Mexican Peso decline tied to diverging rages favoring the US Dollar

Most recent article: Mexican Peso rises against US Dollar despite Banxico rate cut, mixed economic signals

- Mexican Peso losses steam as USD/MXN paired earlier losses.

- Banxico's split decision to cut rates to 11.00% provides a nuanced outlook, contributing to the Peso's resilience.

- Mexico's economic performance shows contraction in January and high inflation data.

- Banxico underscores a data-dependent approach, aiming for a 3% inflation target by the second quarter of 2025.

The Mexican Peso (MXN) lost ground late on Friday against the US Dollar (USD) after both central banks, the Federal Reserve (Fed) and the Bank of Mexico (Banxico), decided to hold and cut interest rates amid their separate disinflation evolutions. The emerging market currency began to show signs of weakness even though Banxico’s vote split provided a more balanced tone at the Governing Council. The USD/MXN trades at 16.76, up 0.15%.

Economic data from Mexico revealed on Friday that the economy shrunk in January from December, while the mid-month inflation report rose above estimates on a monthly basis and in the 12 months to March.

Elsewhere, Banxico’s decision to lower interest rates was not felt by the USD/MXN exchange rate, although the interest rate differential between the Mexican Central Bank and the Fed contracted. Banxico’s Governing Council reduced the main reference rate to 11.00%, though they emphasized that it would be data-dependent in future monetary policy meetings.

The Bank of Mexico expressed that policy remains restrictive, that the disinflation process would continue, and expects to reach its goal of 3% in the second quarter of 2025.

Daily digest market movers: Mexican Peso strengthens despite rate differential reduction

- Inflation in Mexico exceeded estimates of 4.45%, increased by 4.48%, while core figures jumped above the consensus of 4.62% YoY and rose by 4.69%, revealed the National Statistics Agency (INEGI) on Friday. Besides that, Economic Activity plunged -0.6% MoM, below estimates of a 0.3% expansion, and slowed compared to December, below estimates of 2.6%, down to 2%.

- The outlook in Mexico suggests the economy is stagnating. A weak retail sales report, private spending falling sharply, and a contraction in economic activity justified Banxico’s rate cut. Nevertheless, they face stubbornly stickier inflation, keeping policymakers on their toes.

- Mexico’s retail sales fell by 0.6% MoM in January, missing estimates of 0.4% expansion but better than December’s data. Yearly figures plummeted from -0.2% to -0.8 %, smashing projections for a 1.2% expansion.

- Aggregate Demand rose by 0.3% QoQ in Q4, up from 0%. On an annual basis, it decelerated from 2.7% to 2.6%.

- Private Spending on a quarterly basis slowed from 1.2% to 0.9%. On a yearly basis, it improved from 4.3% to 5.1%.

- Traders are digesting the latest monetary policy decision by the Federal Reserve, which held rates unchanged and maintained their projections for three 25 bps rate cuts toward year end. Despite revising the federal funds rate (FFR) level upward to 3.9%, the Fed’s decision was perceived as dovish.

- After the Fed’s decision, money market traders see a 73.2% chance of the Federal Reserve cutting rates by a quarter of a percentage point.

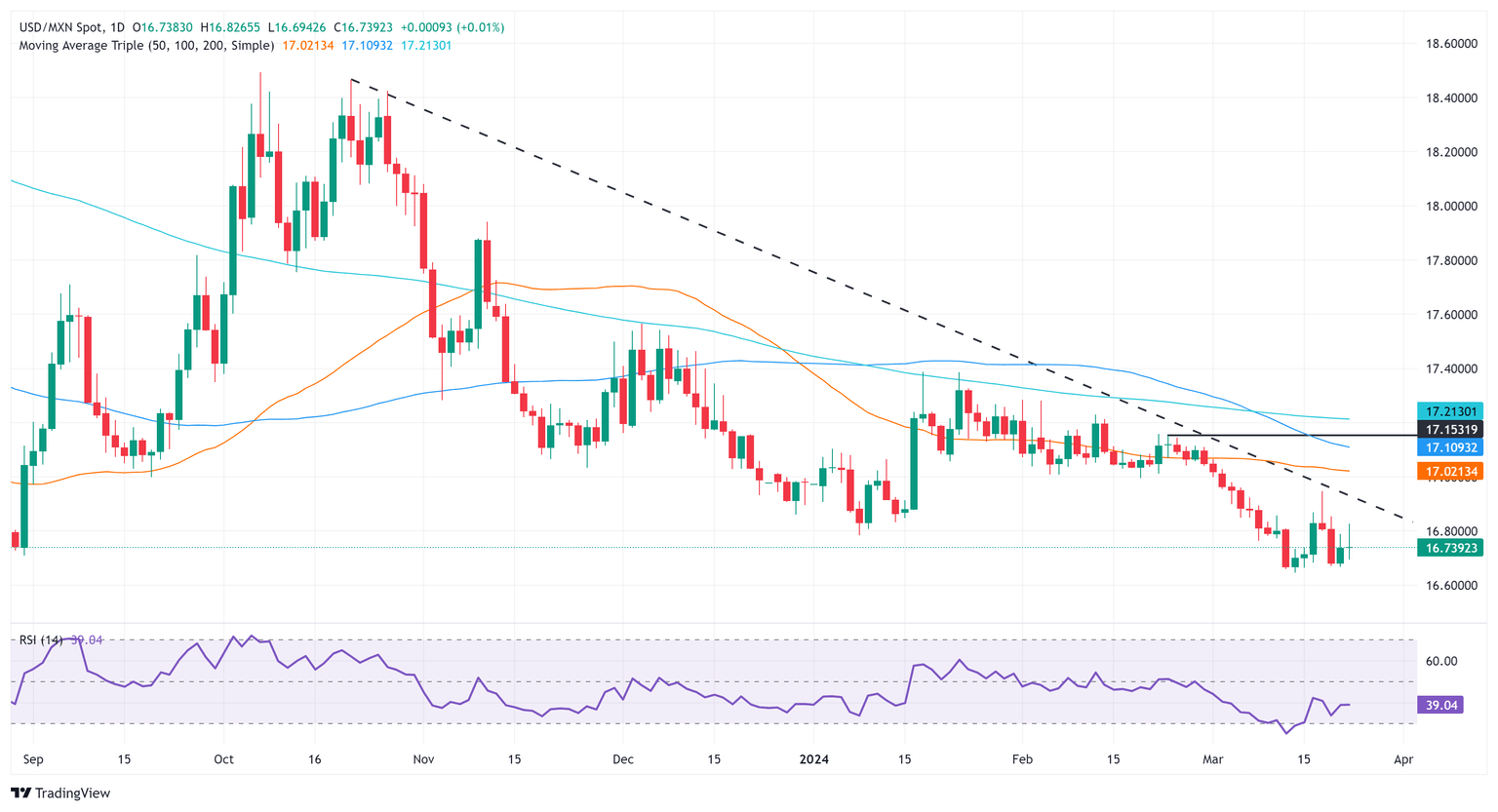

Technical analysis: Mexican Peso treads water as USD/MXN accelerates to 16.80

The USD/MXN daily chart suggests that buyers are losing momentum, with the pair posed to test lows last seen in 2015. Buyers' failure to conquer the 17.00 figure following Banxico’s rate cut suggests supply is higher than demand. In that scenario, the exotic pair's first support level would be the current year-to-date low of 16.64, followed by last year’s cycle low at 16.62 and October 2015’s of 16.32.

For a bullish scenario, traders must reclaim the current week’s high of 16.94, ahead of the 17.00 figure. Up next lie key dynamic resistance levels like the 50-day Simple Moving Average (SMA) at 17.01, the 100-day SMA at 17.11 and the 200-day SMA at 17.20.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.