LCID Stock News: Lucid Group Inc dips as EV stocks drop on Rivian production delays

- NASDAQ:LCID fell by 0.03% during Wednesday’s trading session.

- Rivian tells its customers that SUVs will be ready in 2023.

- Tesla stock falls as Musk continues to sell shares.

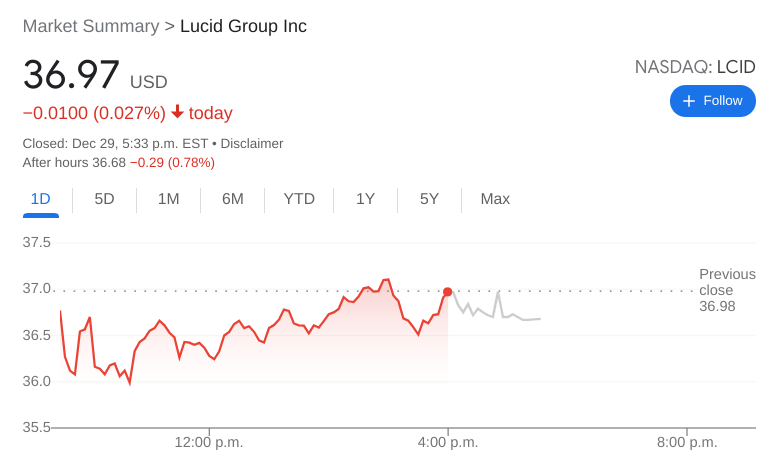

NASDAQ:LCID has been far from the sure bet investors believed it to be when the luxury EV maker went public back in July. But it is still early, and many people forget that even Tesla (NASDAQ:TSLA) struggled for a majority of its start as a public company. On Wednesday, shares of Lucid fell by 0.03% and closed the trading day at $36.97. This still gives Lucid a market cap of over $60 billion, which is certainly an expensive multiple for most investors, especially given the fact that Lucid has delivered less than 500 vehicles in its existence as a company. Still, EV stocks are all about future potential, and if Lucid can execute, it’s hard to argue it doesn’t have the potential to one day be great.

Stay up to speed with hot stocks' news!

In other EV startup news, the freshly public Rivian (NASDAQ:RIVN) has dealt its customers yet another blow. It all started at Rivian’s first quarterly earnings call earlier in December. The company warned that production in 2021 and 2022 could be affected by the ongoing global supply chain crisis. On Wednesday, Rivian told customers that those with pre orders for the premium R1T and R1S models will now likely have to wait until 2023 to see their cars. Shares of Rivian were down 3.43% on Wednesday.

Lucid Motors stock price

EV industry leader Tesla fell as well on Wednesday, as CEO Elon Musk continued to unload shares despite stating last week that he was basically finished. On Wednesday, Musk sold a further $1 billion in Tesla shares, which brings him closer to his personal mark of 10% of this stake in the company. Shares of Tesla were down in the morning, but recovered most of its losses by the closing bell.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet