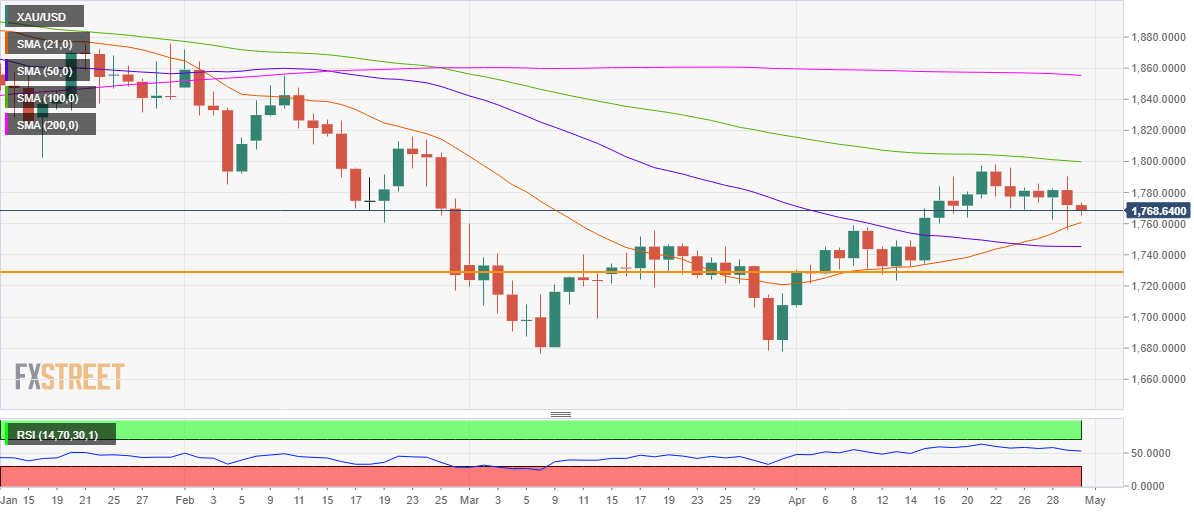

Gold Price Forecast: 21-DMA support holds the key for XAU/USD amid firmer yields

Gold (XAU/USD) rallied as high as $1790 in the Asian trading on Thursday but gave up gains to reached fresh ten-day lows at $1756 after the US Treasury yields hit the highest levels in over two weeks on better-than-expected US Q1 GDP data. The US economy expanded at 6.4% in Q1 on an annualized basis, outpacing expectations of a 6.1% growth. The US weekly Jobless Claims data also came in stronger, reflecting strengthening post-pandemic economic recovery. Risk-appetite improved on the renewed economic optimism that weighed on the safe-haven US dollar, helping stage a modest recovery in gold. However, markets turned cautious, as concerns over rising yields resurfaced, which collaborated with gold’s rebound. Read more...

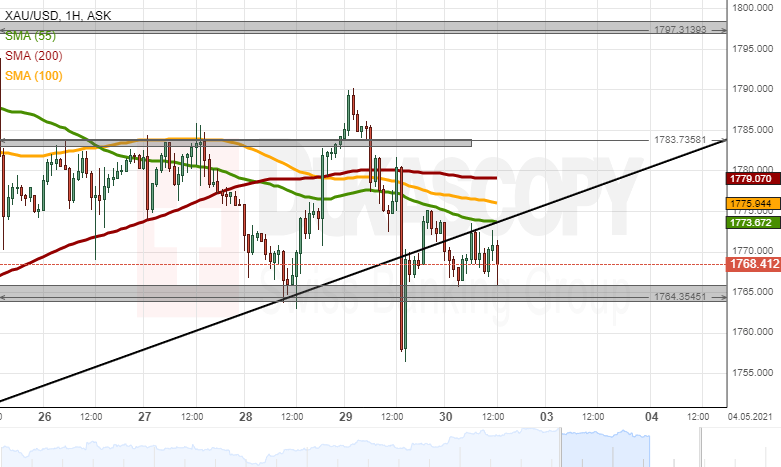

XAU/USD analysis: Breaks pattern

On Thursday, the XAU/USD exchange rate plunged by 312 pips or 1.74%. A breakout occurred through the lower boundary of an ascending channel pattern during Thursday's trading session.

Given that a breakout has occurred, the commodity is likely to continue to edge lower during the following trading session. The possible target for sellers could be near yesterday's low at 1755.00. However, technical indicators suggest on the daily time-frame chart that the precious metal could gain strength against the US Dollar within this session. Read more...

Gold Price Analysis: Three reasons why strong physical demand won’t stop XAU/USD falling – CE

Recent data have highlighted the strength of the rebound in physical demand for gold, especially in India and China. But strategists at Capital Economics don’t think this poses much of a risk to their forecast for the gold price to fall this year.

“Consumer demand has historically been strong after a period of falling prices, reflecting the more price-sensitive nature of these purchases. The upshot is that consumer demand for gold responds to changes in the price (often driven by external factors) much more than the gold price responds to changes in consumer demand. So the recent rise in consumer demand is a symptom of a lower gold price, rather than a reason to think it will rise again.” Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends recovery as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.