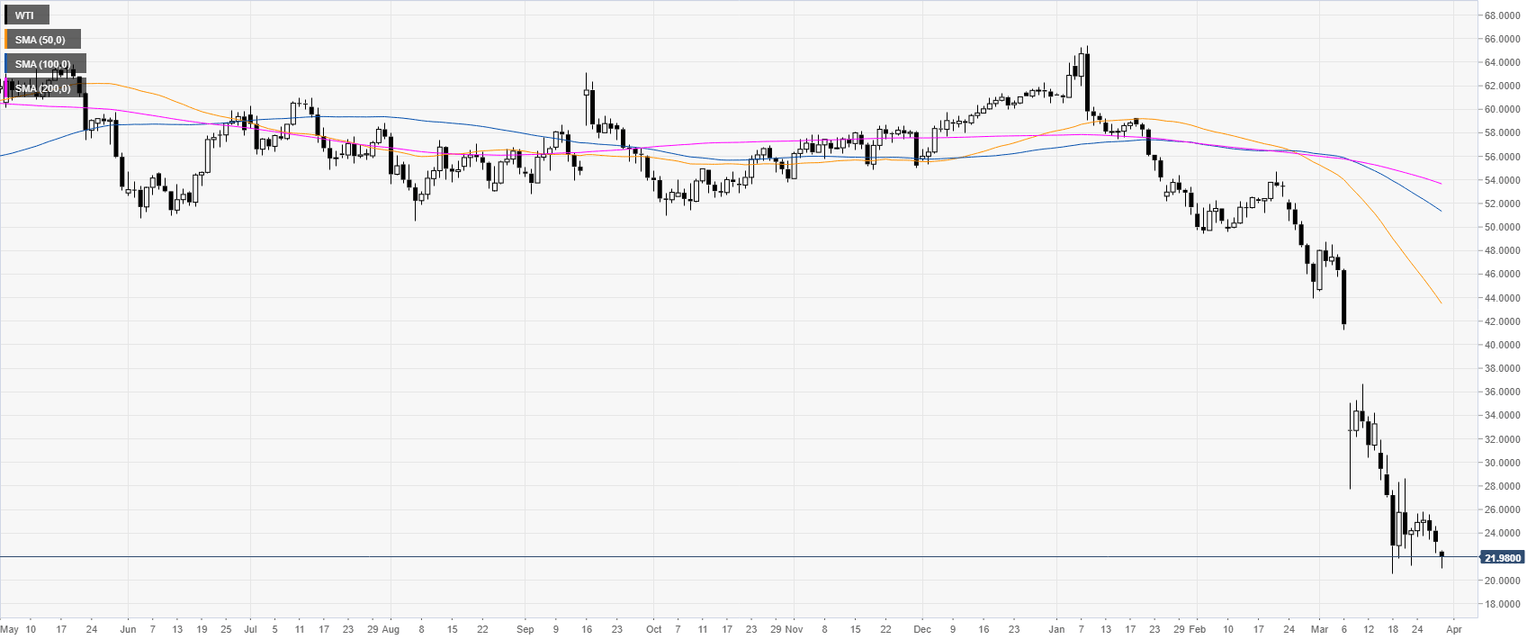

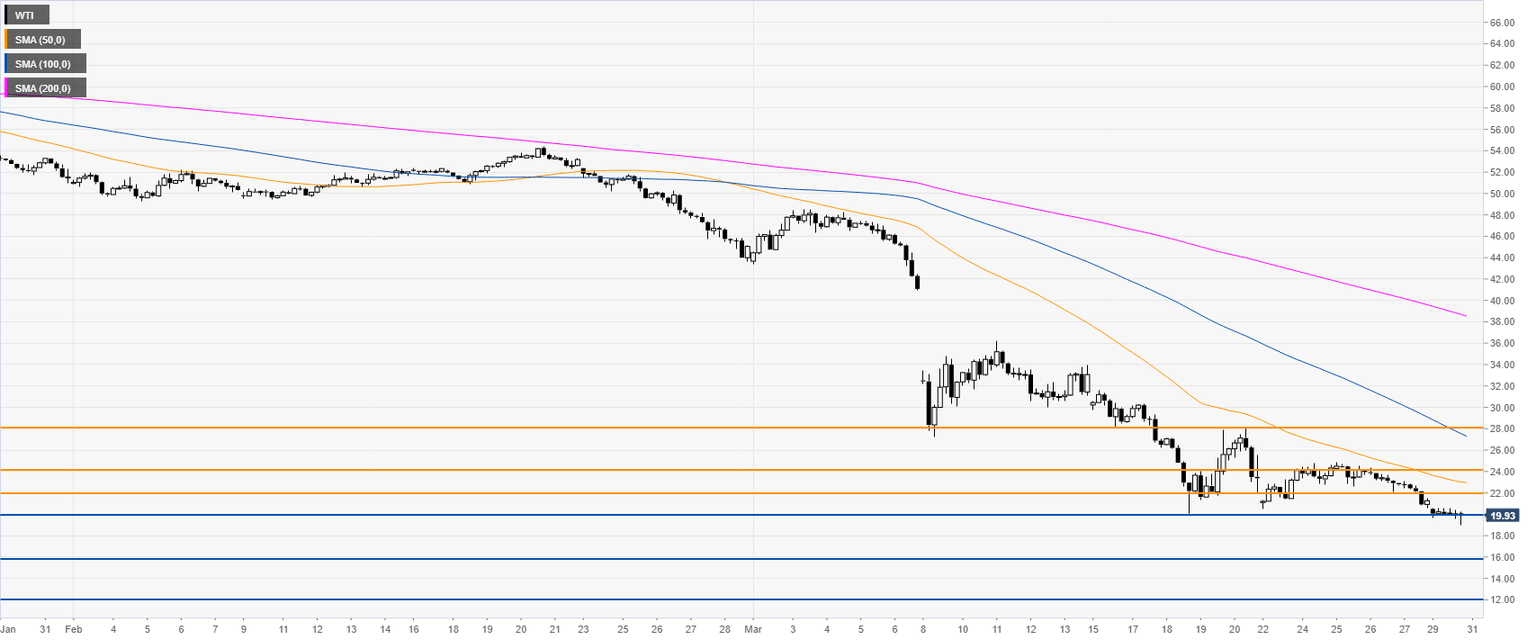

Oil Asia Price Forecast: WTI agonising in multi-year lows, trades near $20 a barrel

- WTI is suffering one of its largest selloffs in history plummeting to $20 a barrel in a matter of weeks.

- WTI remains under heavy selling pressure as March is coming to an end.

Oil daily chart

Oil four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst