Gold rises as US job slowdown dampens Treasury yields

- Gold rebounds strongly, rising nearly 1% in response to increasing optimism that Fed might reduce interest rates sooner.

- Friday’s US Nonfarm Payrolls report, indicating a slowdown in job creation, fuels expectations for September rate cut.

- Comments from Fed officials, including Thomas Barkin and John Williams, highlight ongoing concerns over inflation and employment trends.

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve (Fed) might begin to ease policy sooner than foreseen. This follows last Friday’s Nonfarm Payrolls (NFP) report, which showed the economy continues to create jobs but at a slower pace.

The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291. The latest employment report in the United States (US) increased the odds for a Fed rate cut of a quarter of a percentage point in September 2024.

Market participants continue to digest the latest data from the US as April’s NFP report was softer than expected. If the next inflation report comes in weaker than expected, traders' speculation that the US central bank might lower interest rates during the year will be confirmed.

Recently, Fed officials have crossed the newswires. Richmond Fed President Thomas Barkin said that he has not seen evidence that inflation is on track and added that current policy is restrictive enough. Earlier, New York Fed President John Williams added that the jobs market is moderating and that the Fed is looking at the “totality” of data. He added that there would be rate cuts eventually.

Daily digest market movers: Gold price rises toward $2,320 as US yields fall

- Gold prices remain underpinned by lower US Treasury yields and a softer US Dollar. The US 10-year Treasury note is yielding 4.481%, down three and a half basis points (bps) from its opening level. The US Dollar Index (DXY), which tracks the Greenback’s performance against six other currencies, edged down 0.02% to 105.05.

- Last Friday, April’s US NFP missed estimates and trailed March’s figures. That alongside the Institute for Supply Management (ISM) PMIs in the manufacturing and services sectors entering contractionary territory might undermine the US Dollar, a tailwind for the golden metal.

- Gold advancing more than 12% so far in 2024 is courtesy of expectations that major central banks would begin to reduce rates. Coupled with renewed fears that the Middle East conflict could resume between Israel and Hamas can sponsor a leg up in XAU/USD prices.

- Israel's military has instructed civilians to evacuate certain areas of Rafah, indicating a potential impending offensive in the Gazan city. This directive follows unsuccessful cease-fire negotiations in Cairo between Hamas and Israel. A key issue in these talks was Hamas's demand for a permanent truce.

- After the data release, Fed rate cut probabilities increased with traders expecting 38 basis points of rate cuts toward the end of the year.

- Fed’s first rate cut is expected in September with odds standing at 90% for a 0.25% rate cut. The chances for another quarter point rate cut in December 2024 stands at 79%. This means the fed funds rate would finish the year at the 4.75%-5.00% range.

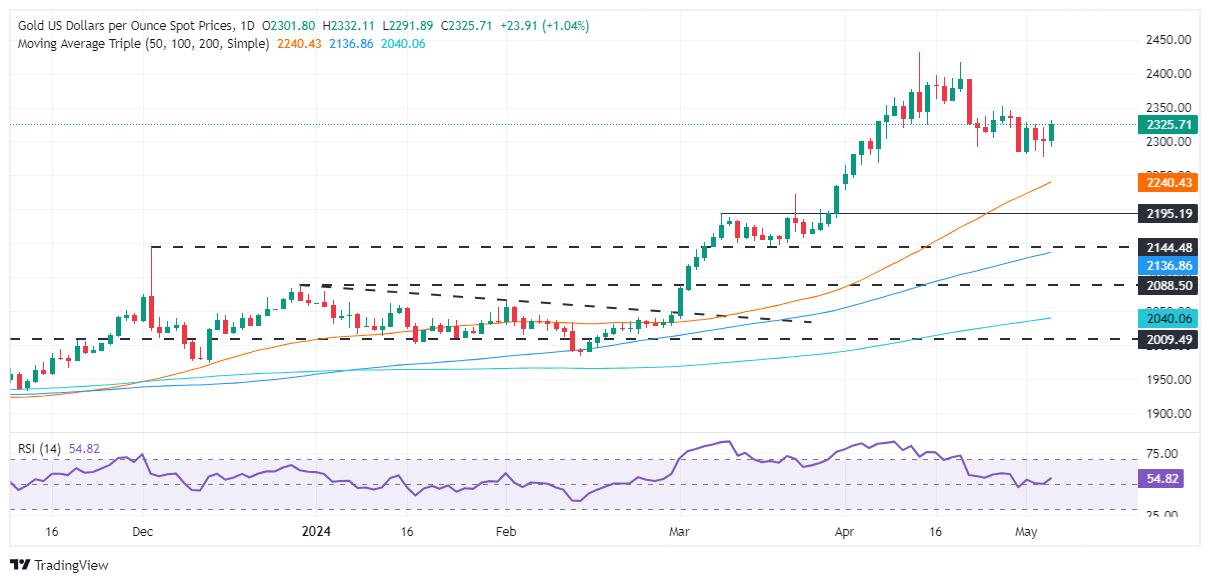

Technical analysis: Gold price rises steadily, stays above $2,320

Gold price is upwardly biased, but it remains shy of retesting the $2,400 mark. For that to happen, buyers must reclaim April’s 26 high, the latest cycle high at $2,352. Once cleared, the next stop would be the $2,400 threshold, followed by the April 19 high at $2,417 and the all-time high of $2,431.

It should be said that momentum is on the side of bulls with the Relative Strength Index (RSI) standing above the 50 midline and aiming higher.

Conversely, if bears drag XAU/USD prices below $2,300, that could pave the way for a pullback toward the April 23 daily low of $2,291. Subsequent losses are expected beneath the March 21 daily high, which turned into support at $2,223, followed by $2,200.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.