McDonald’s (MCD): Final push before diagonal ends

McDonald’s (MCD) stock is holding steady near $298, showing resilience despite mixed consumer trends and pricing pressures. Financially, the company remains strong with a market cap above $213 billion, a dividend yield of 2.37%, and nearly 50 consecutive years of dividend increases. Its Q2 earnings are expected on July 28, with analysts projecting modest profit growth.

Recently, Goldman Sachs upgraded MCD to “Buy,” citing its push to regain market share through product innovation and digital strategy. New menu items like the return of snack wraps and the “daily double” burger are designed to attract value-focused customers. McDonald’s is also expanding its beverage lineup, using insights from its CosMc’s concept to boost traffic and check size.

Leadership changes are underway too—Annemarie Swijtink will become CEO of McDonald’s Canada this September, signaling a fresh strategic direction in key markets. Overall, MCD is navigating a tough consumer environment with smart financial planning, brand strength, and targeted innovation. Want help turning this into a visual or social post? I’ve got ideas.

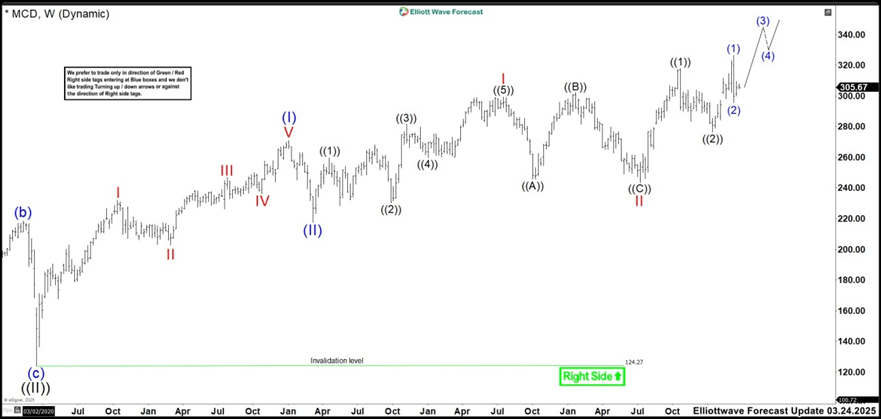

McDonald’s MCD weekly chart March 2025

Back in March, McDonald’s (MCD) completed its correction and reached the projected zone between $281 – $271 area. It touched a low of $276.80 and quickly moved higher, matching our bullish forecast. Since then, the price climbed in a new upward phase, supported by strong momentum. As long as it stays above the previous low, the bullish setup remains valid. If the price dips below that level, it may signal that the correction isn’t over. However, that wouldn’t mean a bearish trend—just a delayed continuation. Overall, the market’s structure still points to more upside ahead.

McDonald’s MCD weekly chart July 2025

Currently, wave (2) has taken significantly more time than expected. Although we initially looked for a strong bullish continuation, we’ve now decided to relabel the structure as a leading diagonal. This adjustment stems from the likelihood that the Dow Jones is nearing to end of an impulsive move that began in April. If true, McDonald’s (MCD) stock should rally and soon experience a pullback. Accordingly, the diagonal now includes wave (1) at 317.84 high, correction wave (2) at 276.63 low, next leg at 326.27 high, and wave (4) at 283.47 low. To complete the pattern, wave (5) must rise above wave (3) but remain below 333.27.

If wave (5) exceeds 333.27, the diagonal structure becomes invalid. This is because wave (3) would then be the shortest, violating Elliott Wave rules. In that case, we must reassess whether MCD is forming a flat correction as wave ((2)), or simply continuing its bullish momentum. This scenario would require a fresh analysis of the broader structure and its implications for future price action. For now, we remain focused on completing the diagonal and preparing for a potential retracement.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com