LCID Stock News: Lucid Group Inc charges higher on inclusion into the NASDAQ-100

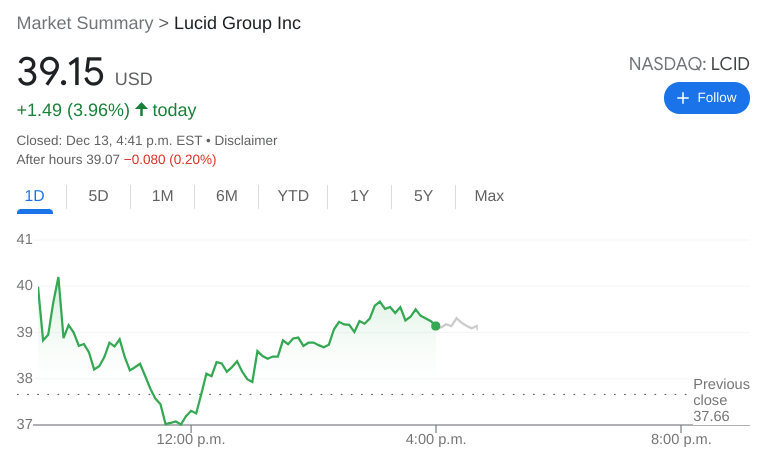

- NASDAQ:LCID gained 3.96% during Monday’s trading session.

- Lucid will officially be included into the NASDAQ-100 index.

- Tesla tumbles on growth stock sell off, Bitcoin slump.

NASDAQ:LCID bounced back nicely on Monday after the stock was hammered last week on a pair of company announcements. Shares of Lucid gained 3.96% on Monday and closed the trading session at $39.15. After being beaten down by an SEC investigation and a $1.75 billion debt offering, Lucid was riding low coming into this week. So too was the NASDAQ index which fell by a further 1.39% to start the week. All three major indices were weaker as the Dow Jones dropped by 320 basis points and the S&P 500 sank by 0.91% in a bearish opening session. General tech stock weakness and higher than anticipated inflation figures for the month of November have caused some volatility in the markets.

Stay up to speed with hot stocks' news!

Finally some good news for Lucid investors as the stock was chosen to be included in the NASDAQ-100 index. The next stock shuffle will take place near the end of December, and also see stocks like AirBNB (NASDAQ:ABNB), Zscaler (NASDAQ:ZS), Datadog (NASDAQ:DDOG), Fortinet (NASDAQ:FTNT), and Palo Alto Networks (NASDAQ:PANW) added in. While the inclusion does not necessarily guarantee gains for the stock, it does provide increased exposure as well as inclusion into more NASDAQ-based ETFs.

Lucid Motors stock price

It was not as rosey of a start to the week for Tesla (NASDAQ:TSLA), as the EV industry leader tumbled by a further 4.98% on Monday. Tesla has seen its valuation slashed as of late, despite increased price targets from Wall Street analysts. Added to this volatility are the fact that CEO Elon Musk continues to sell his shares in the company, as well as general weakness in Bitcoin, of which Tesla holds several hundred million dollars worth on its balance sheet.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet