Gold Price Forecast: XAU/USD sinks below $2,000 as US PMIs improve and recession fears fade

- Gold price dives on a surprisingly positive US S&P Global PMIs.

- Improvement in business activity in the US bolstered the US Dollar.

- The US Federal Reserve is expected to hike rates by 25 bps at the May meeting – FedWatch Tool.

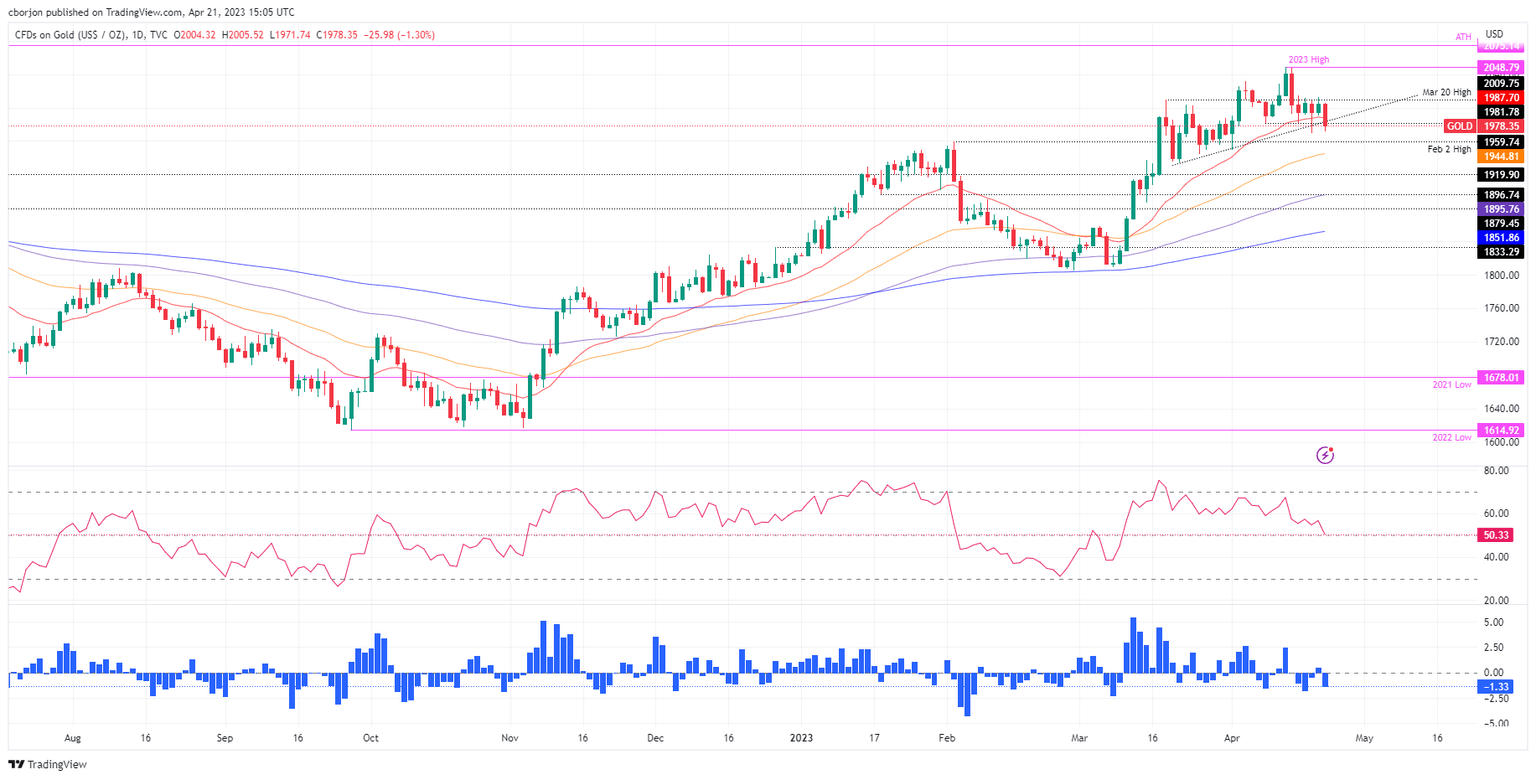

Gold price plunges below $2,000 and hit a daily low of $1,971.74 after the release of economic data from the United States (US) showed that the economy continues to expand, despite recent reports flashing a recession. Therefore, XAU/USD is trading at $1,982.78, losses 1.07%, at the time of writing.

US business activity picked up, Gold tumbles

S&P Global reported the final PMI readings for the US, which surprised most investors, which were caught off guard, as shown by the market’s reaction. The S&P Global Manufacturing PMI was 50.4, above 49 estimates, while the Services rose to 53.7, exceeding the consensus of 51.5. Therefore, the Composite reading was 53.5, above its previous reading.

As a result, XAU/USD spiked to $1,997.95 before tanking toward a two-day low of $1971.30, $1.5 above the S3 daily pivot point and shy of testing the weekly low of $1,968.80. Conversely, US Treasury bond yields climbed, as the report signals that inflation could rise, with 2s and 10s, gaining each three basis points, at 4.184% and 3.564%, respectively.

In the meantime, the CME FedWatch Tool, which forecasts the next move of the US Federal Reserve (Fed), keeps odds at 88% for a 25 bps rate hike at the May 2-3 meeting. Hence, the greenback is pairing some of its Thursday’s losses, as shown by the US Dollar Index (DXY), which tracks the buck’s performance vs. six peers, up at 0.14% at 101.936.

On Thursday, Federal Reserve officials crossed newswires. Philadelphia Fed President Patrick Harker suggested the US central bank is close to ending its campaign to control inflation. At the same time, Cleveland’s Loretta Mester believes rates should go above 5% due to high inflation. The current benchmark rate is between 4.75% and 5%.

Next on the agenda, the Federal Reserve Governor Lisa Cook will cross newswires ahead of the media blackout that Fed officials would begin, ending with the Fed Chair Powell press conference on May 3.

XAU/USD Technical Analysis

From a technical perspective, Gold finally broke below the 20-day Exponential Moving Average (EMA) at 1988.01, which could pave the way for further downside. It should be said the 20-day EMA has been dynamic support for Gold buyers, meaning that sellers must keep prices below $1,988. If XAU/USD sellers want to cement their case, a break below the weekly low of $1,969.34 could keep them on the path toward the $1,950 area before testing the 50-day EMA at $1,944.87. Otherwise, XAU’s buyers, once reclaiming $1,990, could pave the way for a retest of $2,000.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.