Gold Price Forecast: XAU/USD surges to a seven-month high, amid Powell's remarks

- Gold price rallied to a new multi-month high of $2060.62 amid Powell’s speech.

- Federal Reserve Chair Jerome Powell's remarks on soft inflation data and high core inflation boost Gold's appeal as a hedge.

- US interest rate expectations now include nearly 135 basis points of Fed rate cuts by the end of 2024, as indicated by money market futures.

Gold price extended to a new seven-month high in the mid-North American session after the US Federal Reserve Chair Jerome Powell welcomed recently revealed soft inflation data, though stressed core inflation “is still too high.” At the time of writing, the XAU/USD is trading at around $2059, gaining more than 1.10%.

XAU/USD extended its gains despite Powell’s neutral stance

During a Q and A session, Fed Chair Powell said, “Wed (Fed) are getting what we wanted to get,” giving a green light on bullion traders, which took advantage of XAU/USD’s dip to the $2044.50 area, before jumping to new day and multi-month highs. Meanwhile, US Treasury bond yields are plunging, with the 10-year benchmark note coupon dropping six and a half basis points, at 4.263%, after reaching a high of 4.349%, a tailwind for Gold prices.

Consequently, the Greenback tumbles, as revealed by the US Dollar Index, which measures the currency against six peers, down 0.24%, at 103.26.

In the meantime, money market futures show investors are expecting close to 135 basis points of Fed rate cuts for the end of 2024.

Earlier, the Institute for Supply Management (ISM) revealed the Manufacturing PMI for November, which showed that business activity remains in contraction for the thirteenth straight month. Prices paid by manufacturers rose while the employment index eased, in alignment with the recent unemployment claims data.

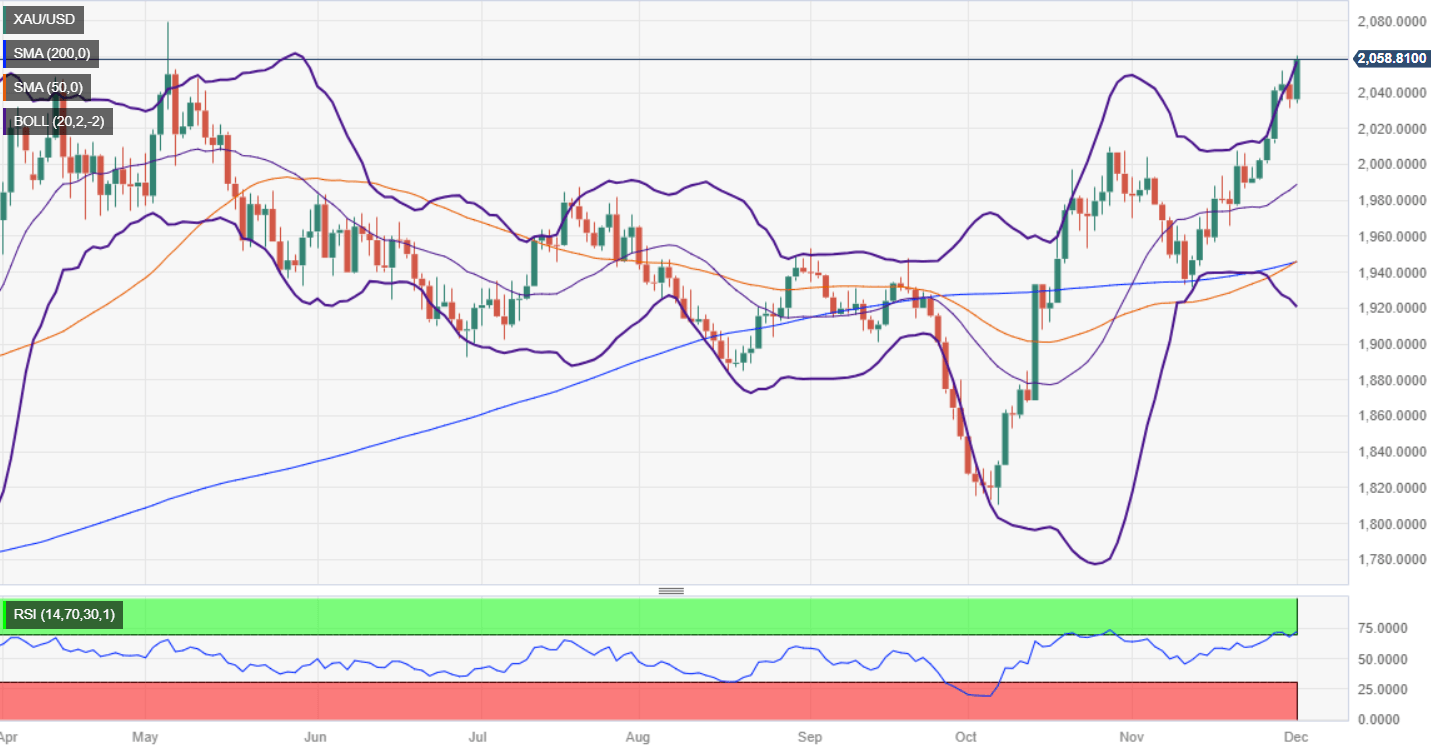

XAU/USD Price Analysis: Technical outlook

Gold’s is rallying sharply, with buyers eyeing all time high of $2081.82. It should be point out, there’s no additional resistance levels on its way, besides the $2060 and $2070 areas. Once those psychological levels are taken out, the ATH would be at reach. On the flip side, the first support is seen at the November 29 daily high at $2052.13, before opening the door slip to November’s 30 daily low at $2031.58.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.