MULN Stock News: Mullen Automotive skyrockets as Yahoo feature starts investor frenzy

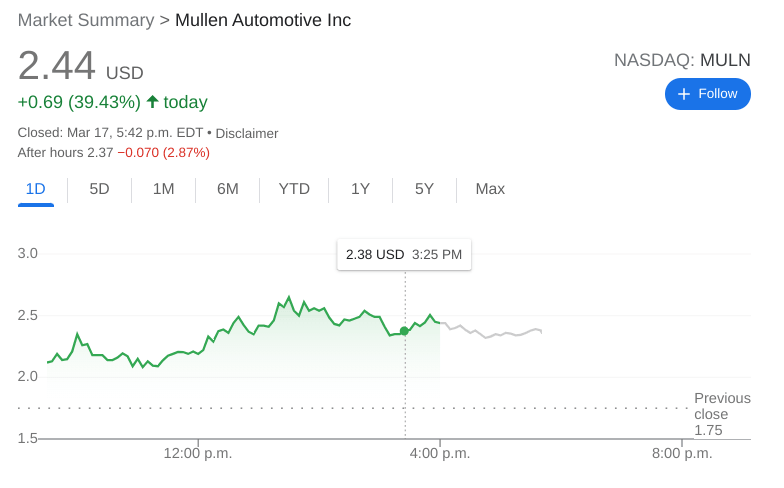

- NASDAQ:MULN gained 39.43% during Thursday’s trading session.

- Yahoo Finance features Mullen Automotive and penny stock traders bought in.

- Tesla surges after Elon Musk announced the Master Plan Part 3.

NASDAQ:MULN continued its momentum from earlier in the week as the startup EV maker has now gained more than 144% since Monday. On Thursday, shares of MULN hit orbit as the penny stock jumped by 39.43% and closed the trading session at $2.44. It was yet another bullish day on Thursday as all three major indices extended their rally and closed higher for the third consecutive day. Even with the price of oil rebounding for its largest gain of the week, the Dow Jones added a further 417 basis points, the S&P 500 added 1.23%, and the NASDAQ extended its winning streak with 1.33% gain.

Stay up to speed with hot stocks' news!

After Yahoo Finance ran a feature on Mullen Automotive where it identified the company as a standout in the EV space, the stock rallied sharply on Thursday. It was yet another positive headline for Mullen this week after its solid-state battery technology was highlighted, as well as a recent article from CarBuzz that featured its FIVE crossover EV. Investors should still be aware that Mullen is a speculative, pre-revenue penny stock with a market cap of only $85 million. With production still at least a year away, Mullen wouldn’t be the first EV startup to not reach expectations.

MULN stock forecast

Industry leader, Tesla (NASDAQ:TSLA), had one of its best sessions in weeks after CEO Elon Musk unveiled the company’s Master Plan Part 3. Now not many details were provided as it was just a singular tweet from Musk, but it seemed to be enough to get diehard Tesla fans excited. Musk wrote Part 1 of the Master Plan back in 2006 and Part in 2016. Part 2 included FSD technology in Tesla’s vehicles so perhaps Musk believes Part 2 to be mostly completed. Shares of Tesla were up 3.73% during Thursday’s session.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet