NZD/USD Price Analysis: Bears move in from key highs for the week

- NZDUSD bears move back in following a test of key highs.

- US Dollar is pressured as US yields stall in a risk-on setting.

NZDUSD is plotting highs for the week in Asia, extending on the start of the week's rally in a risk-on environment. The high beta currencies have been finding demand due to signs of some easing of market conditions following last week's mixed Nonfarm Payrolls report that shows that the Unemployment Rate rose to 3.7%.

A Federal Reserve pivot could be on the cards that would give relief to global stock markets and currencies, such as the Kiwi, that tend to track the performance of equities. Consequently, US yields are weak at the start of the week as the following technical analysis will show and NZDUSD is gathering pace on the bid into last weeks and the overnight highs:

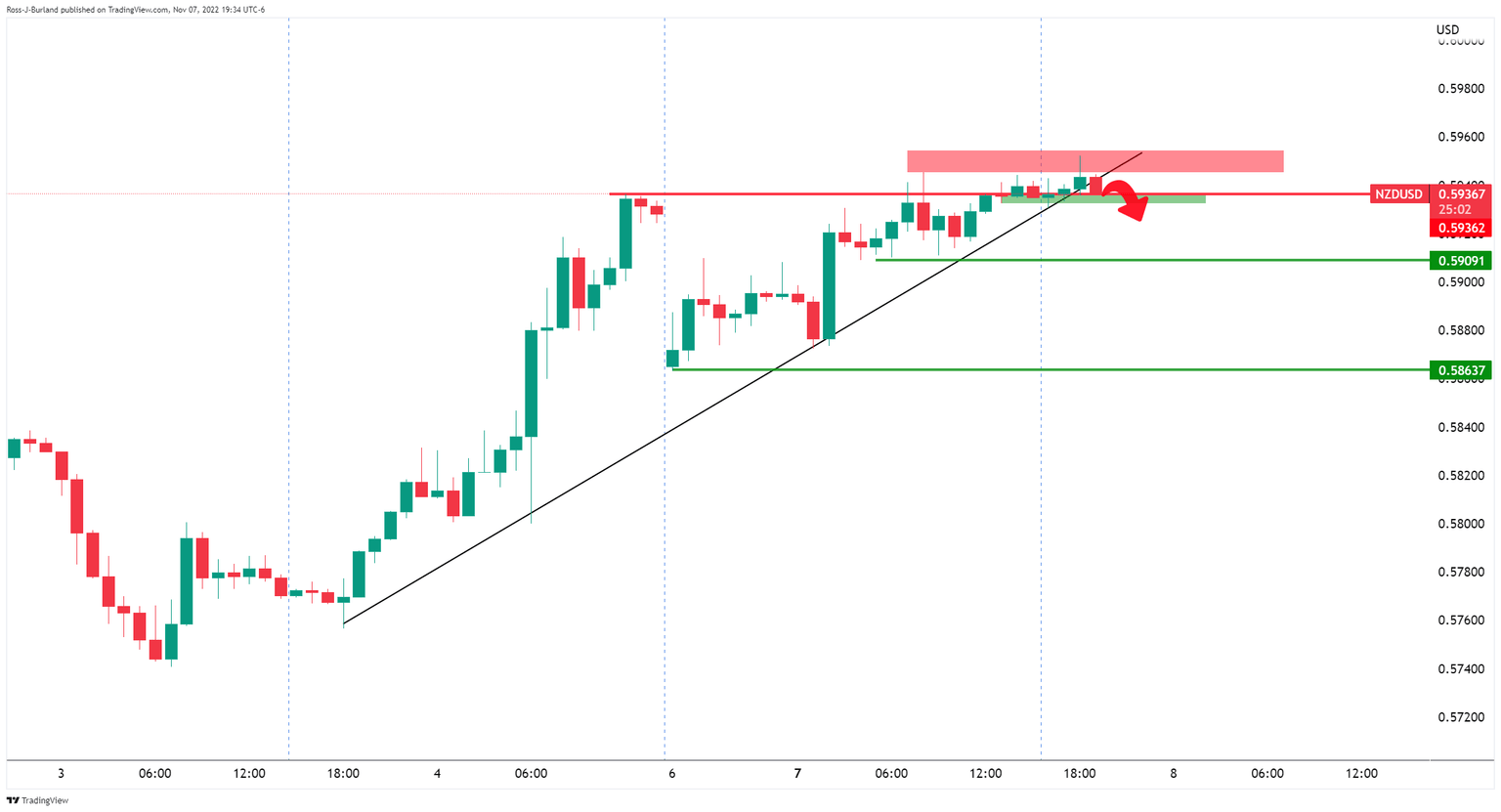

NZD/USD H1 chart

However, if the bears are able to commit at this juncture, then there would be a case for a move below the key trendline and prospects for a test of key structures, as illustrated in the chart above.

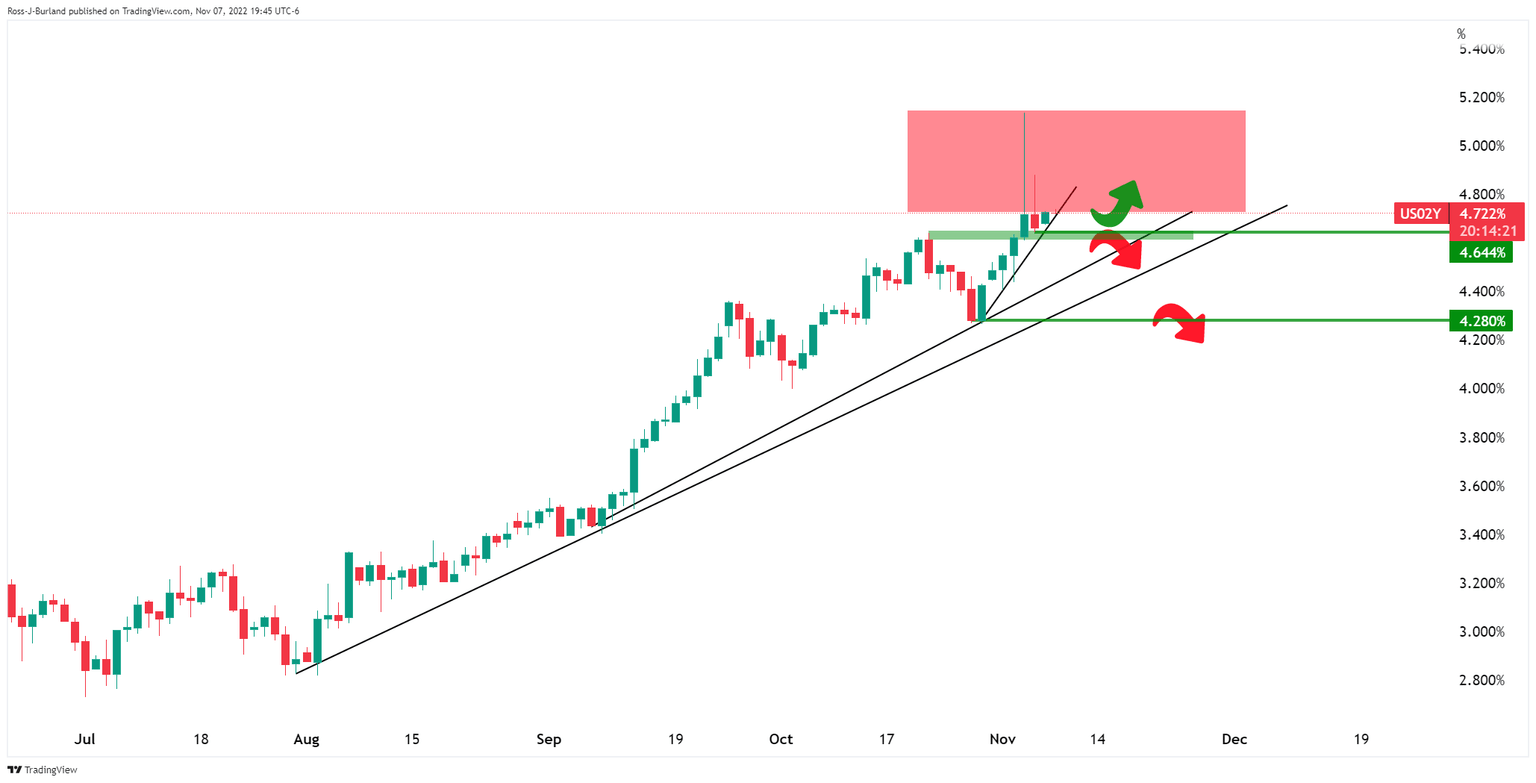

US 2-year yield

Meanwhile, US yields are at a crossroads and should they give out below the micro trendline, there is a risk that a significant move lower below the key daily structures would derail the US dollar, lending huge support to stocks and currencies such s the Kiwi.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.