Gold Price News and Forecast: XAU/USD looks firmer and closer to $1,900/oz

Gold Futures: Further upside appears limited

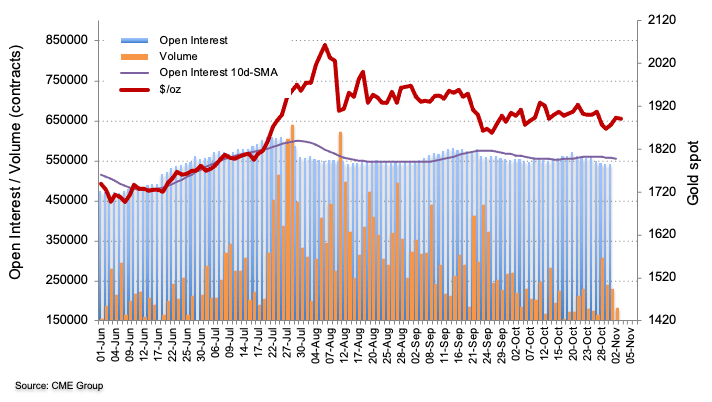

Open interest in Gold futures markets extended the downtrend for yet another session on Monday, this time by just 114 contracts in light of preliminary readings from CME Group. Volume, in the same line, decreased for the third consecutive session, now by around 48.3K contracts.

Gold met support around $1,860/oz.

The positive performance of Gold prices at the beginning of the week was on the back of shrinking open interest and volume, leaving the likeliness of further upside somewhat limited in the very near-term. That said, initial contention now emerges at the October’s low at $1,860 per ounce. Read more...

Gold Price Analysis: XAU/USD looks firmer and closer to $1,900/oz

Gold prices reverse the initial bearishness and refocus on the upside, trading at shouting distance from the key barrier at the $1,900 mark per ounce troy. The better tone surrounding the precious metal tracks the upbeat sentiment in the broad risk complex, all so far propped up by the renewed selling pressure in the dollar ahead of the US elections.

Indeed, traders appear optimistic on a Biden win and the potential “blue wave” that it is supposed to follow. Under this scenario, bets of another coronavirus stimulus bill remain high as well as a more market-friendly approach to the US-China trade dispute. Read more...

Gold Price Analysis: XAU/USD trades with modest losses, focus remains on US elections

Gold edged lower through the Asian session, albeit lacked any strong follow-through and remained well within the striking distance of multi-day tops set earlier this Tuesday.

The precious metal stalled its recent recovery move from one-month lows ahead of the $1900 mark and witnessed a modest pullback during the first half of the trading action on Tuesday. The prevalent upbeat market mood – as depicted by another day of strong gains in the US equity futures – was seen as a key factor weighing on traditional safe-haven assets, including gold. Read more...

Author

FXStreet Team

FXStreet