Mexican Peso rebounds after run of down days for emerging market assets

- The Mexican Peso takes a break after a string of days in which the currency has seen losses.

- As an emerging market currency it remains sensitive to risk sentiment which has dipped in recent sessions.

- USD/MXN pulls back from the key 20.00 level although the short-term trend remains bullish.

The Mexican Peso (MXN) bounces on Tuesday after a multiple-day run of weakness in its key pairs. Emerging market (EM) assets had been hit by a general unwinding of risk appetite triggered by a recalibration of global interest rate expectations. This has generally hit risk-sensitive EM currencies like the Peso at the worst. The trend started after United States (US) investors changed their expectations about the trajectory of interest rates in the US, seeing them not falling as sharply due to unexpectedly strong US economic data.

Further pressure on the Mexican Peso comes from former US President Donald Trump’s improved performance in opinion polls. This now means the race to the White House is neck-and-neck between him and US Vice President and Democratic candidate Kamala Harris. Trump has threatened to tear up the US’s free trade agreement with Mexico and whack up to 300% tariffs on Mexican cars imported into the States. Such a move would hit the Mexican economy and reduce demand for its currency.

The latest poll by TIPP Insights on October 18-20 shows Donald Trump in the lead with 48% of the vote to Kamala Harris’s 47%, according to election website FiveThirtyEight. Betting website OddsChecker, meanwhile, gives Trump an 8/13 or 61.9% chance of winning over Harris’s 8/5 or 38.50%.

Mexican Peso under pressure from cautious investor sentiment

The Mexican Peso is facing challenges due to a growing cautious stance among global investors towards emerging market assets, as noted in an article from El Financiero. This sentiment stems partly from rising concerns that the Federal Reserve (Fed) may have prematurely lowered US interest rates by a substantial 50 basis points (bps) at its September meeting.

Strong US economic data indicates that such a significant rate cut may not have been justified. While a robust US economy generally benefits Mexico due to their close trading relationship, high US interest rates make EM assets — especially from Brazil and Mexico — less attractive, as highlighted by The Wall Street Journal (WSJ). A shift back to a tighter monetary policy could dampen global investor interest in Mexican assets.

Additionally, disappointment over the limited scope of recent Chinese stimulus measures may be contributing to heightened investor caution regarding EM holdings, further impacting the Peso. However, it's worth noting that the People's Bank of China (PBoC) announced cuts to its one- and five-year prime rates to ease credit conditions on Monday.

On the data front, Mexican Economic Activity data showed a 0.3% YoY rise in August which was below forecasts of 0.7% and the 3.8% rise in July. On a MoM basis Economic Activity declined 0.3% which was below expectations of negative 0.1% and previous 0.6% result.

Technical Analysis: USD/MXN repulsed by 20.00 barrier

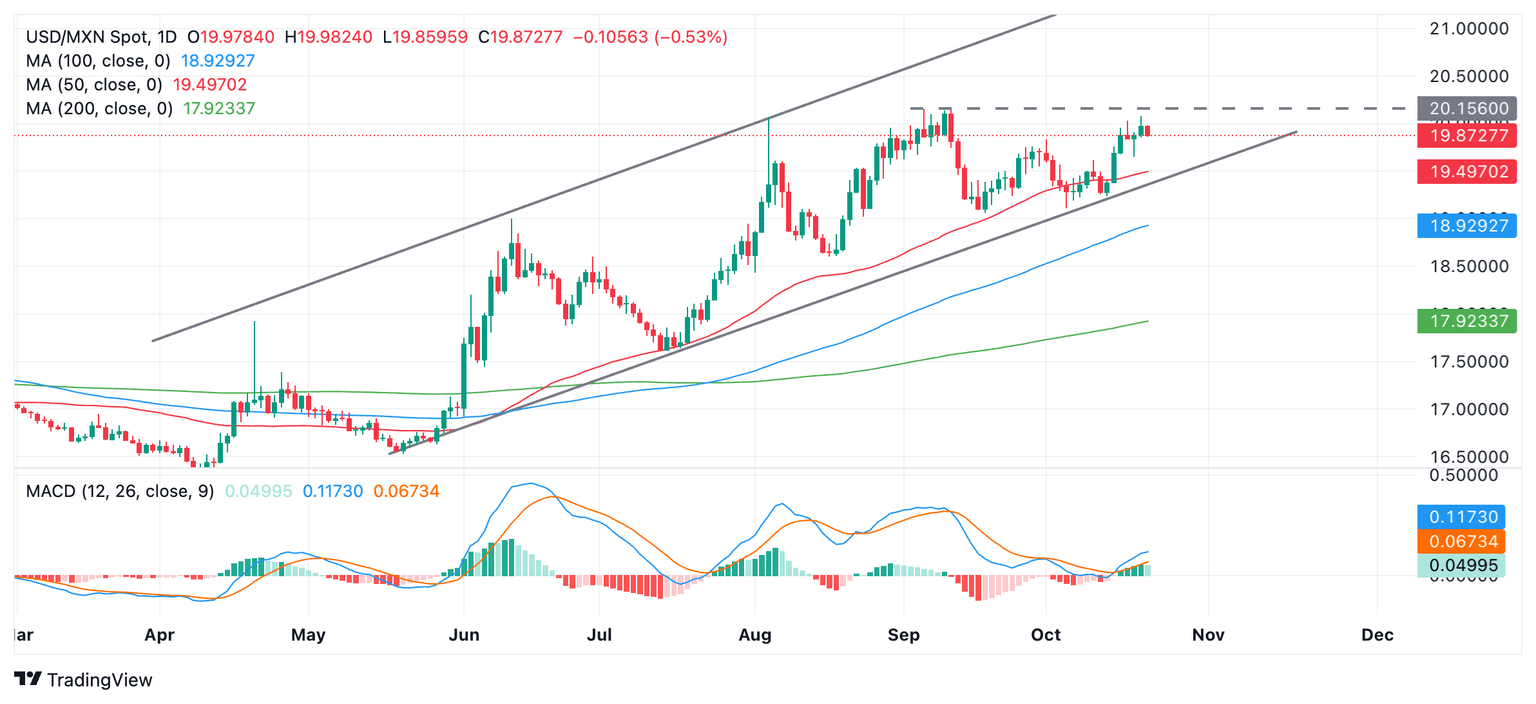

USD/MXN flirts with the key 20.00 barrier and then pulls back. It will probably resume going higher once the correction ends. The pair is in a short, medium and long-term trend, which, given the principle in technical analysis that “the trend is your friend,” is more likely than not to extend.

USD/MXN Daily Chart

The break above 19.83 (October 1 high) has confirmed a probable move up to the next target in the vicinity of the September 10 high at 20.13.

The blue line of the Moving Average Convergence Divergence (MACD) momentum indicator is rising quite strongly after bottoming out at the zero line and crossing above its red signal line, supporting a mildly bullish outlook overall.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.