Gold braces for side effects of US CPI release on US rates

- Gold flat after Eu and China vow to counter US tariffs earlier this Wednesday.

- A US-brokered ceasefire deal on Ukraine is up for Russia to consider in the coming days.

- Traders are awaiting the upcoming US inflation data on Wednesday.

Gold’s price (XAU/USD) turns flat to $2,915 at the time of writing on Wednesday ahead of the United States (US) Consumer Price Index (CPI) release for February. Market consensus is for a deceleration in all inflation measures, both monthly and yearly gauges. However, many analysts and economists have commented that the current US tariff approach will be inflationary for the US, which could trickle through in the numbers.

Meanwhile, traders are still cautious about tariffs after the Chinese Minister of Foreign Affairs Wang Yi commented that if the US wants to suppress China with its steel and aluminum tariffs. Europe, meanwhile, committed to putting countermeasures in place by April 13. On the geopolitical side, a ceasefire deal in Ukraine brokered by the US has been put forward to Russia for consideration.

Daily digest market movers: Fed rate cut bets on watch

- Chinese consumption stocks rise as the nation’s annual political gathering wraps up with support for domestic demand. Hong Kong jewelers lead the gains, bolstered by haven demand for Gold proxies, Bloomberg reports.

- Wall Street is growing angsty as investors become increasingly unnerved by whipsawing tariff policy, sticky inflation, and the unknown pace of the Federal Reserve’s (Fed) interest-rate easing. Market forecasters at banks, including JPMorgan Chase & Co. and RBC Capital Markets, have tempered bullish calls for 2025 as Trump’s tariffs stoke fears of slowing economic growth, Bloomberg reports.

- The CME Fedwatch Tool sees a 97.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. The chances of a rate cut at the May 7 meeting currently stand at 39.5%.

Technical Analysis: CPI could trigger domino effect in US yields

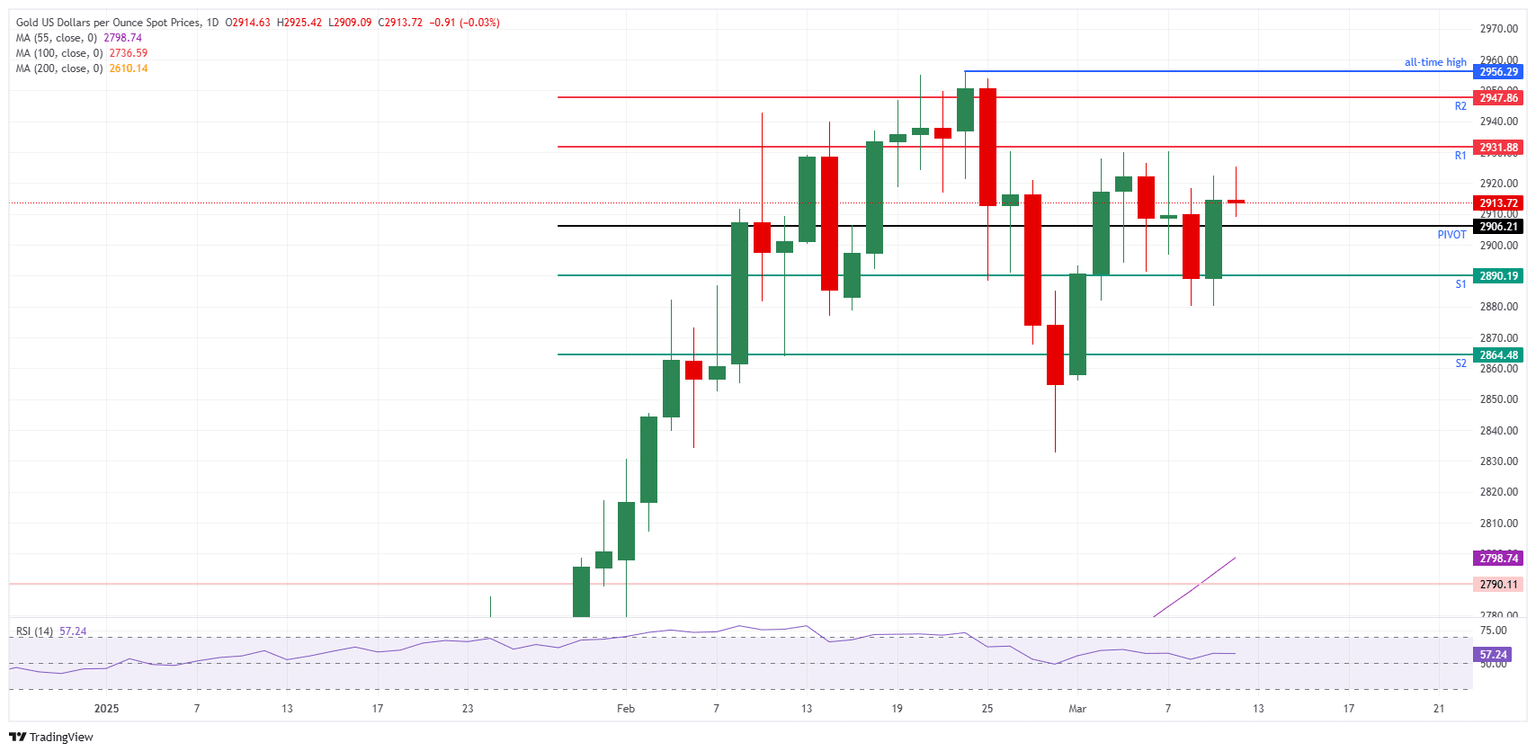

Relentless – that is wording that comes to mind when thinking about both the headlines on tariffs and the move in Gold this week. The Monday dip was bought eagerly, while Bullion now makes its way to test the monthly cap around $2,930. Once that level breaks, a move toward a new all-time high is back in the cards.

Gold is back above the $2,900 round level and, from an intraday technical perspective, it is back above the daily Pivot Point at $2,906. Gold is on its way to the R1 resistance near $2,931, converging with last week’s highs. Once through there, the intraday R2 resistance at $2,947 comes into focus on the upside ahead of the all-time high of $2,956.

On the downside, the Wednesday Pivot Point stands at $2,906. In case that level breaks, look at the S1 support around $2,890. The S2 support at $2,864, coinciding with the February 12 low, should avoid any further downturn.

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.