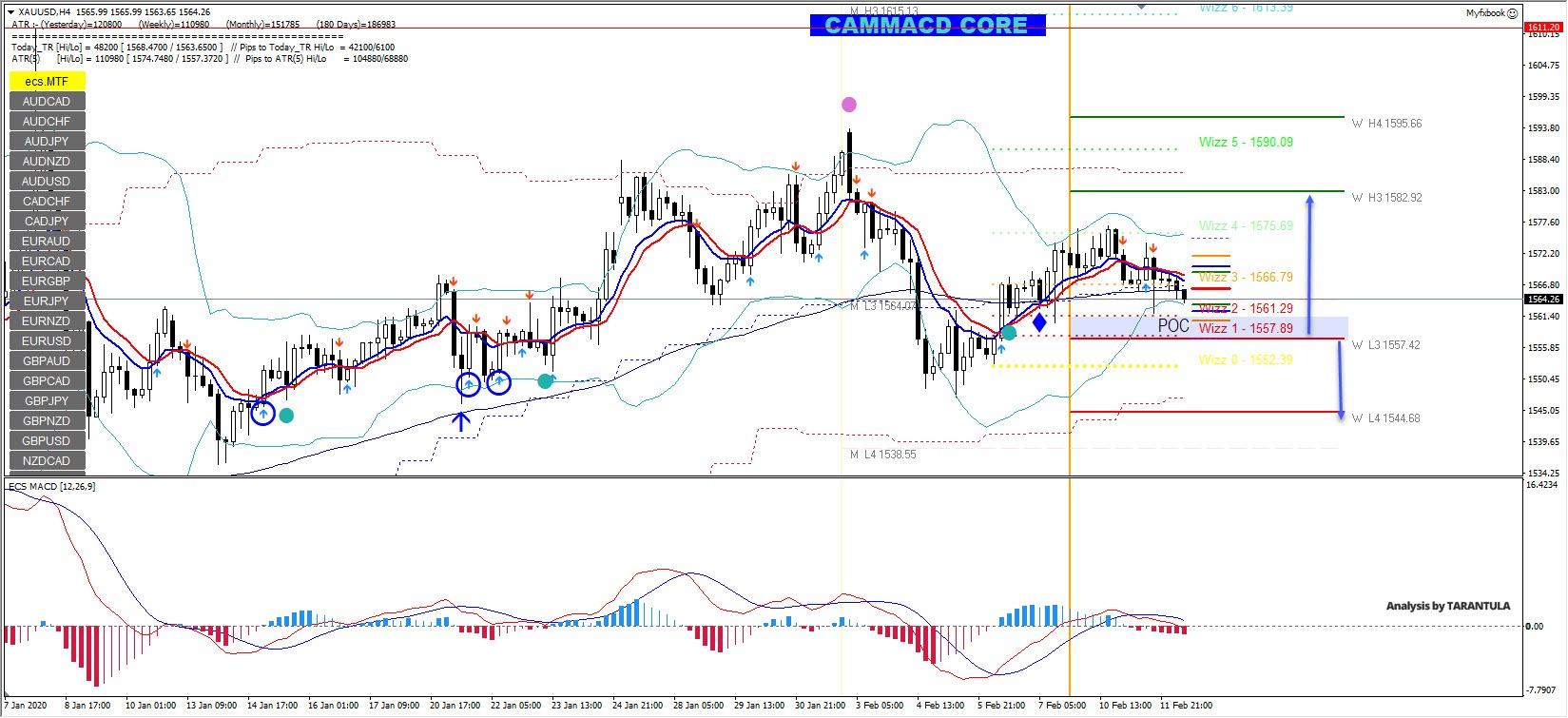

GOLD Should Bounce From the W L3 Camarilla

1557-1560 is still the POC zone where Gold buyers might be waiting. The price might bounce towards 1566 and 1574. If 1574 breaks we could see 1582 W H3 pivot retest. A deeper retracement might follow only if 1555 breaks lower. In that case watch for 1552 and 1544. Read more...

Coronavirus hits China’s gold jewelry demand - Bloomberg

The demand for gold jewelry in the world’s top consumer, China, is likely to plunge this year, as the China coronavirus negatively affects the shoppers’ sentiment, per Bloomberg.

Key Points:

“Jewelry retailers such as Luk Fook Holdings International Ltd. are shortening business hours and managing time off for employees in an effort to prevent the disease from spreading.

Zhang Yongtao, Chief Executive Officer of the China Gold Association, noted: “People are not in the mood to shop for jewelry. Stores and shopping malls are closed because of the virus. The sales of gold jewelry and bars will drop substantially this year.” Read more...

Gold hangs near weekly lows, below $1565 level

Gold edged lower for the second consecutive session on Wednesday and is currently placed near the lower end of its weekly trading range, around the $1564-65 region.

The precious metal failed to capitalize on the previous session's late bounce and met with some fresh supply on Wednesday amid a positive mood around equity markets, which tends to undermine demand for perceived safe-haven assets.

Gold weighed down by a combination of factors

The risk-on flows led to a goodish pickup in the US Treasury bond yields, which further played their part in exerting some additional pressure on the non-yielding yellow metal. Meanwhile, the prevailing bullish sentiment surrounding the US dollar did little to lend any support to the dollar-denominated commodity. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold rises above $2,340 as US yields retreat

Gold gained traction and advanced above $2,340 in the European morning on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.7% ahead of key inflation data from the US, helping XAU/USD stretch higher.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.