Gold Price News and Forecast: XAU/USD on the defensive below $1930 level

Gold technical analysis: Sustains bullish tone despite crawling sideways

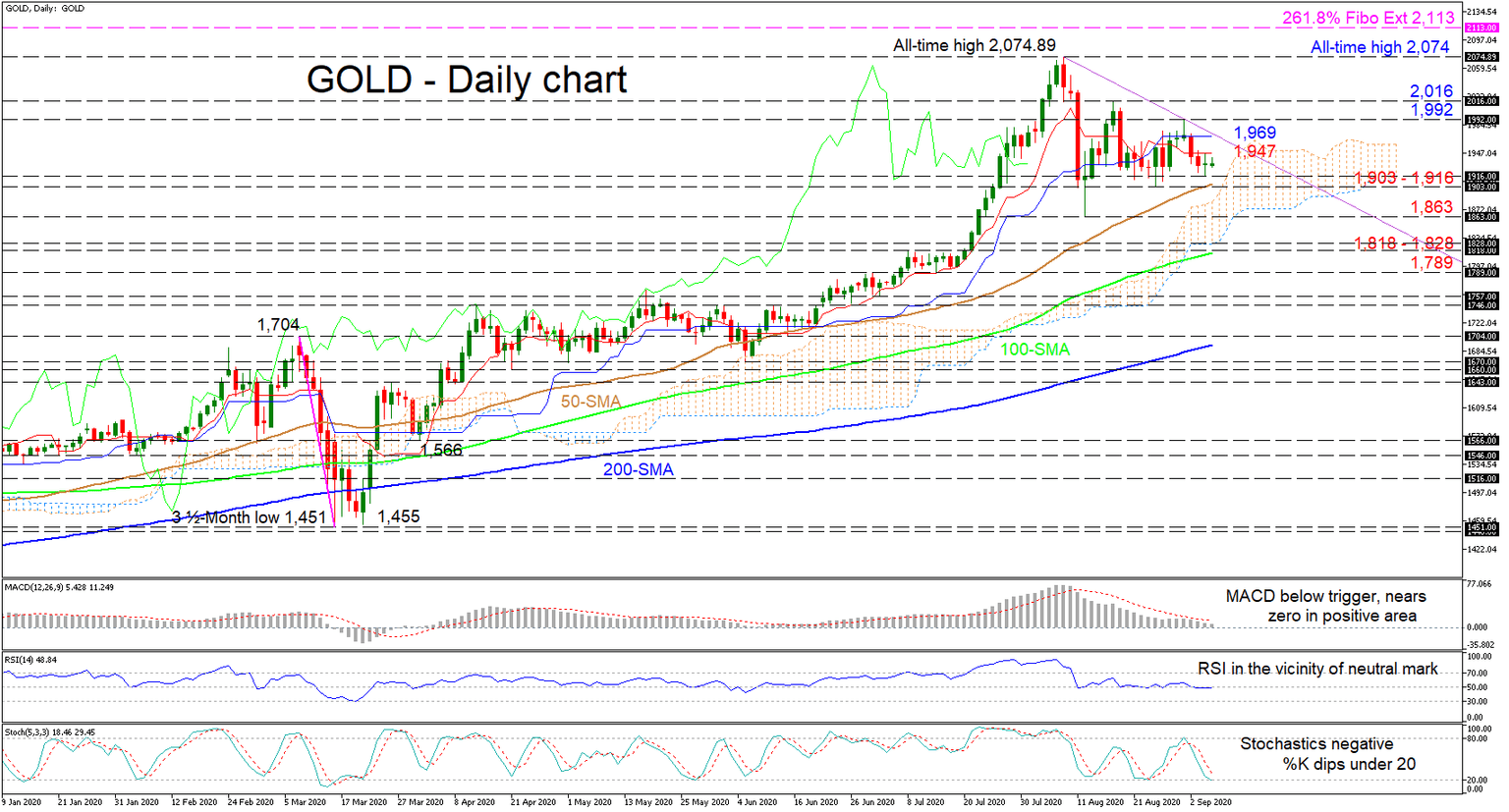

Gold is currently extending a sideways pattern above the simple moving averages (SMAs) and the 1,900 psychological number. Directional momentum has dried up as displayed by the steadied Ichimoku lines. Nonetheless, the rising SMAs continue to dictate a predominant bullish bias.

The short-term oscillators reflect a relatively paused picture under a restrictive diagonal line drawn from the all-time high. The MACD has remained somewhat in the positive region but beneath its red signal line, while the RSI hovers marginally underneath its neutral threshold. That said, the stochastic oscillator is bearish and the %K line has slipped below 20, promoting weakness in the commodity. Read More...

Gold Price Analysis: XAU/USD on the defensive below $1930 level

Gold refreshed daily lows, around the $1927-26 region during the early European session, albeit lacked any strong follow-through selling.

The precious metal failed to capitalize on its early uptick, instead met with some fresh supply near the $1941-42 region and was being pressured by a strong pickup in the US dollar demand. As investors looked past Friday's mixed US monthly jobs report, the greenback was back in demand on the first day of a new trading week. This, in turn, was seen as one of the key factors weighing on the dollar-denominated commodity. Read More...

Gold: Breaking an uptrend is not the end for the bulls

During the latter stages of last week we discussed the importance of the market continuing to form support around the 23.6% Fibonacci retracement (of $1451/$2072) at $1926. Intraday tests continue, but the consistent appetite to protect this support into the close is encouraging for the gold bulls. This has been a spluttering phase in recent weeks, where the market has effectively formed a range between $1900/$2000 (with the support low the low at $1902 and resistance of rebound highs at $1991 and $2015. Daily momentum indicators have moderated back into broadly neutral positioning with this loss of traction. It has also meant that the rising three month uptrend which has supported the market since mid-June, is now being breached (albeit not decisively broken yet). Read More...

Author

FXStreet Team

FXStreet