NZD/USD Price Analysis: Sidelined after rejection at 0.70

- NZD/USD in statsis as daily chart shows uptrend fatigue.

- A pullback to widely-followed SMA support may be seen.

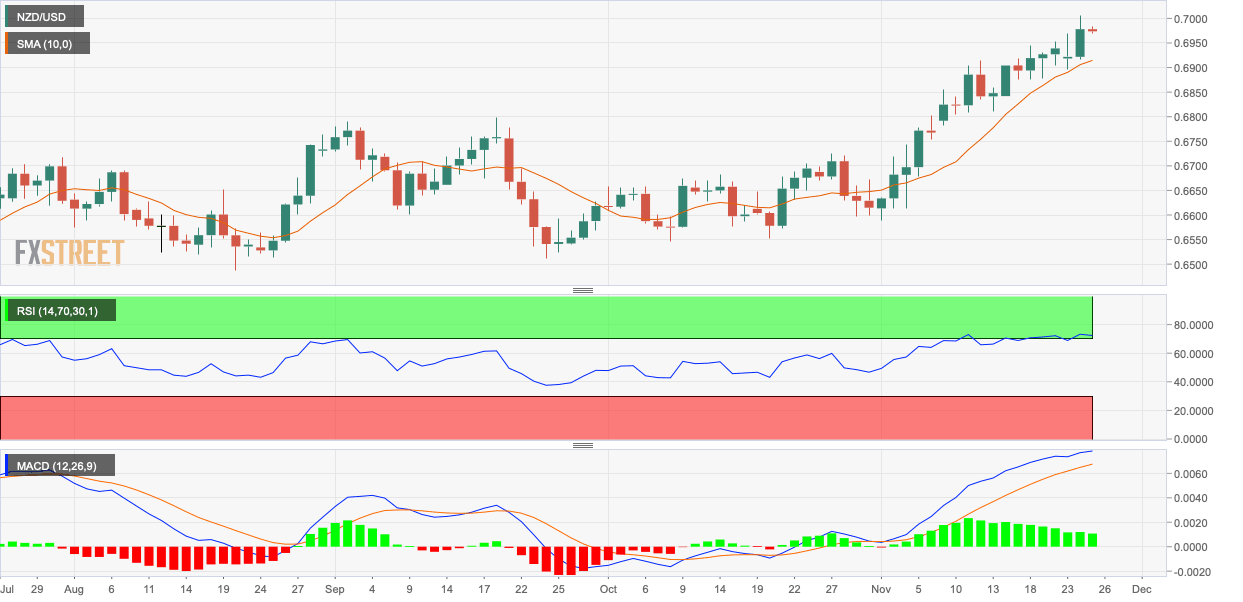

NZD/USD is currently trading in a sideways manner near 0.6975, having faced rejection at the psychological hurdle of 0.70 on Tuesday.

The 14-day relative strength index is reporting overbought conditions with an above-70 print. The MACD histogram is producing smaller bars above the zero line in a sign of weakening of the upward momentum.

As such, the pair could pull back to the 10-day Simple Moving Average (SMA), currently at 0.6910. A close below the average would neutralize the immediate bullish view.

On the higher side, 0.70 is the level to beat for the bulls.

Daily chart

Trend: Bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.