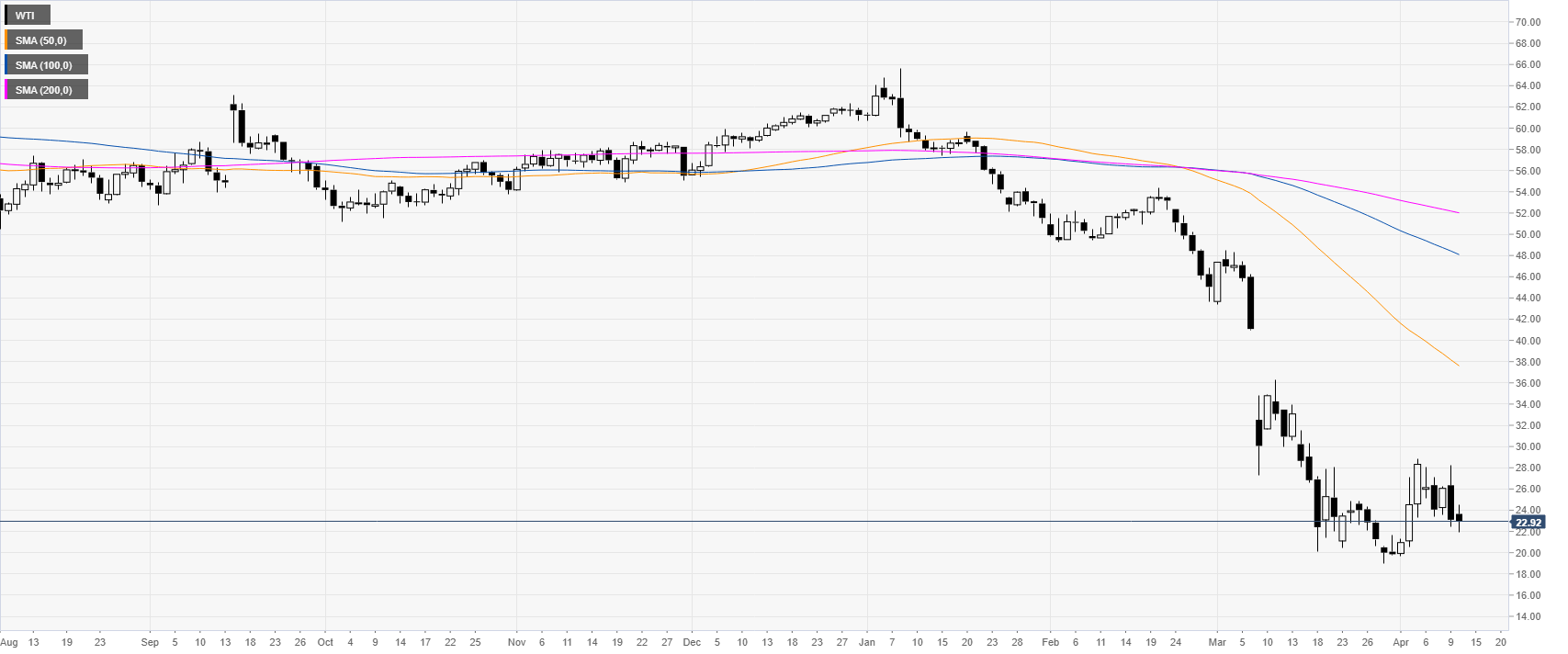

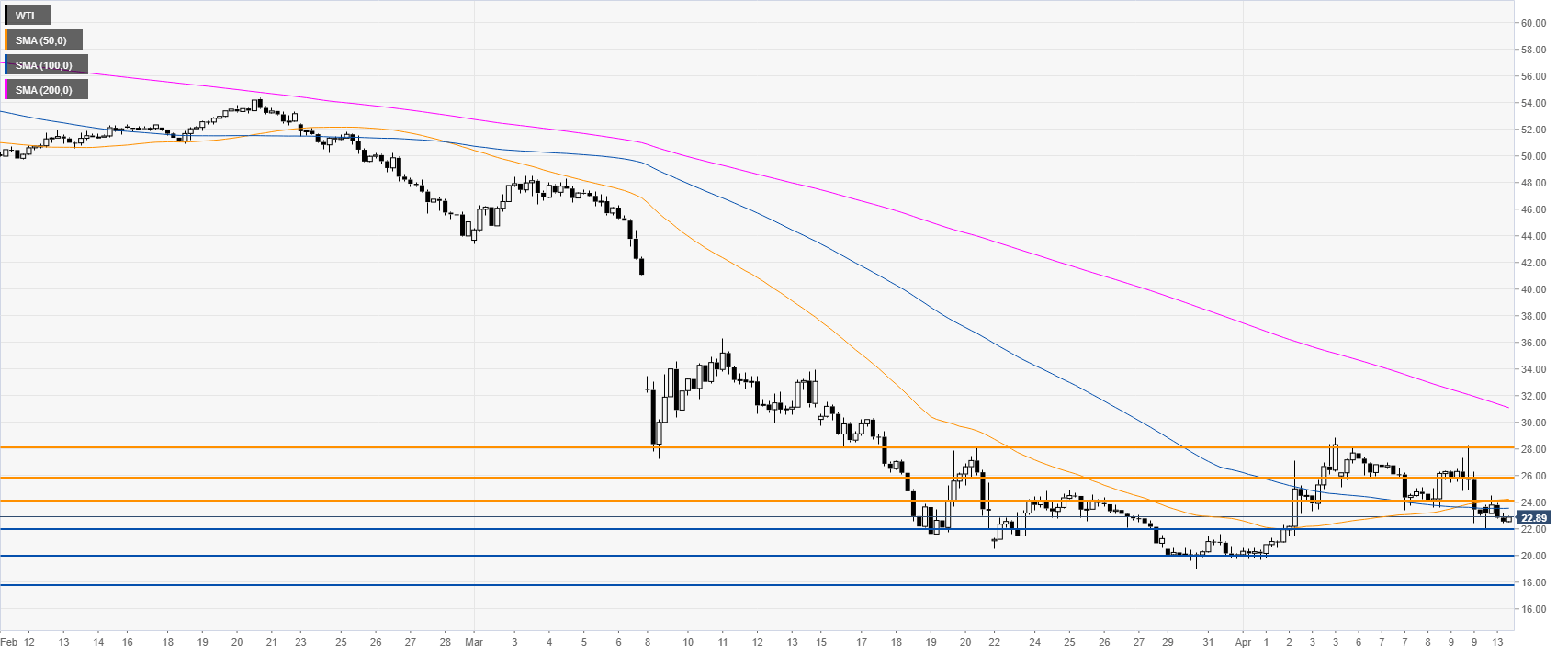

- WTI bear trend remains intact below $24 per barrel.

- The level to beat for sellers is the 22 support.

WTI daily chart

WTI four-hour chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD gains ground due to risk-on mood, US CPI awaited

AUD/USD remains steady with a positive sentiment despite the lower-than-expected Wage Price Index released on Wednesday by the Australian Bureau of Statistics. This index serves as an indicator of labor cost inflation. The appreciation of the Aussie Dollar could be attributed to the improved risk appetite.

USD/JPY extends its upside above 156.50 ahead of US CPI, Retail Sales data

The USD/JPY pair trades in positive territory for the fourth consecutive day near 156.55 on Wednesday during the Asian session. The uptick of the pair is bolstered by the speculation that the Federal Reserve might maintain rates higher for longer amid the elevated inflation.

Gold price trades with a mild positive bias, US CPI and PPI data loom

Gold price posts modest gains on the weaker US Dollar on Wednesday. The rising gold demand from robust over-the-counter market investments, consistent central bank purchases, and safe-haven flows amid Middle East geopolitical risk act as a tailwind for XAU/USD.

Ethereum bears attempt to take lead following increased odds for a spot ETH ETF denial

Ethereum is indicating signs of a bearish move on Tuesday as it is largely trading horizontally. Its co-founder Vitalik Buterin has also proposed a new type of gas fee structure, while the chances of the SEC approving a spot ETH ETF decrease with every passing day.

US CPI data expected to show slow progress towards 2% target

The US Consumer Price Index is set to rise 3.4% YoY in April, following the 3.5% increase in March. Annual core CPI inflation is expected to edge lower to 3.6% in April. The inflation report could influence the timing of the Fed’s policy pivot.