Mexican Peso falls despite higher inflation, diminishing hopes for Banxico cut

- Mexican Peso weakens against US Dollar, with USD/MXN climbing 0.74% following mixed Mexican inflation report, robust US Durable Goods Orders.

- Mexico's CPI for mid-April shows mixed signals, potentially influencing Banxico's upcoming rate decision in May.

- USD/MXN gains momentum past the 17.00 mark as Treasury yields rise, underscoring stronger demand for Greenback.

The Mexican Peso weakens on Wednesday as the North American session begins, following a mixed inflation report for the first half of April. Mexico’s Consumer Price Index (CPI) rose above expectations, while underlying CPI declined sharply. An upbeat Durable Goods report in the United States (US) sponsored a leg up in the exotic pair. The USD/MXN trades at 17.11, 0.94% above its opening price, after bouncing off weekly lows at 16.90.

Mexico’s National Statistics Agency (INEGI) revealed that mid-month inflation rose above estimates and March’s reading on a yearly basis. In the meantime, the annual Core CPI number was below last month’s data. The mixed reading would prevent the Bank of Mexico (Banxico) from cutting rates at the May meeting.

Across the border, the US Commerce Department revealed that Durable Goods Orders rose above estimates, while core orders improved compared to February’s reading but missed forecasts.

After the data, the USD/MXN broke above the 17.00 figure and extended its gains. The rise in US Treasury yields lent a lifeline to the Greenback, which, according to the US Dollar Index (DXY), rose 0.24% at the brink of reclaiming the 106.00 threshold.

Daily digest market movers: Mexican Peso depreciates following strong Durable Goods Orders

- Mexico’s National Statistics Agency (INEGI) revealed that mid-month CPI rose by 4.63% YoY, above March’s reading and estimate of 4.48%. Monthly, inflation increased 0.09%, missing forecasts of 0.03%.

- The core CPI edged lower compared to last month's figures. It rose by 4.39% YoY as expected, down from 4.69%, a 0.3% decrease. MoM data showed that core prices rose 0.16%, aligned with estimates.

- Citibanamex Survey showed that most analysts expect Banxico to hold rates unchanged at the May meeting. The median foresees a rate cut in June, while they estimate the main reference rate to end at 10.00%, up from 9.63% previously.

- Banxico Governor Victoria Rodriguez Ceja said that service inflation is not slowing as expected. She added that the Peso’s strength has helped to temper inflationary pressures and lower imported goods. She emphasized that Banxico would remain data-dependent.

- Mexico’s economy is faring well as Economic Activity expanded in February compared to January’s data. Figures increased by 1.4% MoM and 4.4% YoY in the second month of the year, up from January’s 0.9% and 1.9% expansion, respectively.

- US Durable Goods Orders in March expanded by 2.6% MoM, up from 0.7%, and exceeded forecasts of 2.5%. Excluding Transport, they increased 0.2% MoM, higher than February’s 0.1% but missed projections of 0.3%.

- Data from the Chicago Board of Trade (CBOT) suggests that traders expect the Fed funds rate to finish 2024 at 4.98%, up from 4.965% on Tuesday.

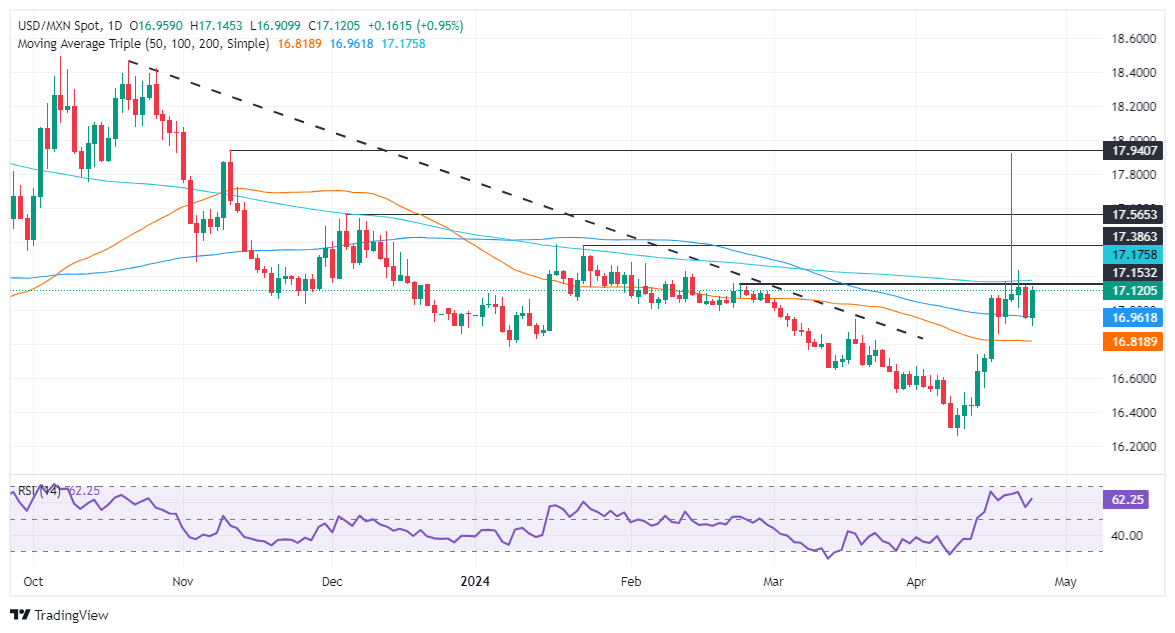

Technical analysis: Mexican Peso on backfoot as USD/MXN rallies toward 200-day SMA

The Mexican Peso loses traction as the USD/MXN aims toward the 200-day Simple Moving Average (SMA) at 17.16. Once surpassed, this SMA clears the way for buyers to push prices toward the January 23 high at 17.38. The next resistance would be December 5’s 17.56 and the 18.00 figure.

Although the exotic pair trades below the 200-day SMA, the Relative Strength Index (RSI) shows that bullish momentum is growing, which means that shorts are vulnerable to a short squeeze.

On the other hand, if USD/MXN edged below the 17.00 figure, that would open the way to testing the 100-day SMA at 16.96. A breach of the latter would expose the 50-day SMA at 16.81.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.