Mexican Peso reaches eight-year high against US Dollar unfazed by Banxico’s rate cut

- Mexican Peso skyrockets sharply toward 16.51 against the US Dollar as USD/MXN contracts 0.48%.

- Mexico’s narrowed trade deficit and the tighter labor market in Mexico contributed to Peso's ascent, surpassing expectations.

- Attention turns to Federal Reserve Governor Christopher Waller's comments on Wednesday.

The Mexican Peso rallied to a new eight-year high against the US Dollar with the USD/MXN pair breaching last year’s low of 16.62, extending its losses to the 16.50s. Thin liquidity conditions amid a shortened week in the observance of Good Friday strengthened the Mexican currency, which hit 16.51. At the time of writing, the exotic pair trades at 16.56, down 0.48%.

Mexico’s economic schedule revealed that the Balance of Trade clocked a narrower deficit than January’s figures, but it exceeded the consensus. In the meantime, the labor market remains tight as the Unemployment Rate was below the previous month’s figures and estimates. The data was revealed before Wall Street opened on Wednesday, yet the USD/MXN dived below 16.60 at around 14:00 GMT.

Across the border, a scarce economic docket will feature comments from Federal Reserve (Fed) Governor Christopher Waller, one of the remaining “hawks” in the central bank’s Federal Open Market Committee (FOMC).

Daily digest market movers: Mexican Peso skyrockets on thin liquidity amid the lack of catalyst

- Banxico Governor Victoria Rodriguez Ceja remained dovish via an interview with El Financiero. Governor Rodriguez commented that the battle against inflation hasn’t been concluded, though adding that in upcoming meetings it would discuss further rate cuts to the main reference rate. She added, “When macroeconomic conditions and the inflationary outlook allow us to make additional adjustments to the reference rate to the one we already have, I consider that they would be gradual.”

- Banxico revealed international reserves grew to $216.9 billion, adding $411 million in US Dollars up to March 22, 2024.

- Mexico’s Balance of Trade in February printed a deficit of $-0.5 billion, lower than the $-4.31 billion in January but missed expectations of $-0.2 billion, according to the National Statistics Agency (INEGI). Other data showed that the Unemployment Rate in February dropped from 2.9% to 2.5%, which is below the consensus of 2.8%.

- Mexico’s Indicator of General Economic Activity flashed signs of contraction in January, justifying Banxico’s 25-basis-point rate cut on March 21. Despite that, traders must be aware that on March 22, the latest mid-month Consumer Price Index (CPI) report saw an increase of a tenth in three measures of inflation, witnessing a dip in headline CPI on a monthly basis.

- Federal Reserve policymakers had been crossing the wires. Atlanta Fed President Raphael Bostic remains hawkish by supporting just one rate cut in 2024. Fed Governor Lisa Cook echoed Bostic’s comments and added that cutting too soon increases the risk of inflation becoming entrenched.

- Chicago Fed President Austan Goolsbee remains dovish, expecting three cuts, though he said he needs more evidence of inflation “coming down.”

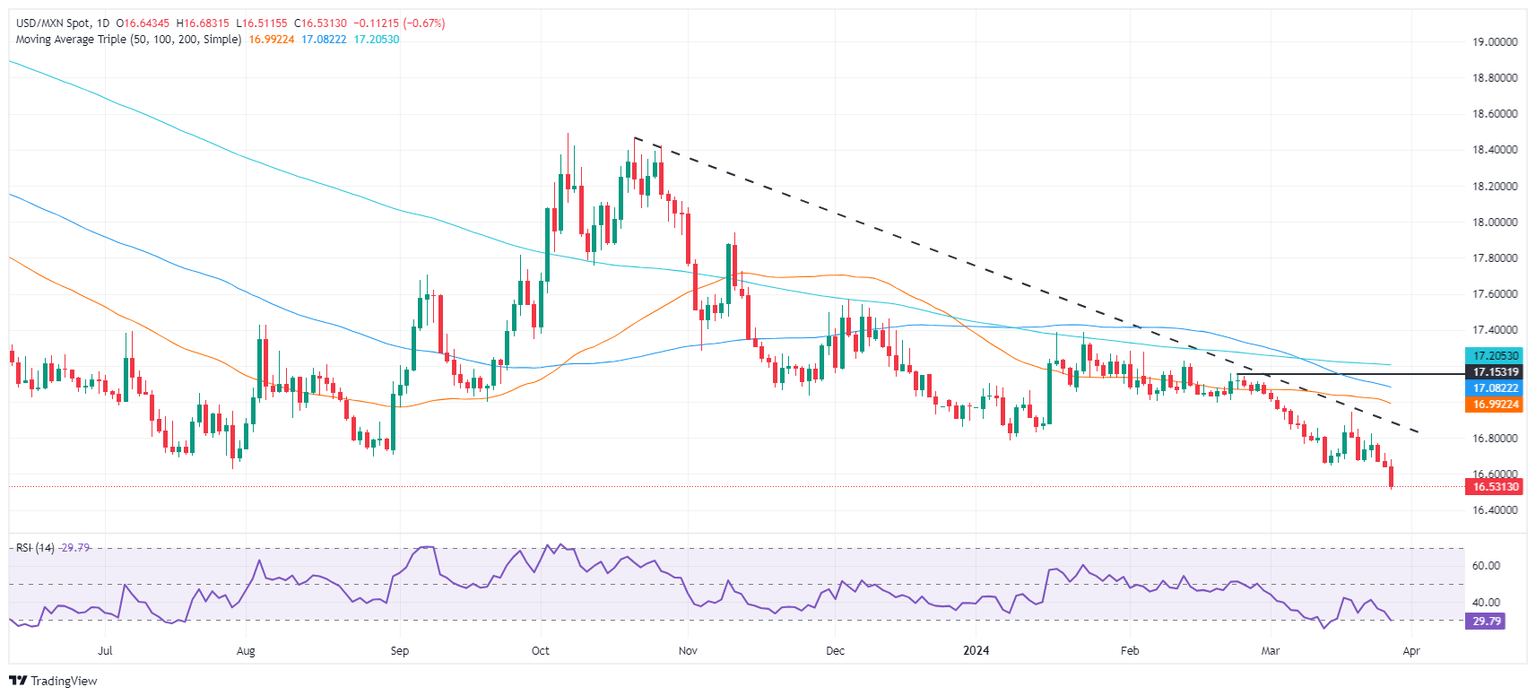

Technical analysis: Mexican Peso rally gathers steam as USD/MXN pushes below 16.60

The USD/MXN sellers gathered steam as the pair extended its losses toward the midpoint of the 16.50/16.60 area, while the Relative Strength Index (RSI) turned oversold. The next support level is the October 2015 cycle low at 16.32 before the pair plunges to the 16.00 figure.

On the other hand, USD buyers need to reclaim the 2023 low-turned-resistance at 16.62 if they would like to push prices toward the 50-day Simple Moving Average (SMA) at 16.98. further upside comes at 17.00, followed by the 100-day SMA at 17.08 and the 200-day SMA at 17.19.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.