- Crude oil prices had one the worst selloff in history plummeting to near $20 a barrel in the last four weeks.

- WTI appears to be stabilizing after the carnage but remains vulnerable to the downside.

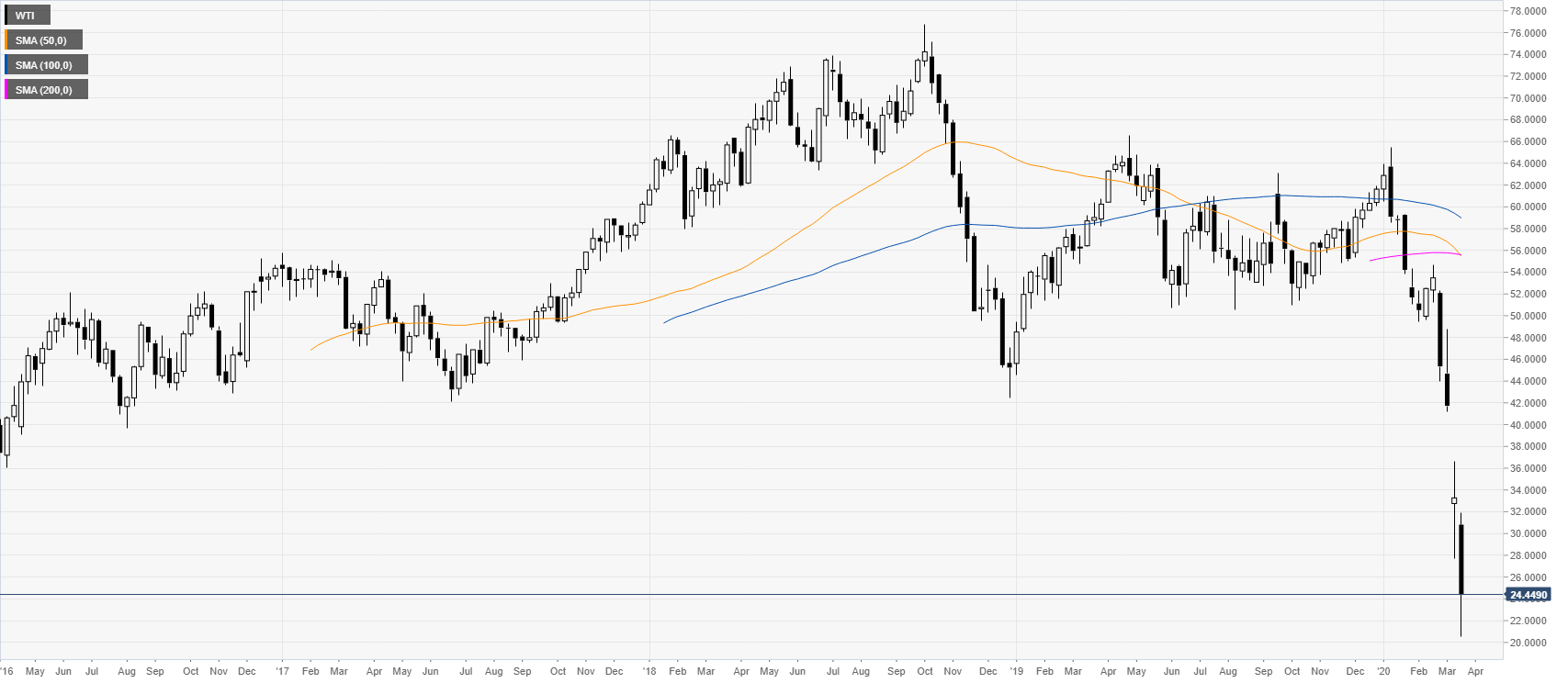

Oil weekly chart

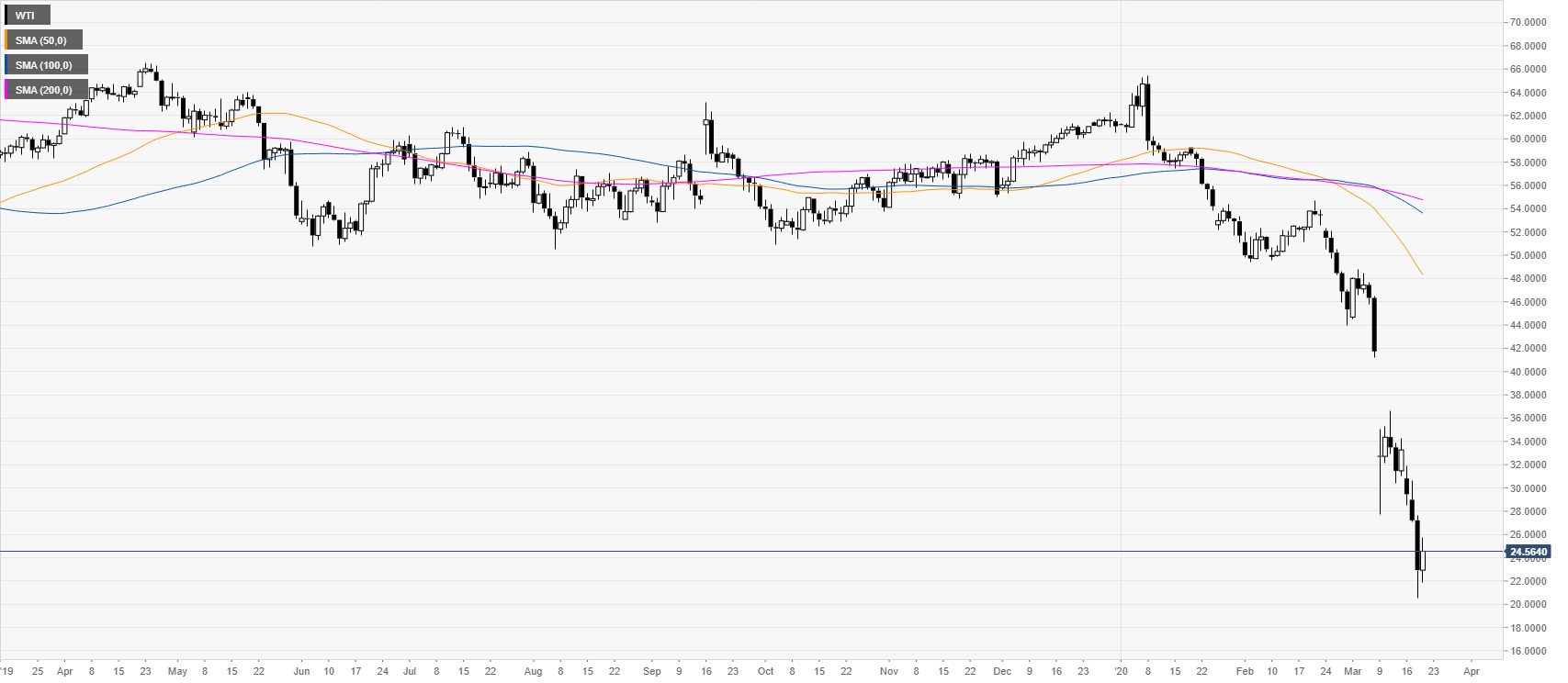

Oil daily chart

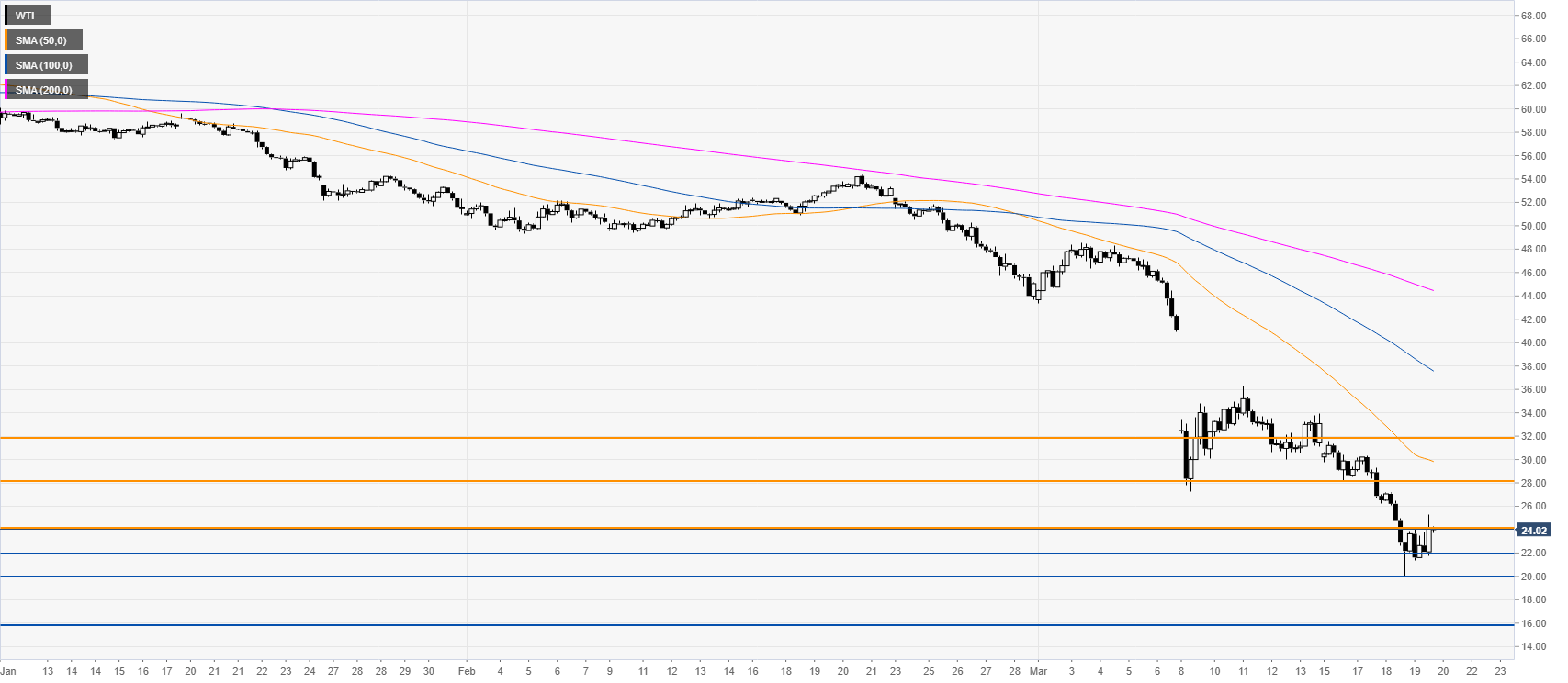

Oil four-hour chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD turns sideways below 1.0900 ahead of Fedspeak

EUR/USD is trading sideways below 1.0900 in European trading on Monday, despite a risk-on market mood. The pair, however, finds support from the struggling US Dollar and sluggish US Treasury bond yields, awaiting Fedspeak amid light European trading.

Gold price consolidates near $2,450, fresh record highs

Gold price holds its upbeat momentum intact on Monday, sitting at fresh record highs of $2,450 in the European session. The bright metal benefits from renewed hopes for Fed rate cuts and renewed geopolitical tensions surrounding Iran. Fedspeak is next on tap.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD is off the highs, consolidating near 1.2700 in the European trading hours on Monday. A subdued US Dollar supports the pair amid moderate risk appetite. Traders stay cautious on potential geopolitical escalation in Iran and ahead of Fedspeak.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.