NZD/USD flattens out near 0.6140 after testing 11-week high

- Easing Greenback pressure gives Kiwi another leg into fresh highs.

- Momentum remains thin as NZD rtaders grapple with a lack of data.

- US GDP, PCE inflation prints to dominate the last half of the trading week.

NZD/USD eased back into the 0.6140 level in early Wednesday trading as Kiwi traders await a reason to move. The economic calendar is notably thin except for the NZ government’s latest Budget Release on Thursday, leaving NZD traders adrift until Friday’s speech from Reserve Bank of New Zealand (RBNZ) Governor Orr.

US data in the back half of the trading week will drive investor sentiment with an update to US quarterly Gross Domestic Product (GDP) and the latest print of Personal Consumption Expenditure (PCE) Price Index inflation.

Investors have been awaiting signs of movement from the Federal Reserve (Fed) on rate cuts, with markets broadly keeping an eye on a flurry of appearances from Fed officials in the early week. Broad-market hopes for rate cuts continue to wither against a cautious Fed, and rate markets are pricing in roughly even odds of a quarter-point rate trim from the Federal Open Market Committee (FOMC) in September.

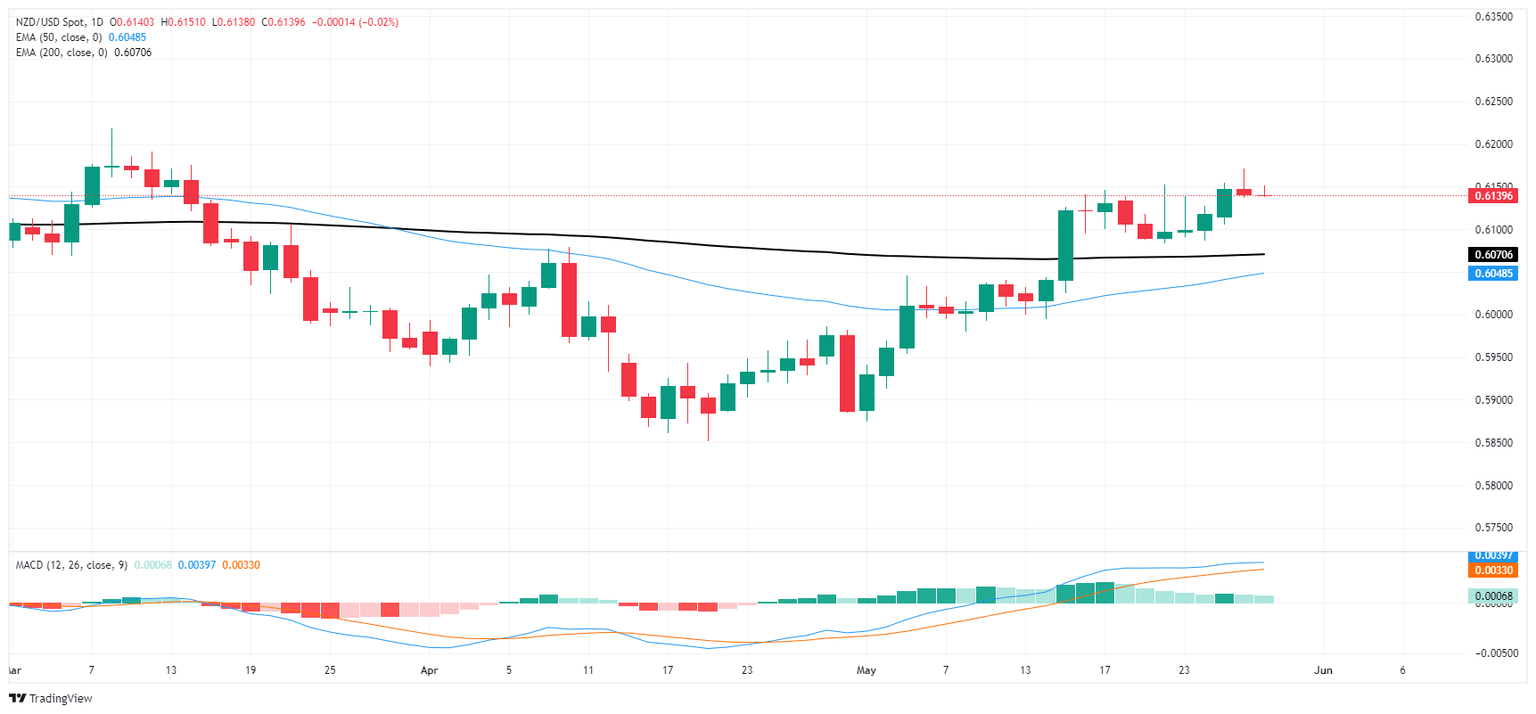

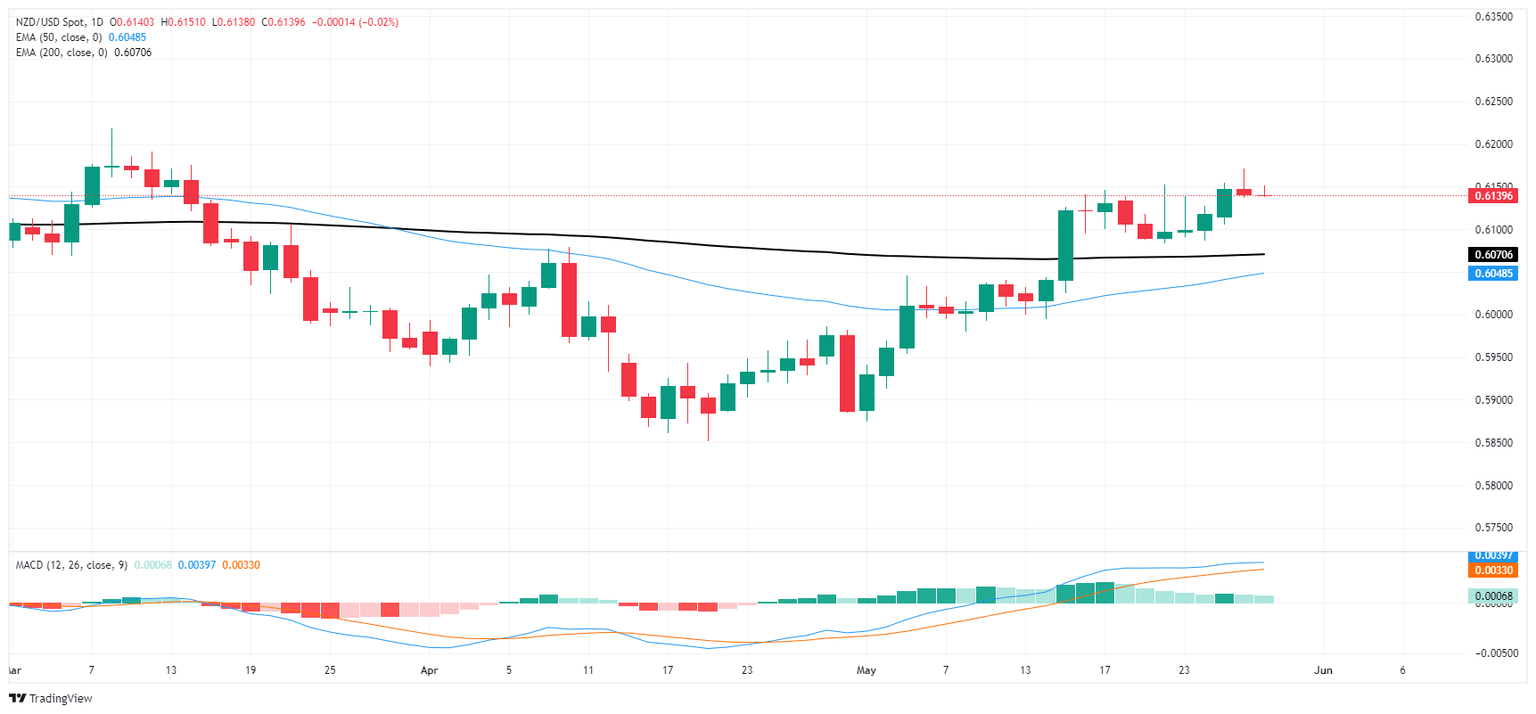

NZD/USD technical outlook

The Kiwi is drifting into the high side against the Greenback this week, and the pair has closed in the green for four consecutive trading weeks. Despite recent upswings, the pair is hitting technical consolidation just north of the 200-day Exponential Moving Average (EMA) at 0.6070.

Bullish momentum may be hitting a wall on the NZD/USD with the Moving Average Convergence-Divergence (MACD) signal lines running far ahead of bullish histogram bars, implying buying pressure may be poised for a reversal.

NZD/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.