Gold Price Forecast: XAUUSD falls further below $1750 after US ISM PMIs, FOMC minutes eyed

- The non-yielding metal slips further as US bond yields recover from Tuesday’s session.

- US Global and ISM Services PMIs beat expectations but slowed compared to May’s readings.

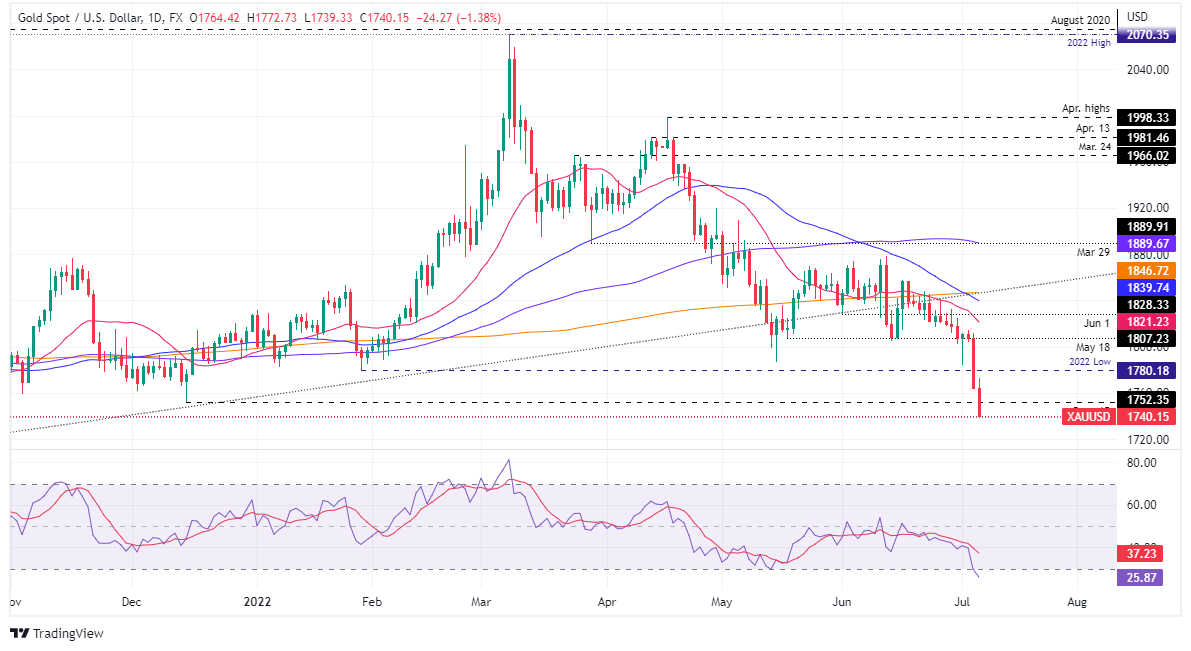

- Gold Price Forecast (XAUUSD): Sellers stepped in and broke the $1750 price level, eyeing the next swing low at around $1720.

Gold price tumbles to fresh multi-month lows below $1752.51, amidst concerns of a global economic recession, but also driven down by a solid greenback, which remains to record new two-year highs as shown by the US Dollar Index, underpinned by rising US Treasury yields. At the time of writing, XAUUSD is trading at $1740.15 a troy ounce.

US Services PMIs beat expectations, but show signs of slowing down

A string of US economic data crossed newswires. The US ISM Non-Manufacturing PMI tripped to 55.3 in June from 55.9 in the previous reading, showing that growth eased but beat expectations of 54.3. in the same tone, the S&P Global Services and Composite PMIs exceeded expectations and trailed May’s figures.

According to Chris Williamson, Chief Business Economist at S&P Global, demand for goods and services shows signs of moderation blamed on high inflation. He added that “tighter financial conditions are starting to hit” and that the services index slowdown was led by a drop in financial services activity.

Meanwhile, US equities fluctuate as well as European ones. The US Dollar Index, a measurement of the greenback’s value vs. a basket of peers, clings above the 107.000 mark, gaining close to 0.60%, while the US 10-year Treasury yield trims Tuesday’s losses up at 2.878%, climbs seven bps.

Those abovementioned factors and rising US Real yields, as shown by US 10-year TIPS, yielding 0.608%, are a headwind for XAUUSD’s price. Gold’s Wednesday price action witnessed the yellow metal opening near the $1765 area and edged towards the daily high around $1772 before plunging toward $1749.

The US economic calendar will unveil the FOMC June minutes will be revealed, which will shed some forward guidance regarding future monetary policy decisions.

Gold Price Forecast (XAUUSD): Technical outlook

From a technical perspective, XAUUSD is still downward biased. Once the December 15 swing low at around $1752.35 was breached, the yellow metal sellers are eyeing a re-test of the September 29, 2021 low at $1721.52. Gold traders should note that oscillators are in oversold territory but showing no signs of turning the corner, as illustrated by the Relative Strength Index (RSI).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.