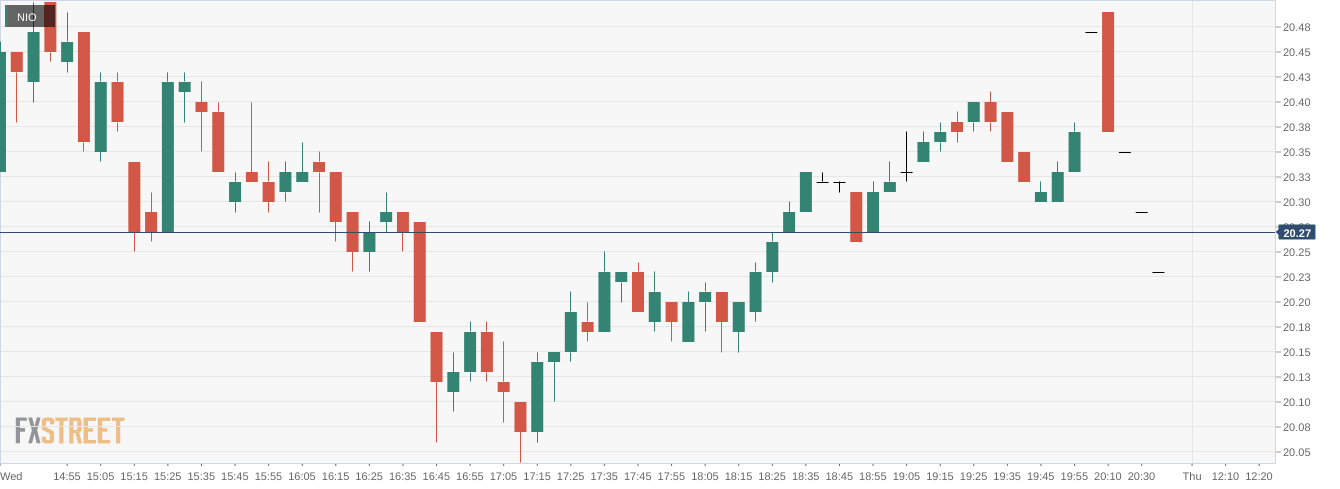

NIO Stock News: Nio Inc rises during bullish session despite rising COVID cases in China

- NYSE:NIO gained 0.74% during Wednesday’s trading session.

- Tesla reported its second quarter earnings after the closing bell.

- BYD continues to march on despite concerns over Buffett stock sale.

NYSE:NIO bounced back from a bearish day on Tuesday, even despite rising fears of a COVID-19 resurgence in China. On Wednesday, shares of Nio added 0.74% and closed the trading session at $20.35. More signs that the bottom might be in for now as stocks consolidated following a major rally on Tuesday. All three major indices still posted positive days on the strength of big tech stocks. Overall, the Dow Jones added 47 basis points, the S&P 500 rose by 0.59%, and the NASDAQ jumped higher by 1.58% during the session.

Stay up to speed with hot stocks' news!

The major electric vehicle sector news on Wednesday was Tesla’s (NASDAQ:TSLA) second quarter earnings report after the closing bell. The EV industry leader posted an impressive 42% year over year revenue growth, although this figure still came in lower than Wall Street expected. Earnings per share came in at $2.27 topping Wall Street estimates of $1.81 per share, but automotive margins declined significantly, proving that the company has been hit hard by the rising production costs. Tesla also sold about 75% of its Bitcoin holdings and converted it into fiat cash. Shares of TSLA gained at first, but at the time of this writing, the stock was down by about 1.0% in after hours trading.

NIO stock forecast

Nio’s domestic rival and Chinese EV industry leader, BYD, continues to march on despite rumors that Warren Buffett has sold his stake in the company. BYD is planning to increase its monthly production to 300,000 vehicles, as it establishes new production facilities around the country. It would be a massive leap as BYD produced just 600,000 vehicles in all of 2021.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet