Palantir Technologies (PLTR) Stock Price and Forecast: Why is PLTR stock up?

- PLTR surges on Thursday, closing up over 5%.

- The stock breaks our key $27.49 resistance, $31.34 next up.

- Palantir announces a new partnership with Wejo.

Palantir stock surged higher on Thursday, as the stock continued the impressive renaissance seen in the share price on Wednesday. Palantir had been confusing us of late – not hard you say! – as it had broken out after a strong set of results in late August, then consolidated and looked to continue its push higher. The stock formed a perfect bullish continuation flag pattern, broke out of this, but then just as it looked ready to push on the move, it stalled, losing momentum.

PLTR came back into the limelight with a strong performance on Wednesday, which started to get bulls excited again but we really wanted $27 to break. Well, wishes do come through! PLTR was strong straight from the open on Thursday with the stock opening nearly 3% higher and pushing higher steadily as the rest of the session progressed. The strong opening was perfect, however, as the stock broke $27 and then quickly the key $27.49 resistance. This meant bulls entered on momentum and the social media postings grew, as the stock trended heavily in the usual meme-stock chatrooms.

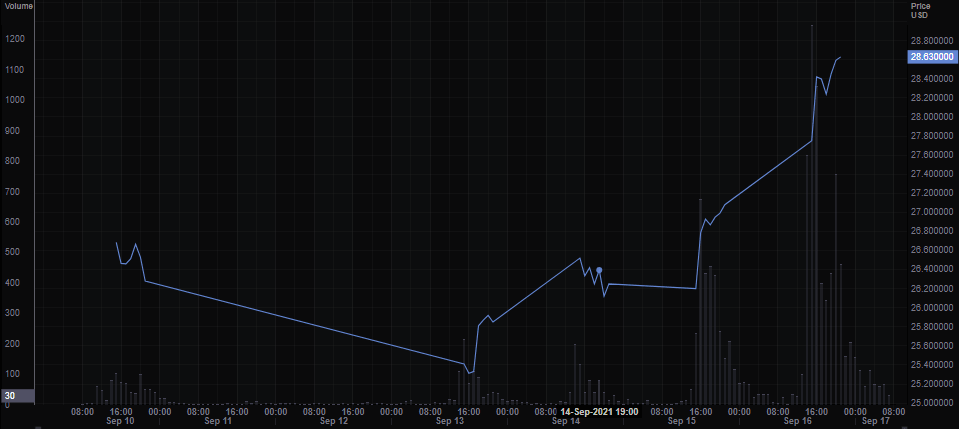

PLTR social media chart

Refinitiv's social media chart above shows how the PLTR spikes in social media volume have corresponded recently with the price appreciation. As the price goes up, it draws more and more attention on social media, as momentum is drawn into the stock. Momentum has always created momentum in the stock market, and the recent FOMO tag is an almost insulting modern description of what is a very psychological human trait. Surging stocks have always created interest.

Palantir key statistics

| Market Cap | $55.9 billion |

| Enterprise Value | $47.8 billion |

| Price/Earnings (P/E) | |

|

Price/Book | 28 |

| Price/Sales | 40 |

| Gross Margin | 0.7 |

| Net Margin | -0.95 |

| EBITDA TTM | -$1.24 billion TTM |

| 52-week low | $8.90 |

| 52-week high | $45 |

| Short Interest | 3.1% |

| Average Wall Street rating and price target |

HOLD $24.61 |

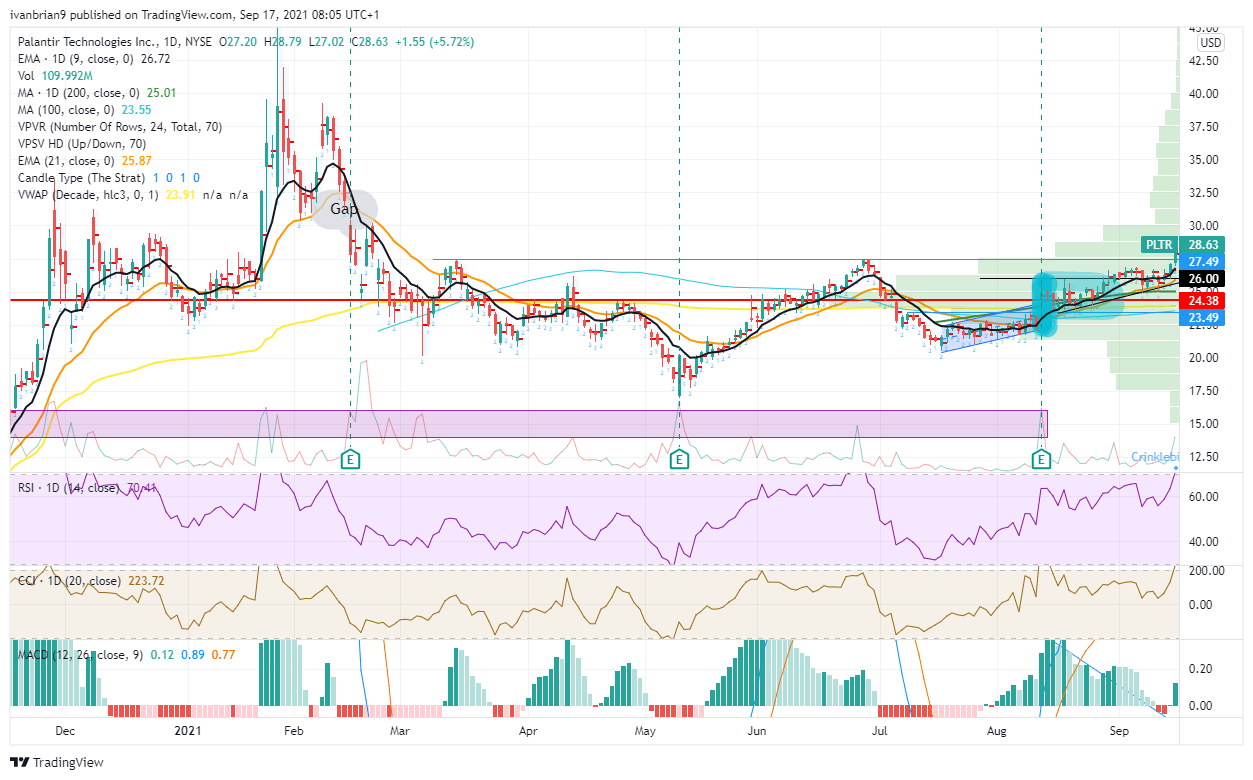

PLTR stock forecast

We did at least identify that, once PLTR got above $27 we turned bullish, as this was likely going to lead to $27.49 breaking. Volume was thinner once above $27, setting up the potential for a sharp move and this is exactly what we got on Thursday. Now, the next level to target is the gap created in February from the earnings release back then. The gap is filled once Palantir stock gets to $31.34.

After such a strong move we would not be surprised to see some consolidation, and this would be a good thing and reduce the likelihood of a quick fall, which we see in many meme stocks. Consolidation allows bulls to recharge and new bulls to enter the market.

PLTR needs to just hold above $27.49, at worst $27. Retracing below these would end the bullish trend in our view. As we have mentioned, volume is lighter up here and it thins out even more above $30, so the move could accelerate again there.

FXStreet view: PLTR bullsh above $27.49, neutral below $27, bearish below $23.

FXStreet trade ideas: Buy the dip at $25 to $23. This is a strong support zone with heavy volume.

PLTR daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.