Mexican Peso edges lower after release of GDP data

- The Mexican Peso declines after the release of Q1 GDP growth data shows a slower year-over-year rate of growth.

- Quarterly GDP is higher at 0.2% than the previous quarter, however, providing an antidote to the yearly slowdown.

- Analysts at Rabobank expect the Peso to appreciate as long as volatility remains subdued.

The Mexican Peso (MXN) weakens roughly 0.1% just after the release of Mexican GDP data shows a fall in the yearly rate of growth although on a quarterly basis the GDP groweth rate increases.

Mexican Peso weakens following GDP data

The Mexican Peso falls immediately after the release of the preliminary reading for Q1 Mexican GDP growth after it shows a slower 1.6% growth rate YoY compared to the 2.5% recorded in the previous quarter, according to data from INEGI.

Some of the sting is taken out of the data, however, by the quarterly figure which shows a higher 0.2% rate of GDP growth QoQ, compared with the 0.1% gain in Q4.

The data suggests an increase in the probability that the Banxico could cut interest rates again, reducing capital inflows to the Peso.

USD/MXN is trading at 16.97, EUR/MXN at 18.18 and GBP/MXN at 21.28, at the time of publication.

Mexican Peso to continue strengthening – Rabobank

The Mexican Peso will continue to strengthen as long as market volatility remains low, according to analysts at Rabobank.

“..as long as volatility is declining, MXN will rally. While suppression of volatility is a tenuous assumption, it is our base case for the next couple of weeks,” says Rabobank.

Relatively high interest rates in Mexico – the Banxico overnight interest rate is 11.00% – support inflows from the carry trade in which traders borrow in a currency with low interest rates and use the loan to buy a currency with higher interest rates like the Mexican Peso.

“We expect interest rate differentials to remain favorable,” says Rabobank.

In the case of Mexican Peso’s most highly traded pair USD/MXN, the rate differential remains Peso-favorable.

“US-MX 2yr rate differentials have widened 33bp in April and will continue to act supportive for MXN over the course of May.”

The Banxico is likely to keep interest rates unchanged at its May meeting based on recent Banxico commentary.

“We have changed our Banxico forecast to reflect a pause at the May 9 meeting. This follows Deputy Governor Jonathan Heath’s interview on April 20, when he noted that he is ‘leaning towards a pause in May, and we can see how data evolves by June,’ which he highlighted is ‘likely’ to be a unanimous decision,” says Rabobank.

The high number of long positions amongst non-commercial speculators in the MXN futures market as well as a seasonal effect, which suggests May is a favorable month for MXN, are further drivers of upside, according to the bank.

Rabobank forecasts USD/MXN to fall below 17.00, eventually reaching a target of 16.80.

Technical Analysis: USD/MXN sideways trend continues

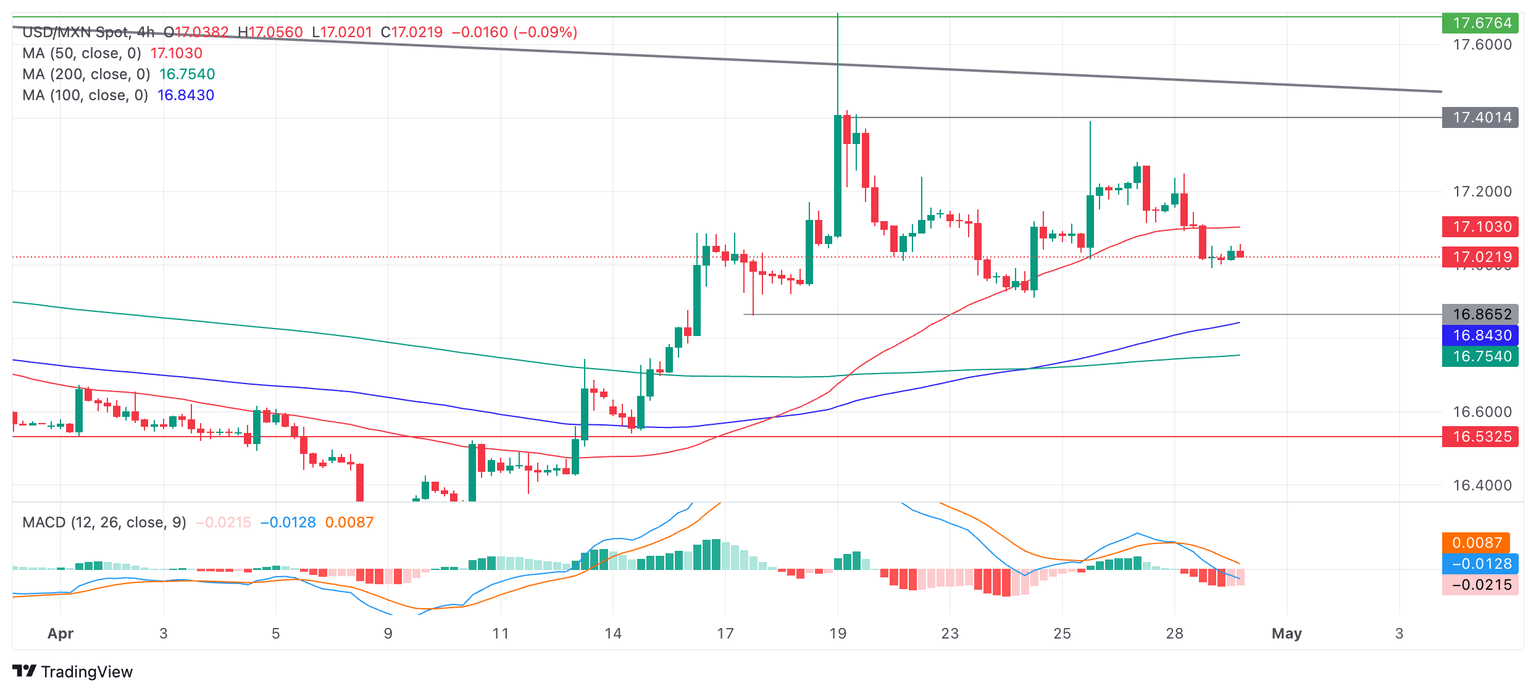

USD/MXN further extends its sideways trend over the short-term, oscillating within a range that has a floor at 16.86 and a ceiling at 17.40.

USD/MXN 4-hour Chart

The pair is in a down leg within the sideways trend and could continue falling to the range lows. The Moving Average Convergence/ Divergence (MACD) is printing a red histogram and looks poised to move below the zero line, further adding a bearish tenor to the chart.

A decisive breakout of the range – either below the floor at 16.86, or the ceiling at 17.40 – would change the directional bias of the pair.

A break below the floor could see further downside to a target at 16.50, followed by the April 9 low at 16.26.

On the other side, a break above the top would activate an upside target first at 17.67, piercing a long-term trendline and then possibly reaching a further target at around 18.15.

A decisive break would be one characterized by a longer-than-average green or red daily candlestick that pierces above or below the range high or low, and that closes near its high or low for the period; or three green/red candlesticks in a row that pierce above/below the respective levels.

Economic Indicator

Gross Domestic Product (YoY)

The Gross Domestic Product released by INEGI is a measure of the total value of all goods and services produced by Mexico. The GDP is considered as a broad measure of economic activity and health. Generally speaking, a high reading is seen as positive (or bullish) for the Peso, while a negative trend is seen as negative (or bearish).

Read more.Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.