Gold Price News and Forecast: XAU/USD flat around $1,900

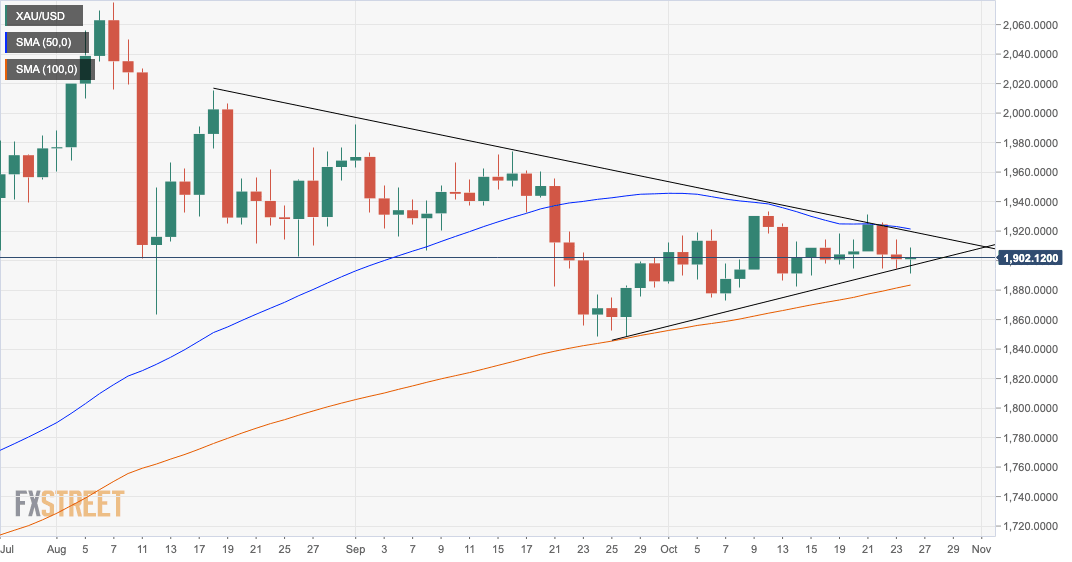

Gold Price Analysis: XAU/USD flat around $1,900 approaching the tip of a triangle pattern

Gold’s futures have remained moving directionless within a tight range, both sides of $1,900 on Monday. The precious metal is approaching the tip of a triangle pattern that has been shaping over the last four weeks

Bullion prices have been trading within a $10 range, between $1,898 and $1,908 on a risk-off session, with the USD outperforming its main peers on growing concerns about the global increase of COVID-19 cases.

Gold & Silver price forecast - U.S Presidential Election prep

Gold found support on Monday, above the key psychological level of $1,900 as a spike in new infections weighed on risk sentiment among investors as cases touched record levels in the United States.

U.S. stocks decline picked pace on Monday afternoon, setting the Dow for its worst day in more than seven weeks, as soaring coronavirus cases and a political deadlock over the fiscal relief bill raised doubts about the fate of the economy recovery.

Author

FXStreet Team

FXStreet