NVDA Stock Prediction: NVIDIA plummets as Wall Street favors rival Intel

- NASDAQ:NVDA fell by 5.76% during Wednesday’s trading session.

- Intel raises eyebrows at CES and has Wall Street analysts on its side.

- NVIDIA says that the global chip shortage could be over by mid-2022.

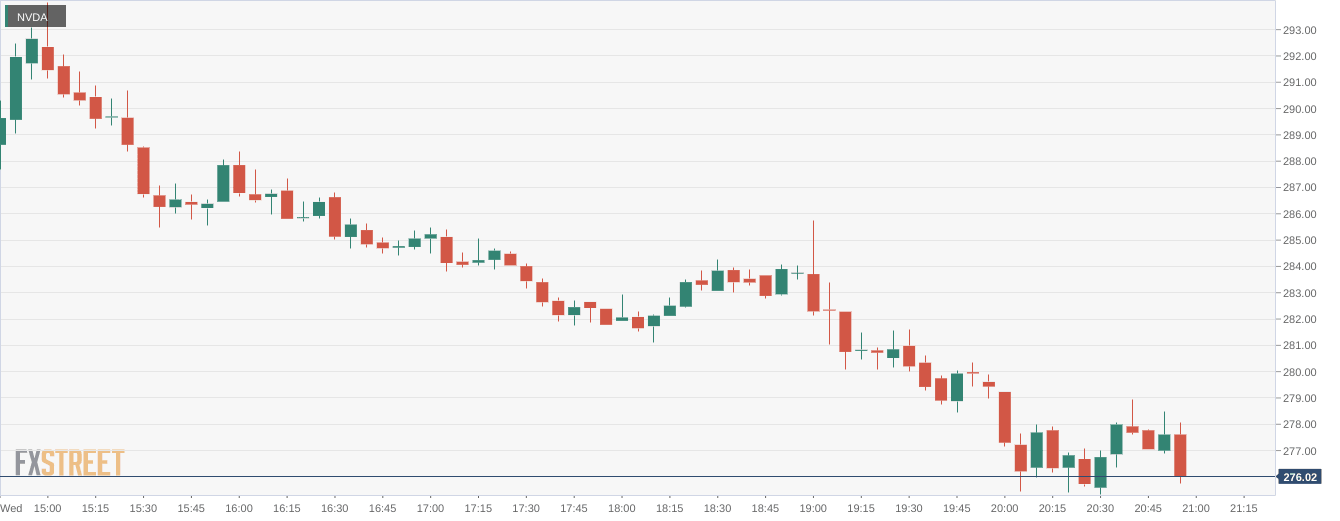

NASDAQ:NVDA was the belle of the ball in 2021, but so far in 2022 the stock has definitely not fared as well. On Wednesday, shares of NVDA tumbled by 5.76% and closed the trading day at $276.04. In a market where growth stocks are getting pummeled right now, semiconductor stocks have been some of the hardest hit. Wednesday saw the tech-heavy NASDAQ index fall a further 3.34%. The S&P 500 and Dow Jones also pulled back as all three major indices closed the day in the red. Much of this downward movement can be attributed to the Federal Reserve stepping up its bond tapering policies to start the year.

Stay up to speed with hot stocks' news!

The nearly entire virtual CES expo is wrapping up for another year and on Wednesday, it was Intel (NASDAQ:INTC) who stole the show for semiconductor companies. Intel unveiled its brand new GPU processor which is taking direct aim at competing with both NVIDIA and AMD (NASDAQ:AMD). Furthermore, Intel is fresh off announcing a new partnership with Taiwan Semiconductor (NYSE:TSM) on new 3nm and 2nm semiconductors. Wall Street analysts are in favor of Intel’s stock since it trades at a much lower multiple than both AMD and NVIDIA, which could mean high growth in 2022.

NVIDIA stock chart

Perhaps some relief for global supply chains could be on the way as NVIDIA believes the chip shortage should begin to wane by mid-2022. Still, this news came before the fire at ASML’s (NASDAQ:ASML) Berlin factory last week, so we could still see some delay in production down the road. The ongoing COVID-19 pandemic is still having an effect on supply chains as well so this news falls more under the ‘believe it when we see it’ category.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet