MVIS Stock Price: Microvision inc ready to resume rally after short breather

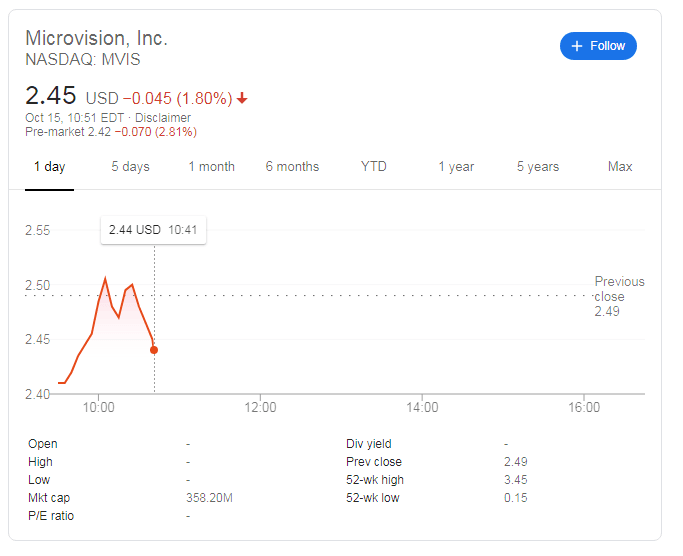

- NASDAQ: MVIS is trading down some 2% on Thursday after several days of rallies.

- Microvision's smart glasses provide reasons to be optimistic about the future of the stock.

- Demand from Microsoft is the key to further moves.

A Redmond, Washington-based company's shares are sliding alongside the stock market – and it is not Microsoft. Microvision, which has a similar name but is worth far less than its neighbor, is trading lower as equities are worried about further stimulus measures.

However, for NASDAQ: MVIS, a fall of 2% is a quiet day, especially after the large rally. The company is now worth around $358 million and that may be a fair value for a firm that has only 30 employees. However, Microvision has room to rise.

NASDAQ: MVIS news

The laser-scanning technology firm is establishing itself as the leader in smart glasses technology. While Google's project was far from a success, Microsoft uses the tech for its HoloLens 2.augmented reality eyewear. Other potential users of the tech are Bosch and Apple – as CEO Tim Cook called wearable glasses "the next big thing."

The Apple Watch is gaining traction around the world but is far from being a cash cow like the iPhone. If Apple, Samsung, Huawei, and other phone makers make a push for glasses, they would need a miniature display engine – and Microvision is already there.

With a market capitalization of only $358, NASDAQ: MVIS has room to rise. It has been making its way higher without any major deals, and that could be the next trigger for an increase.

See 2020 Elections: How stocks, gold, dollar could move in four scenarios, nightmare one included

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.