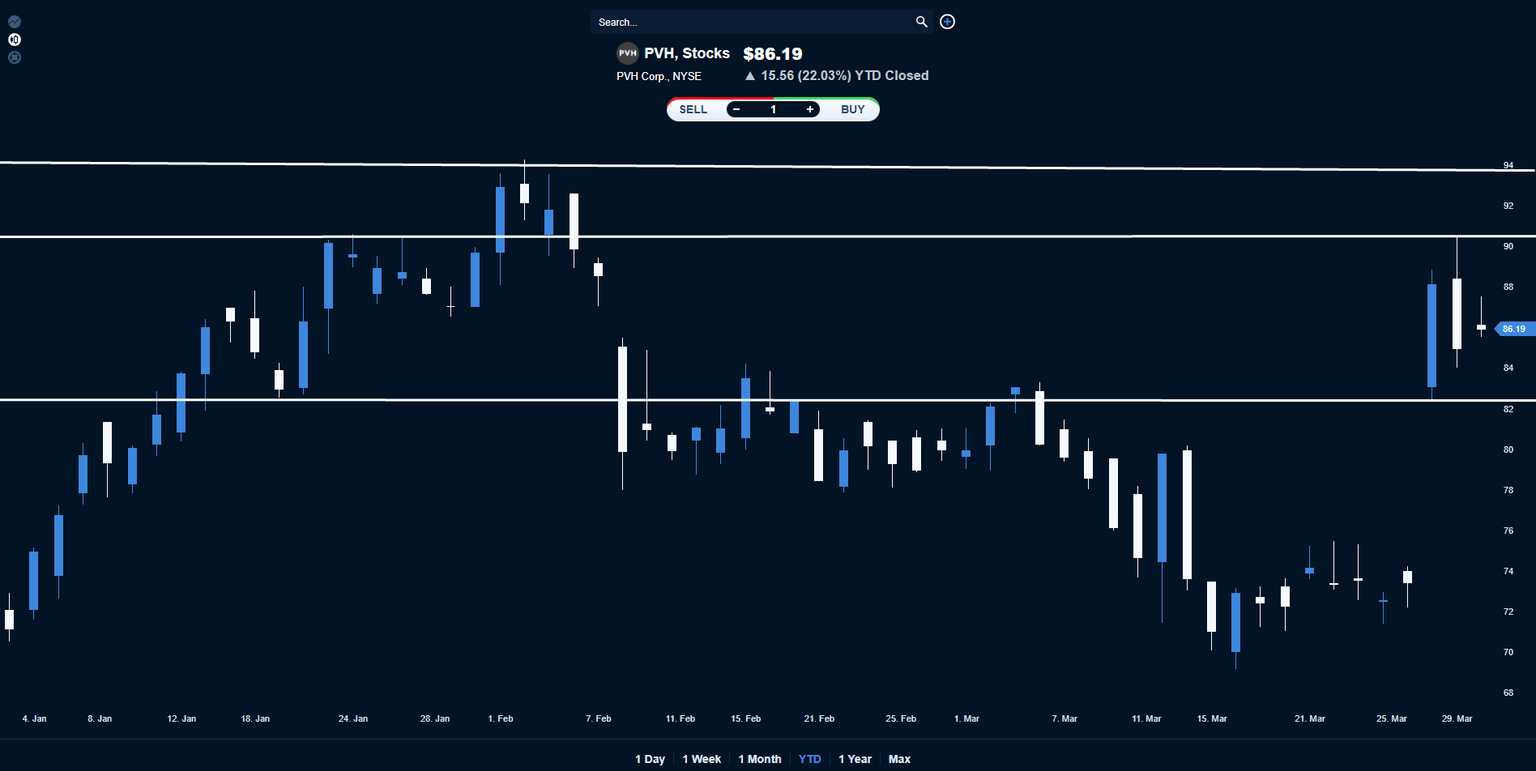

Possible further correction of PVH towards its support level at around $84

Today’s instrument is the PVH Corp, a global apparel company, whose stock is traded in NYSE exchange under the ticker PVH.

Looking at the PVH’s chart, we can see that on the 28 th of March, the price had boosted up from the price of around $74 to the resistance level of around $90.40 due to the previous night’s announcement on the better-than-expected quarterly earnings. After that “long run” it was corrected to the lastly traded price of around $86.20. Today we could expect it to further correct towards its support level at around $84, though at the same time, to keep above that level with the potential to make another upward run.

Author

AAATrade Team

AAATrade

The AAATrade Team has extensive experience in content writing for the financial industry. Stelios Nikolaou is the lead writer of the team, he currently works at AAATrade to provide research and content writing services.