Gold Price Forecast: XAU/USD grinds lower towards $1,800 on sour sentiment

- Gold remains sidelined as risk-off mood battles it’s traditional safe-haven status.

- Inflation woes push central banks towards tighter monetary policies, China’s covid conditions also strengthen flight to safety.

- Weekly horizontal support restricts short-term downside amid steady oscillators.

- Second-tier US data, risk catalysts are crucial for near-term directions.

Gold (XAU/USD) treads water at around $1,816 as traders remain divided over the precious metal’s outlook, due to its hedge-against-inflation status. In doing so, the commodity prices pay a little heed to the broad risk-aversion, despite being pressured during the early Asian session on Thursday.

Record high inflation in Eurozone joins a 20-year peak of the UK Consumer Price Index (CPI) and Canada’s upbeat price pressure data to propel the market woes that higher prices would weigh on growth. The same could be witnessed in the recently watered-down US Gross Domestic Product (GDP) forecasts from the leading banks.

Adding to the risk-off mood is the recent rush of the major central banks towards higher rates, led by the Fed, to ward off the negative impacts of inflation on the economy. However, doubts that the absence of easy money isn’t suitable for the time when supply chains are constrained seem to strengthen the rush to risk safety.

Also weighing on the market’s mood is Shanghai’s refrain from total unlocks and an increase in covid cases in mainland China, as well as fresh virus-led activity restrictions in Tianjin, the port city near Beijing. On the same line were headlines concerning the Russia-Ukraine crisis as the West braces for more sanctions on Moscow for invasion of Kyiv.

While portraying the mood, Wall Street benchmarks saw the red while the US 10-year Treasury yields dropped 11 basis points (bps) to 2.88% by the end of Wednesday’s North American trading session. It’s worth noting that the S&P 500 Futures drops 0.60% intraday at the latest.

Although gold traders are in dilemma over its traditional safe-haven status, a firmer US dollar exerts downside pressure on the prices. Hence, today’s second-tier US data are also important to determine short-term XAU/USD moves, in addition to the risk catalysts mentioned above.

Also read: Gold Price Forecast: Steady around $1,820 as overheating inflation spurs fears

Technical analysis

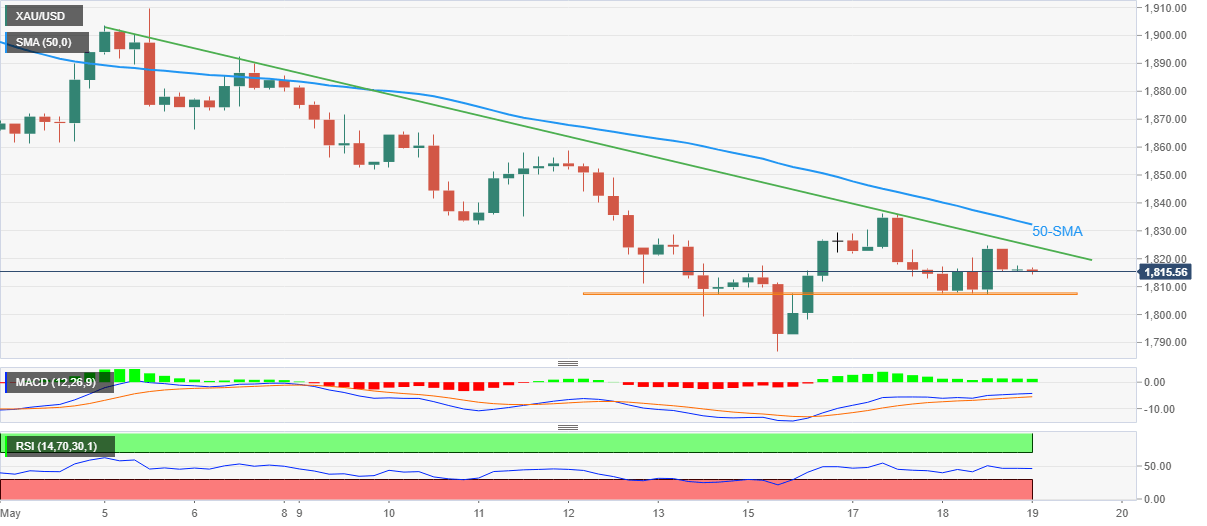

Gold prices fade bounce off one-week-old horizontal support amid receding bullish bias of the MACD, as well as steady RSI (14), which in turn highlights the $1,808-07 area for the bears. However, any further downside needs validation from the $1,800 threshold before challenging the monthly low near $1,787.

Alternatively, a two-week-old descending trend line near $1,825 restricts immediate upside ahead of the 50-SMA level surrounding $1,834.

Overall, gold prices are stuck in a range between $1,807 and $1,825 of late.

Gold: Four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.