Gold Price Forecast: XAU/USD trapped in a $14 range as bulls prepare an assault of $1900

- Gold aims for a 2.06% gain on the week, courtesy of geopolitical jitters amid Fed speaking ignored by market players.

- The conflict in Eastern Europe gives signs of no de-escalation as Russian President Putin decided to oversee nuclear drills in the weekend.

- XAU/USD Technical Outlook: Despite finishing the week on the wrong foot, still upward biased, as XAU bulls prepare to probe $1900.

Gold (XAU/USD) slides as the New York session winds down and fails to cling to the $1,900 mark pierced on Thursday, so far in the week up 2.02%. At the time of writing, XAU/USD is trading at $1,897. A risk-off market mood kept the safe-haven gold bid through the majority of the week, with four days of gains and one day in the red.

Russia/Ukraine update

In the meantime, the Russia Ukraine narrative keeps grabbing the headlines. In the last couple of hours, tensions have remained unchanged. Ukraine’s intelligence reported that Russian special forces placed numerous explosive devices around local infrastructure in separatist-held territories in Donetsk. Meanwhile, the Russian Communist leader Zyuganov said that Russian President Vladimir Putin would announce a decision on Donbas on February 20.

Furthermore, late in the day, a Senior US admin official said that Russian President Putin’s decision to oversee nuclear drills on Saturday is “escalatory.” In contrast, other US officials privately urged Ukraine President Zelensky to stay put, as concerns of a possible incursion rise, as reported by CNN’s reporter.

That said, what happened to gold? During Friday’s session, the yellow metal consolidated around the $1,886-$1,900 area, amongst exchanges of statements in news media between Russia, Ukraine, and NATO countries, keeping uncertainty around the current situation in Ukraine.

The US 10-year Treasury yield fell five basis points sits at 1.925% in the bond market. At the same time, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, edges up 0.31%, at 96.10, reflecting the increased demand for the US dollar amid geopolitical concerns.

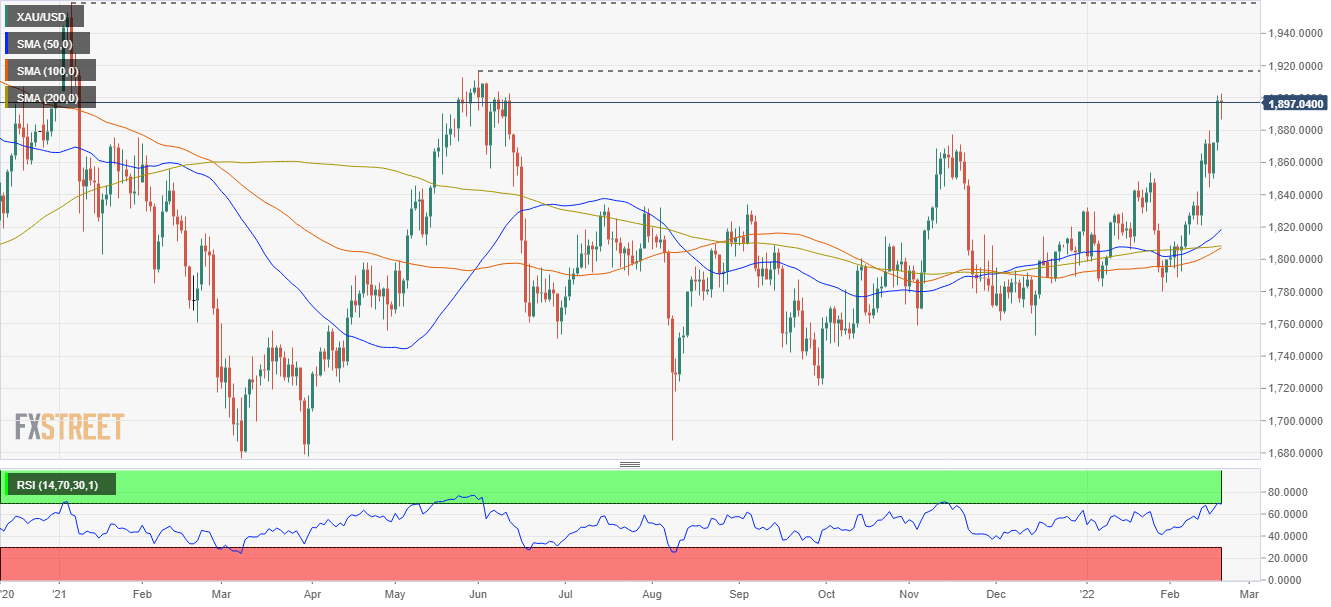

XAU/USD Price Forecast: Technical outlook

On Thursday, the non-yielding metal pierced the $1,900 mark for the first time since last June. However, XAU bulls’ failure to record a daily close left the yellow metal subject of a mean reversion move.

On Friday, XAU/USD consolidated in a $14.00 range. Should gold close within the range, a move towards February 15 daily high, resistance/support at $1,879 is on the cards, as XAU bulls prepare for an assault of $1,900. If that scenario plays out, XAU/USD first resistance is $1,900. The breach of it opens the door towards $1,916, which, once cleared, will expose January 2021 highs at $1,959.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.