Plug Power Stock Price set to bounce after the unrelated broader market downfall

- NASDAQ:PLUG gains 0.62% to close the week as its upward trajectory continues.

- Wall Street analysts remain bullish on the energy company as year-over-year revenue growth is in store for 2020.

- Friday's pre-market is showing a bounce is on the cards.

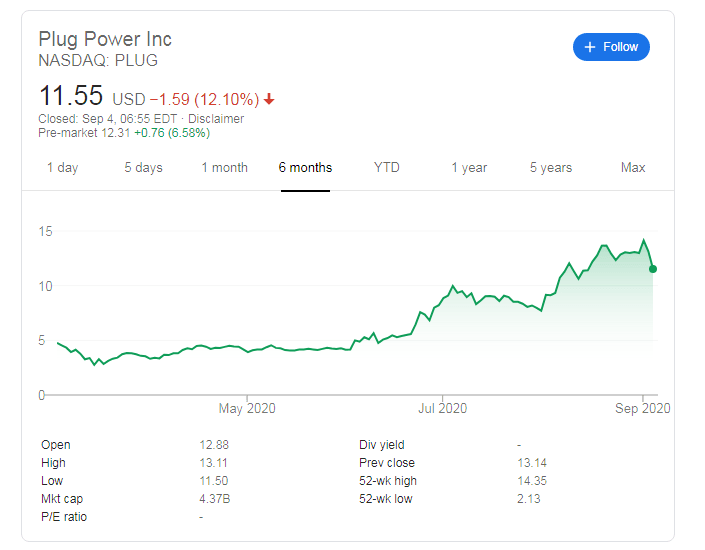

Update 2: NASDAQ: PLUG is changing hands at around $12.31 in pre-market trading, up some 6.58% and partially compensating for the fall of 12% recorded on Thursday. Plug Power suffered from the broad sell-off in markets – heavily affecting tech stocks. As the dust settles, bargain-seekers are separating winners from losers, and PLUG may come out on top.

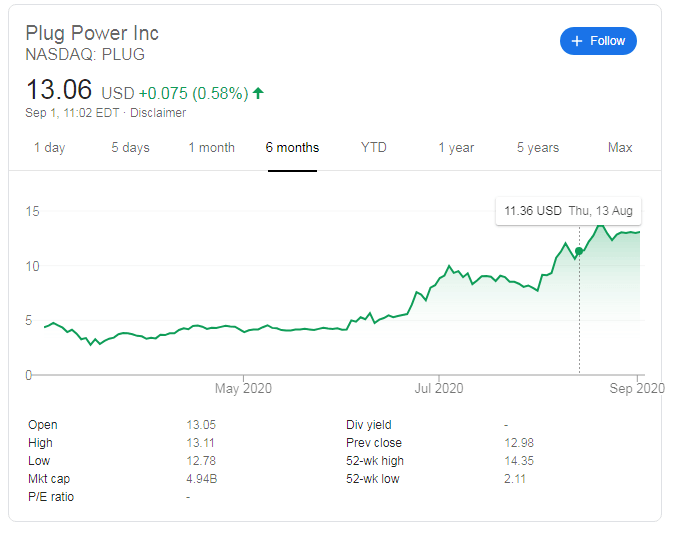

Update: Plug Power's stock price has kicked off September with gains, trading around $13.06 at the time of writing and nearing the closing high of $13.65 recorded in mid-August. Investors are defying warnings from skeptics warning about "red flags" and the Citron report. The broader market mood remains upbeat amid the Fed's dovishness – potentially maintaining zero rates through 2025.

NASDAQ:PLUG has mostly recovered after Citron’s damaging report. That analysis prompted investors to flee from the energy firm on reports of unprofitability and an impending drop to $7 per share. Shares have done the complete opposite since the report was released on August 21st rebounding back to levels within reach of the 52-week highs. Still, the stock has performed admirably even throughout the COVID-19 pandemic with near 500% returns over the past twelve months and currently trading well over the 50-day and 200-day moving averages.

With the recent announcement of its new light-weight 1kW fuel cell – that can be used in drones or autonomous vehicles – Plug clearly has its hands in all of the trendy new markets that should be dictating the tech world for years to come. While Citron was bearish on Plug’s revenues for this year, most Wall Street analysts have held onto a buy rating for the stock with anticipation of beating year-over-year revenues by over 30%. Even if revenue results in land somewhere in between these two assessments, it would be an impressive showing during a period where many firms have had declining revenues – especially in the energy industry.

Plug Stock News

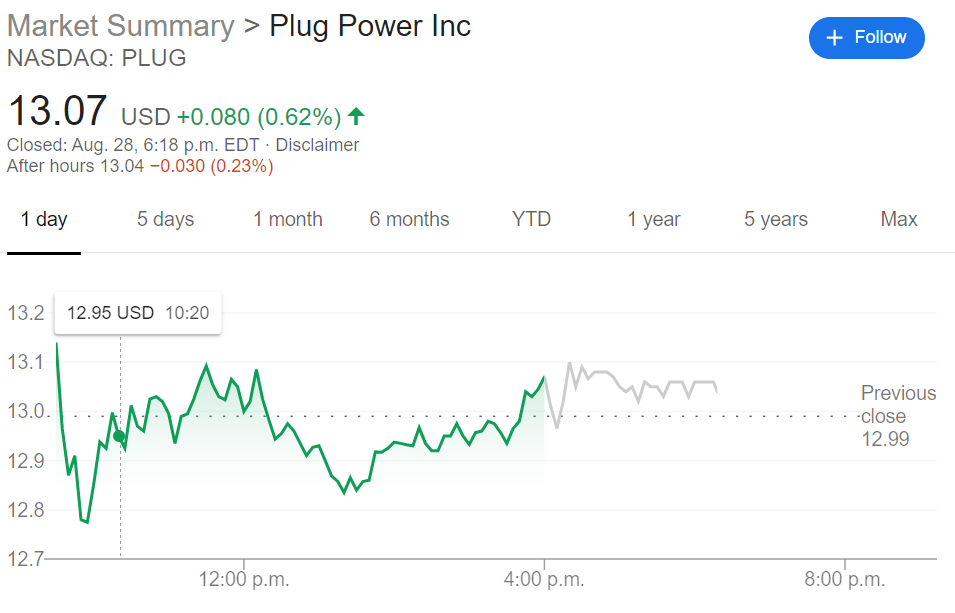

Plug currently sits at $13.07 and has seen its market-cap grow to over $5 billion. That is not an insignificant number for a company that has never been profitable in its 23-year existence. Even still, Wall Street remains bullish on the stock with a one-year price target of $13.45 – which shows that shares have some room to grow but for the most part are fairly priced.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet