PLTR Stock Forecast: Palantir Technologies falls as a bullish analyst lowers his price target

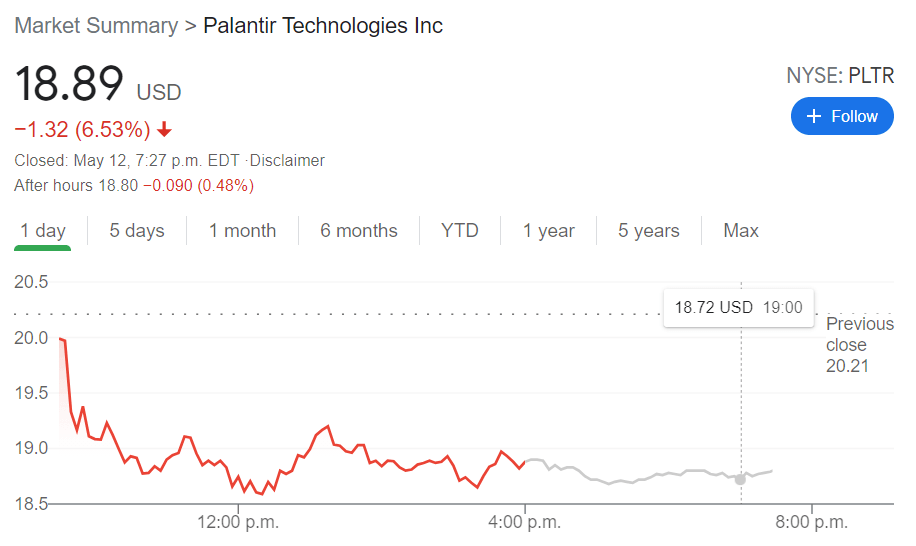

- NYSE:PLTR dropped by 6.53% on Wednesday as the broader markets had the worst trading day since January.

- One of Palantir’s strongest supporters lowered their price target for the stock.

- Other analysts chime in on Palantir following its impressive Q1 earnings call and the stock remains as divisive as ever.

NYSE:PLTR saw most of the gains it made following its first quarter earnings report vanish the next day as the broader markets continued their violent correction. Wednesday saw Palantir fall by 6.53% to close the trading day at $18.89, just one day after gaining nearly 10%. The red day continues Palantir’s downward descent as the stock market battleground stock has tried desperately to grasp at support levels on its way down the charts.

Stay up to speed with hot stocks' news!

Following Palantir’s first quarter earnings call, Goldman Sachs downgraded the price target of the stock from $34 to $30, while reiterating a buy rating. Goldman Sachs has been one of the more bullish investment firms on Palantir since it debuted on Wall Street last September, so the decrease in the price target definitely caught the eye of investors. The change in price target comes after Palantir beat Wall Street revenue estimates and reiterated its guidance on revenue growth for the rest of the year. Palantir also announced that it would be accepting Bitcoin as a payment for contracts moving forward, which is another divisive topic for investors and analysts alike.

PLTR price prediction

Goldman Sachs is not the only firm to weigh in on Palantir’s successful quarter. RBC Capital lowered its price target on Palantir to $20, while on Wednesday, CitiGroup analysts raised their price target to a Wall Street high $170 per share, in a stunning memo. Despite all of these changes, Cathie Wood of Ark Invest continues to stockpile shares of Palantir and bought another 1.3 million shares following its earnings call.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet