NZD/USD Price Analysis: Bears take control in the open

- NZD/USD bears in control at the start of the week.

- Eyes on the support structure in the US dollar.

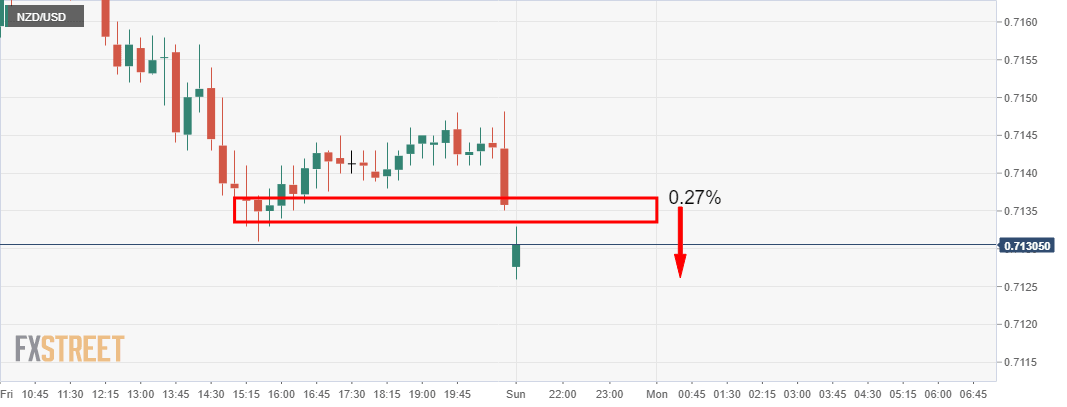

With spreads wide at the start of the day, NZD/USD has opened with a significant gap to the downside:

15-min chart

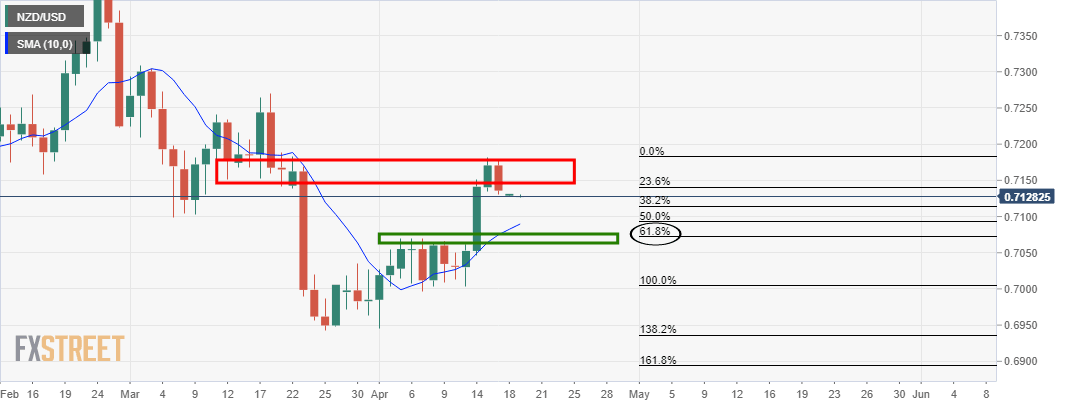

Meanwhile, the overall technical picture for the pair is bearish according to the W-formation on the daily chart as follows:

In meeting resistance, the bears can now target the confluence of the 62% retracement that aligns with both the 21-EMA and the prior highs as a presumed support structure.

1-hour chart

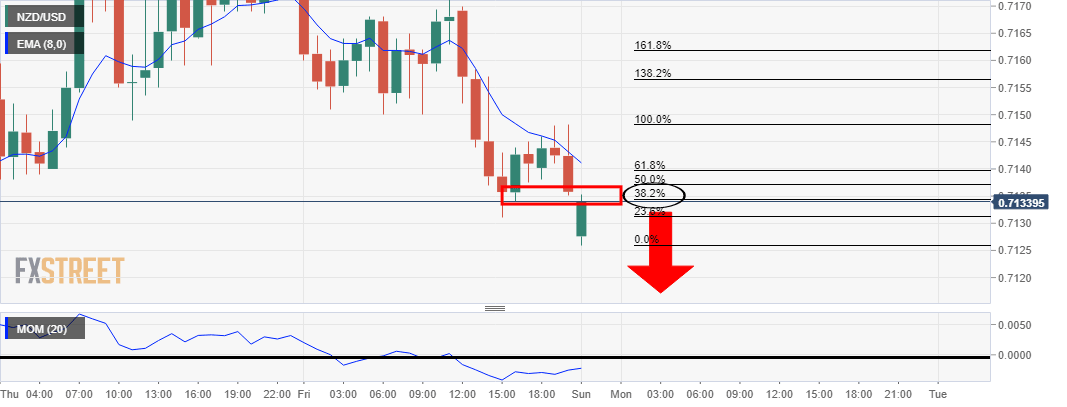

With the price in bearish conditions according to the Momentum indicator and while below a 38.2% Fibonacci retracement of the bearish impulse, bears can look to engage and target the daily support structure.

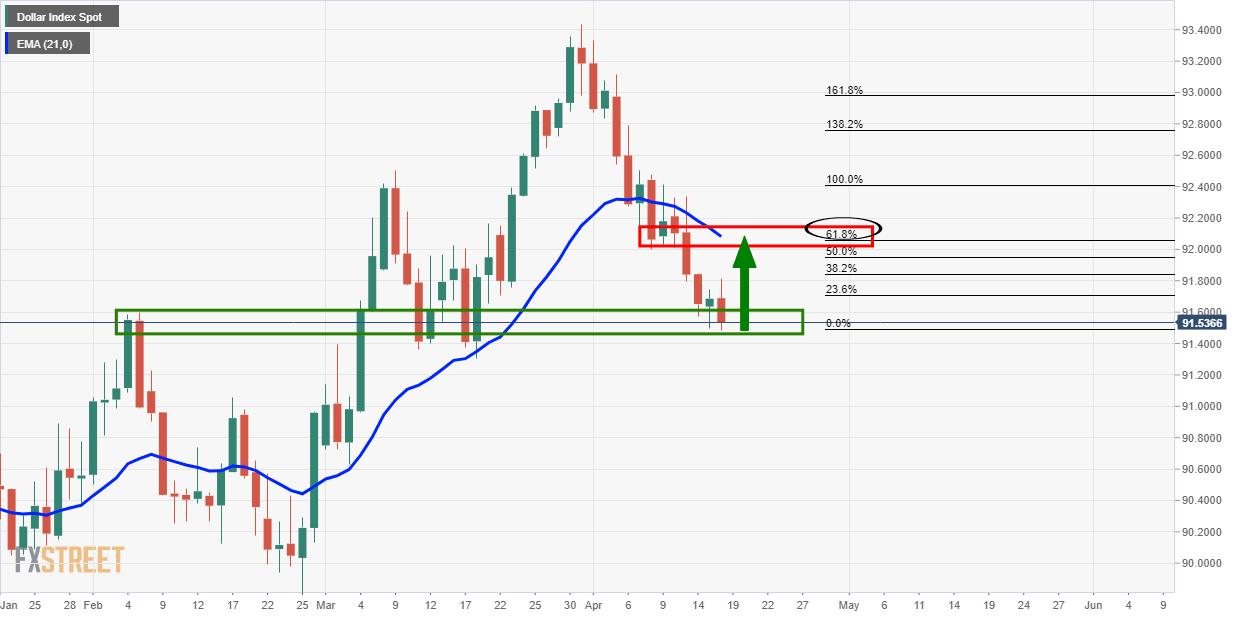

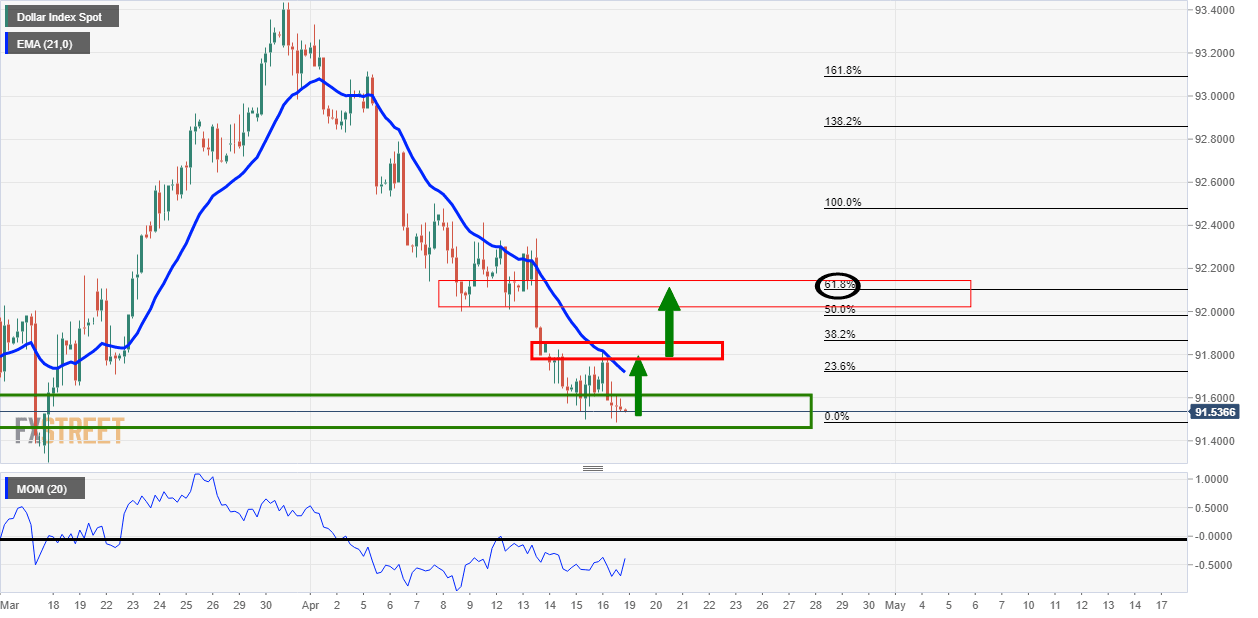

DXY analysis

The bearish bias aligns with the bullish technical conditions and market structure in the DXY for the week ahead.

Daily chart

4-hour chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.