Moderna Stock Price and Forecast: Is MRNA going to top $400 as Pfizer and BNTX all surge?

- MRNA stock surges over 20% on Friday.

- Moderna bounces on new covid strain possibly evading vaccines.

- The healthcare giant has been struggling due to poor earnings.

Moderna (MRNA) stock roared back into life on Friday as the beaten-up name staged a huge rally of over 20%. The reason is by now fairly well known. The new covid variant identified in South Africa looks like it may require a whole new vaccine in order to combat it. The new variant, given the name Omicron, looks to be able to avoid the current suite of vaccines and is potentially more transmissible than the dominant delta strain. This put vaccine manufacturers in the green on Friday with Pfizer up 6% and BioNTech (BNTX) stock jumping over 14%. Moderna had been one of the worst performers due to poor earnings in early November. The stock had been heavily punished so naturally, the snapback was greater here.

Moderna stock news

Added to the good news for the stock (bad news for the world) was news over Merck's (MRK) antiviral pill for covid. Merck announced on Friday that new data into its antiviral drug was not as hopeful as previously thought. Merck said updated data showed its pill reduced the risk of hospitalization and deaths by 30%, a much lower number than previously thought. Merck's antiviral pill, along with one being developed by Pfizer (PFE), had hit stocks of vaccine manufacturers. Interim data from Pfizers antiviral pill has shown an 89% reduction in hospitalization and deaths. Merck (MRK) shares fell nearly 4% on Friday.

MRNA stock forecast

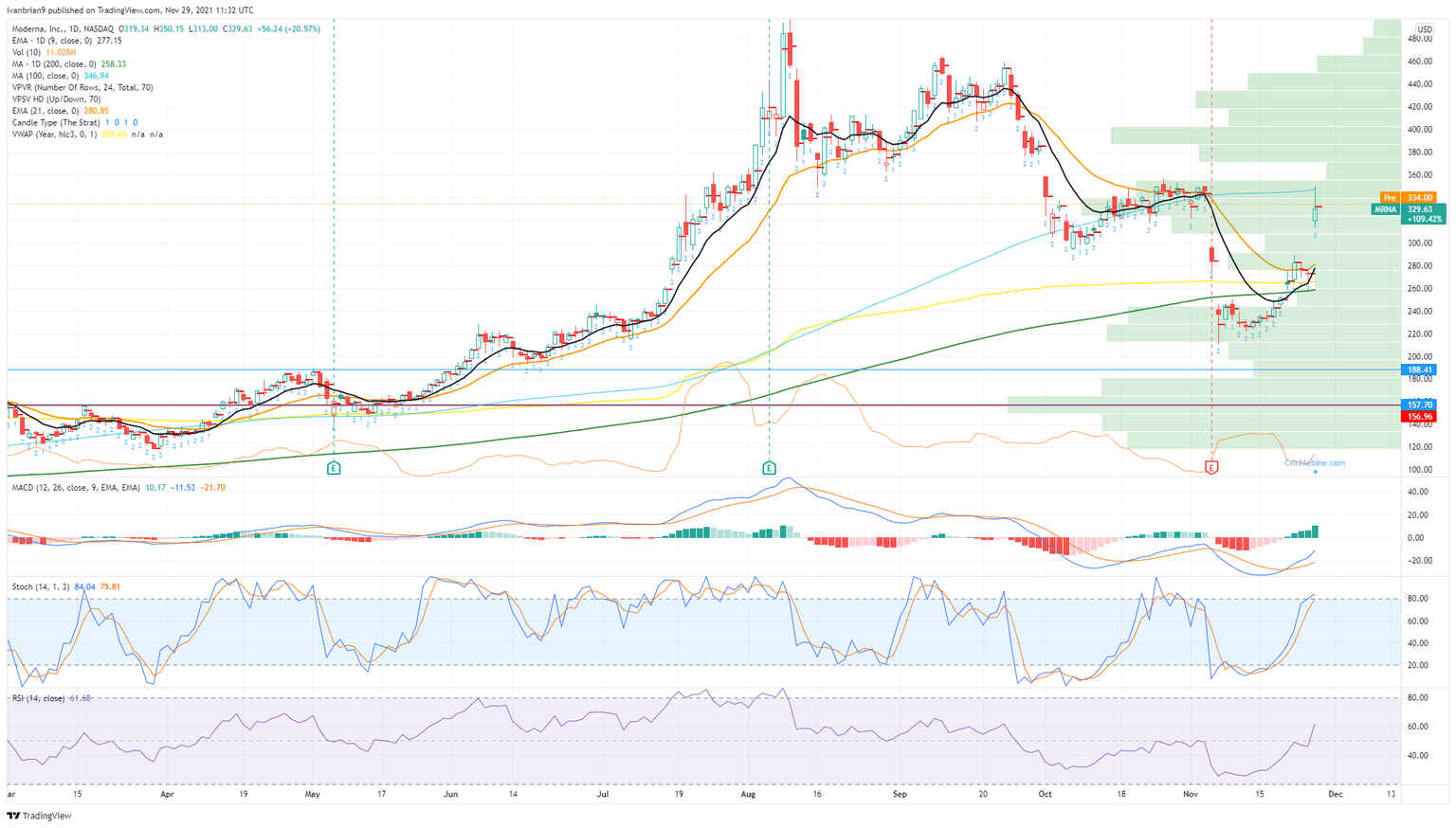

Friday's strong performance for MRNA stock saw it rally to the 100-day moving average and also a point of high volume resistance. The charts do work! $360 is the last resistance and Moderna (MRNA) is trading here in Monday's premarket so it will be interesting to see if it can hold these gains. We would not be inclined to chase the stock up here and would favour a bearish position with a stop at $380. The bearish traits have not been totally eliminated in our view. The last earnings were a disappointment and markets are rallying as not enough information is known about the new covid variant just yet. Moderna is now overbought on stochastic but no other indicator is confirming this move just yet.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.