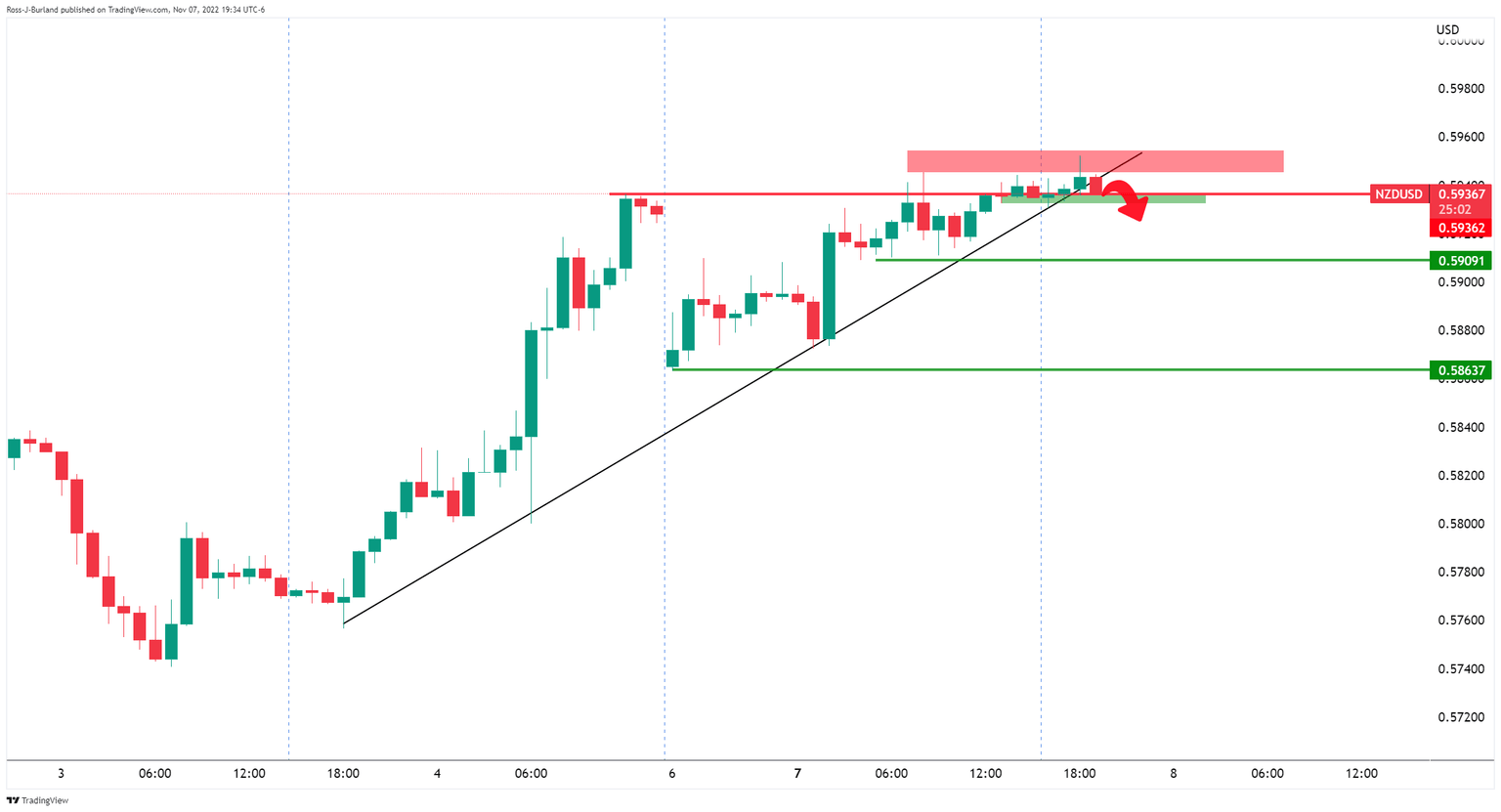

NZDUSD Price Analysis: Bulls holding above key 0.5950 as bears try to take back control

- Bears eye a move into the key Fibonacci near 0.5850 in a 50% mean reversion.

- Bulls remain on the front side of a key underlying trendline support.

NZDUSD spiked as the US Dollar sold off on Tuesday, extending the losses that started to take shape on Friday. Tuesday was the third day of longs in the market since last week and bears could be lurking on a mid-week opportunity to counter the trend into in-the-money-longs as the following will illustrate.

NZDUSD H1 charts

The bears broke the micro trendline and met key support, as anticipated in the prior analysis: NZD/USD Price Analysis: Bears move in from key highs for the week

(Prior analysis, 07/11/2022)

Meanwhile, the price is now topping out at a fresh high for this and last week:

The pair is testing the commitments of the bulls at the next micro trendline. 0.5950 is important in this regard.

NZDUSD daily chart

As for the daily chart, the price is bounded by resistance and the doji could turn out to be pivotal for the pair and week. If the bears commit, then there will be prospects of a test of the broader trendline and a move into the key Fibonacci near 0.5850 in a 50% mean reversion.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.