Gold Price Forecast: XAU/USD plunges below $1,800 amid rising US T-bond yields

- Gold came under renewed bearish pressure on Wednesday.

- 10-year US Treasury bond yield is testing 1.5%.

- Next near-term technical support is located at $1,790.

Gold closed in the negative territory after jumping to its highest level in more than a month at $1,820 on Tuesday and seems to be having a hard time shaking off the bearish pressure mid-week. XAU/USD was last seen losing 0.6% on a daily basis at $1,795.

The renewed dollar strength on Wednesday is weighing on XAU/USD ahead of the American session. The US Dollar Index is clinging to modest daily gains at 96.35 as investors remain cautious in the face of the surging number of Omicron cases.

There won't be any high-tier macroeconomic data releases in the remainder of the day and investors will remain focused on the risk perception. As of writing, US stocks futures were posting small gains, suggesting that risk flows could return in the second half of the day but thin trading conditions make it difficult to assess the market sentiment.

In the meantime, the benchmark 10-year US Treasury bond yield is edging higher toward 1.5% and not allowing XAU/USD to stage a rebound.

Gold technical outlook

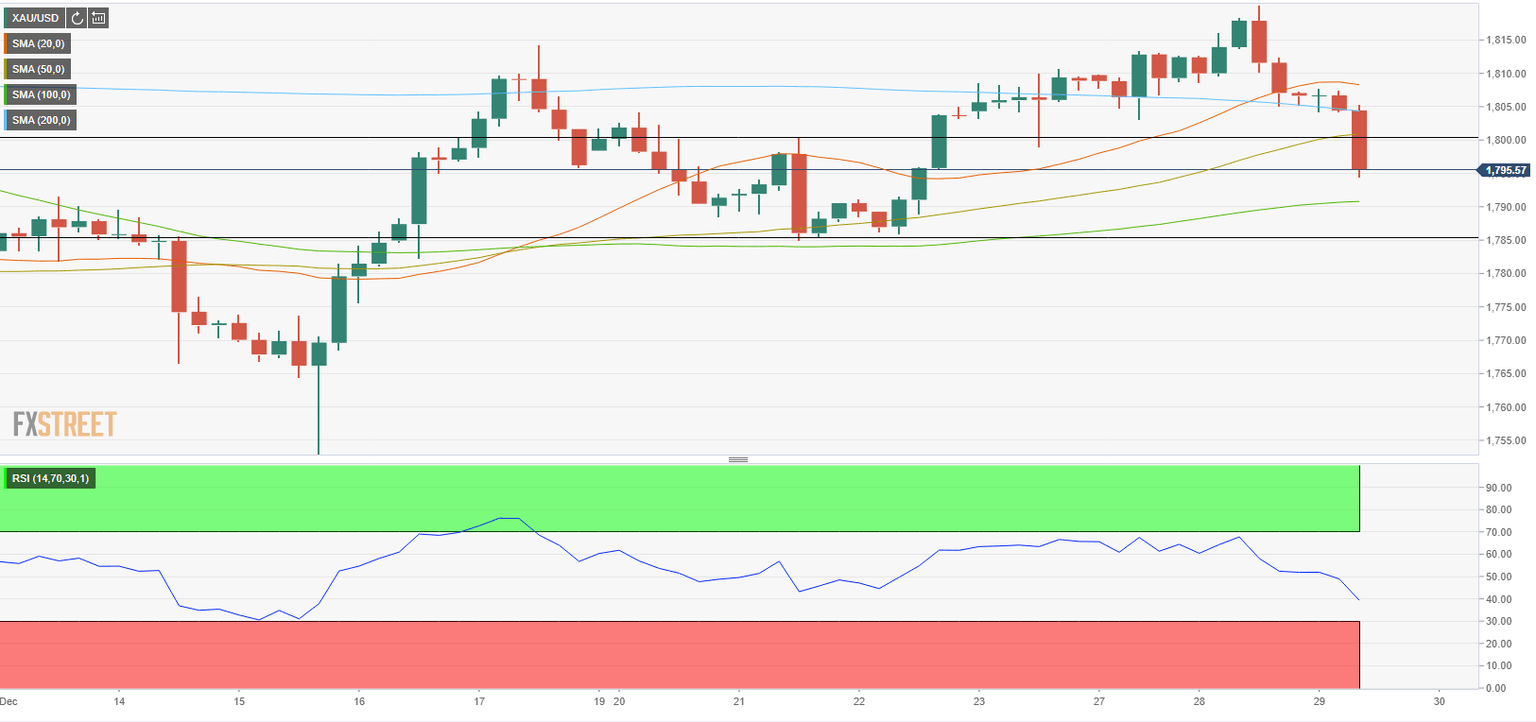

On the four-hour chart, the Relative Strength Index dropped below 50, confirming the view that the bearish pressure is gathering strength. On the downside, the 100-period SMA is forming the first near-term technical support at $1,790 ahead of $1,785 (static level).

On the upside, $1,800 (psychological level) aligns as first resistance before $1,805 (200-period SMA). In case a four-hour candle closes above the latter, buyers could see that as an opportunity to reclaim the control of the pair's action.

Additional levels to watch for

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.