The world's coronavirus situation is detrimental to risk appetite and a series of headlines at the end of the week are concerning.

The US reported its second-highest daily death toll of the pandemic, even as hospitalizations continued to edge downward, offering a small sign of hope for health experts and officials.

The US President Joe Biden has stated that the roll-out of vaccinations has been poor and that things will likely get worse before getting better, predicting that the death toll will top 500,000 next month.

The US recorded 4,375 deaths on Wednesday, according to a Wall Street Journal analysis of data compiled by Johns Hopkins University.

The coronavirus vaccine won’t be widely available in US pharmacies by late February as previously promised, the new director of the Centers for Disease Control and Prevention said Thursday.

“We are going to, as part of our plan, put the vaccine in pharmacies. Will it be in every pharmacy in this country by that timeline? I don’t think so,” Dr. Rochelle Walensky told the “Today Show.”

Meanwhile, in the UK, the UK reported record numbers two days in a row, with 1,820 fatalities, the highest yet, reported on Wednesday.

This has led UK government ministers to try to force Boris Johnson into closing Britain's borders to foreigners.

A growing Cabinet row over how to prevent new variants of the virus spreading to the UK is taking the market's focus.

Across the Channel, the European Union leaders agreed that borders should remain open.

The virus’ mutations are concerning and the 27 leaders have looked at further border restrictions like limits on all non-essential travel, better tracking of mutations and improving coordination of lockdowns.

The leaders are assessing more measures to counter the spread of coronavirus variants during a video summit Thursday.

The bloc’s top disease control official said urgent action was needed to stave off a new wave of hospitalizations and deaths.

Meanwhile, in the latest headlines, Japan's vaccine programme chief has said that the nation will start coronavirus vaccination with Pfizer vaccines.

Market implications

The US dollar may continue to attract a bid if the sentiment flips, which brings the case for the dollar bullish on a number of levels.

On the other side of the coin, trade war sentiment and demand for US Treasuries coupled with inflationary expectations and a less dovish Fed leading to rising US yields could be the catalyst for a period of US dollar strength.

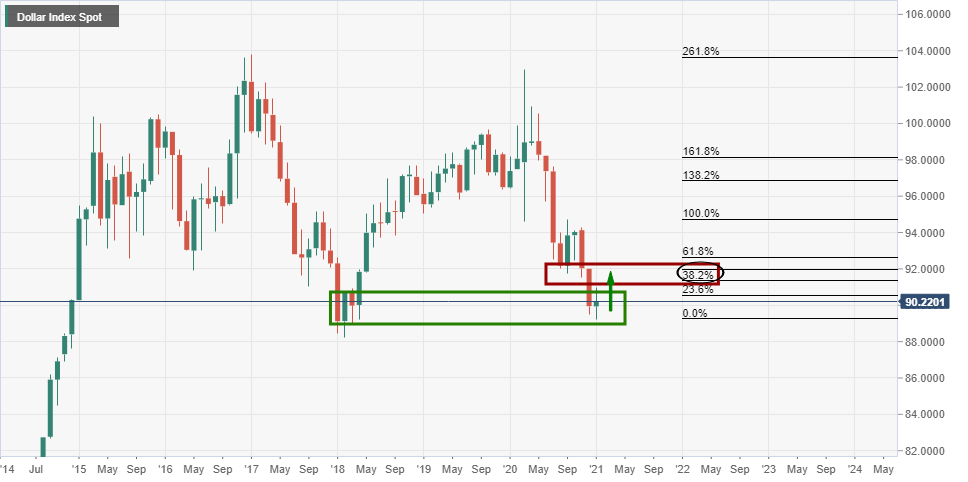

DXY monthly chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trims gains, hovers around 1.1900 post-US data

EUR/USD trades slightly on the back foot around the 1.1900 region in a context dominated by the resurgence of some buying interest around the US Dollar on turnaround Tuesday. Looking at the US docket, Retail Sales disappointed expectations in December, while the ADP 4-Week Average came in at 6.5K.

GBP/USD comes under pressure near 1.3680

The better tone in the Greenback hurts the risk-linked complex on Tuesday, prompting GBP/USD to set aside two consecutive days of gains and trade slightly on the defensive below the 1.3700 mark. Investors, in the meantime, keep their attention on key UK data due later in the week.

Gold loses some traction, still above $5,000

Gold faces some selling pressure on Tuesday, surrendering part of its recent two-day advance although managing to keep the trade above the $5,000 mark per troy ounce. The daily pullback in the precious metal comes in response to the modest rebound in the US Dollar, while declining US Treasury yields across the curve seem to limit the downside.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

Elliott Wave analysis: Apple set to complete impulsive rally from January 21 low

The cycle from the January 21, 2026 low in Apple (AAPL) is unfolding as a five‑wave Elliott Wave impulse. From that low, wave 1 advanced to $268.34, followed by a corrective pullback in wave 2 that terminated at $252.12. The stock then resumed its upward trajectory in wave 3.