NZD/JPY Price Analysis: Bulls in control, though face a wall of resistance near 82.50

- The New Zealand dollar posted gains of 3% vs. the Japanese yen amid a risk-on market mood.

- The euro and the Japanese yen suffered losses against most G8 currencies.

- NZD/JPY Price Forecast: The bias is upward, but the steepness of the rally might spur a correction before resuming up.

The NZD/JPY extends its gains in the week, surging in tandem with global equities courtesy of a positive market mood, despite ongoing fighting between Russia – Ukraine. At the time of writing, the NZD/JPY is trading at 82.25

The market mood is positive, as Wall Street closed the trading session with gains. In the FX space, safe-haven peers, except for the Swiss franc, dropped whilst risk-sensitive currencies advanced.

Overnight, the NZD/JPY was subdued around the 81.64 area but jumped once European traders got to their desks, reaching 82.10, a daily high at the time. Late in the day, the market mood improved, lifting the NZD/JPY towards new YTD highs around 82.36.

NZD/JPY Price Forecast: Technical outlook

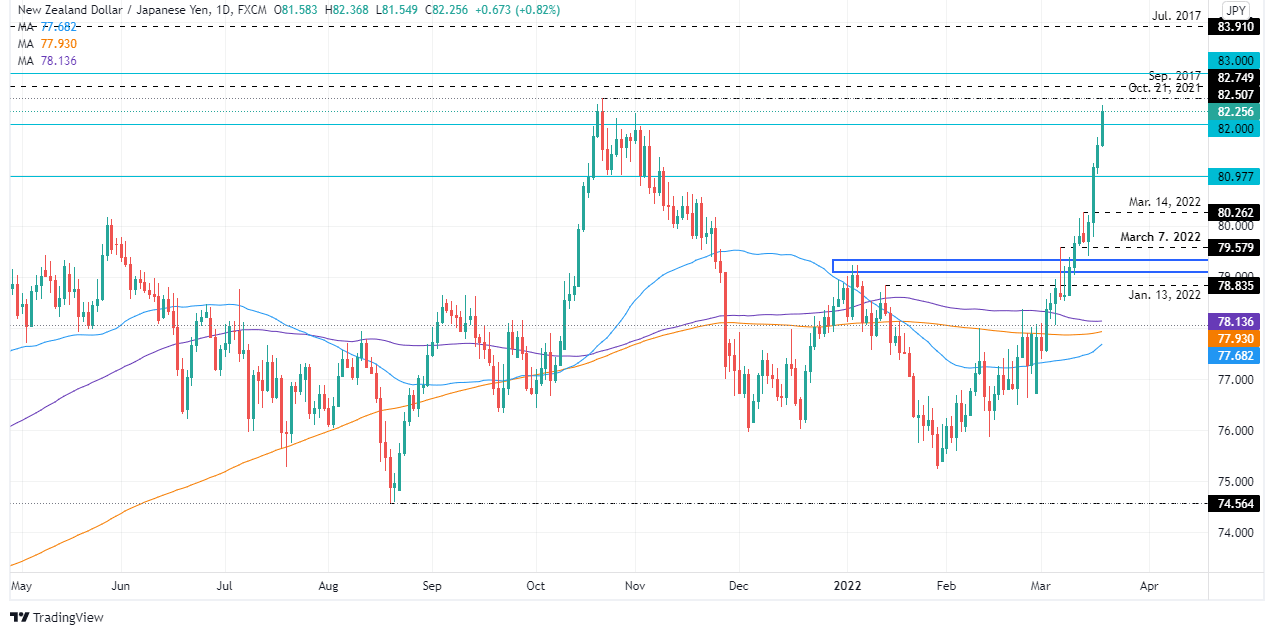

NZD/JPY uptrend remains intact, despite that the 200-day moving average (DMA) is trapped between the 100 and the 50-DMAs. However, due to the steepness of the move, the cross-currency might aim for a correction before resuming upwards.

If the scenario plays out, the NZD/JPY first demand area would be 82.00. Once cleared, the next support would be 81.00, followed by March 14 daily high at 80.26. On the flip side, on the way north, the NZD/JPY’s first resistance would be September 2017, highs around 82.75, followed by the 83.00 mark, and the July 2017 high at 83.91.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.