NYSE:Snap: Snap Inc. Stock Price flattens amid coronavirus scare, ignoring firm's financials

- Snap Inc. stocks are consolidating their gains after a busy week.

- Optimism about Snap's finances has been supporting the price.

- The instant messaging app's correlation with the broader market is growing.

Snap's shares were once deemed a failure and compared to penny stocks. However, the company founded by Evan Spiegel has made a comeback last year, thanks to better finances.

The firm ramped up its sales and its revenues rose. With Facebook – which also owns Instagram and Whatsapp – under the regulatory spotlight, Snap's chatting app has made inroads into investors' portfolios.

Snap's top executives accused Facebook of copying its features to get ahead, but the opposite seems to be happening – on the business side. Snap's ad platform is a new source of revenue.

Snap Inc. stock price

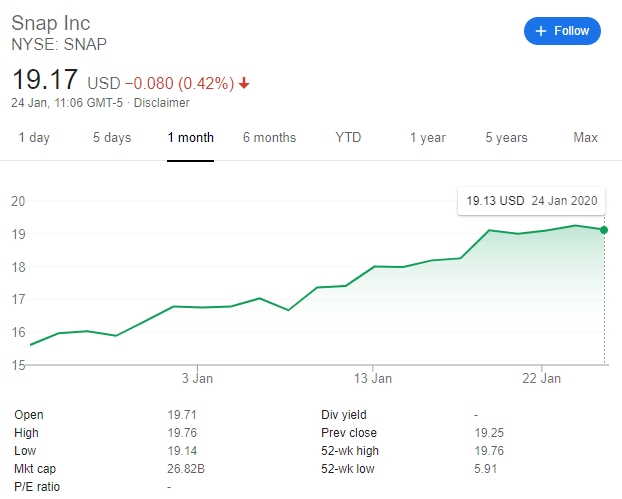

Over the past month, NYSE:SNAP nearly reached the $20 level. It had traded below $16 on December 24 and those who held onto the stock seemed to receive a nice Christmas present.

In recent days, share values have become flatter, but its behavior seems correlated with listless markets. The coronavirus disease has been weighing on global equities amid fears that the world economy would suffer.

However, Snap is a technology company, and like its peers – it is vulenrable to a sell-off tech stocks that may occur in 2020. Valuations of several companies have ballooned, with a growing $1 trillion club. An implosion of the "tech bubble" due to regulation, investor fright, or any other phenomenon may weigh on the messaging company even if its financials are stable.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.