PLTR Stock Forecast: Palantir Technologies extends losses on eve of earnings call

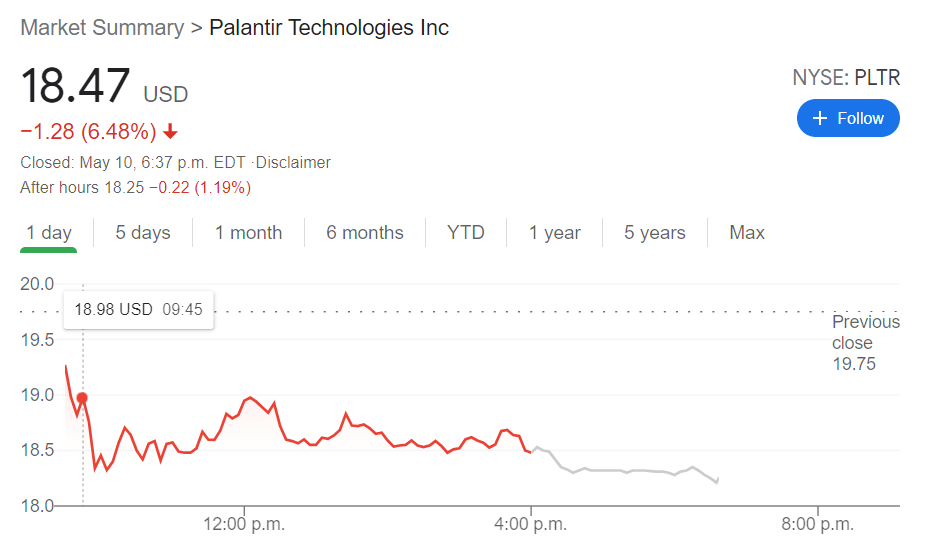

- NYSE:PLTR dropped by a further 6.48% on Monday as growth stocks got rocked once again.

- Palantir is set to report its quarterly earnings call on Tuesday before the opening bell.

- Palantir investors turn bearish after the Pentagon cancels a cloud-based government program.

NYSE:PLTR has remained one of the market’s most enigmatic companies as it approaches its third quarterly earnings call as a publicly traded firm. On Monday, shares of Palantir continued their downward descent as the stock fell by 6.48% to close the last trading session before the pre-market earnings call on Tuesday, at $18.47. For technical analysts, Palantir has formed a descending wedge pattern, which is formed when a stock continues to make lower highs and lower lows. Unless Palantir can finally find some support from bullish investors, the stock could continue to plummet, given how post-earnings drops have become the norm in 2021.

Stay up to speed with hot stocks' news!

Before the opening bell on Tuesday, Palantir executives will be hosting the company’s earnings call. It is perhaps one of the most anticipated calls of the week, as Palantir has developed a near cult following since its public debut at the end of September last year. The mood heading into the call is extremely bearish, and Palantir is in danger of falling back down towards its direct listing price levels. As recently as January, Palantir traded at an all-time high of $45.00, but the stock has lost nearly 60% since.

PLTR price prediction

On Monday, the Pentagon announced that the U.S. Department of Defense has proposed cancelling a JEDI-cloud computing project. Despite the fact that it is not a project that Palantir is a part of, the fact that much of its portfolio consists of government contracts shows why investors are taking this as a negative sign. Shareholders are hopeful that an update on Palantir’s consumer contracts will be positive following the company’s Double Click Foundry demo day earlier this year.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet