Gold Price Forecast: Steady around $1,820 as overheating inflation spurs fears

XAUUSD Current price: $1,822.15

- Inflation is in the eye of the storm, doubling or tripling central banks’ comfort levels.

- Higher demand for government bonds maintains the greenback strong across the board.

- XAUUSD could retest the weekly high, but bears are in charge.

Gold Price hovers around $1,820 a troy ounce, little changed on a daily basis for a fourth consecutive day. Markets participants are rushing to safety, leaving XAUUSD confined to a tight intraday range. The latest catalyst for the ongoing sour mood came from the hand of inflation figures. The UK, the EU and Canada released their latest inflation figures, which doubled or even tripled the comfort levels of the respective central banks. It is worth noting, however, that the UK and the EU figures were slightly below the market’s expectations.

Meanwhile, the Wells Fargo Investment Institute revised the US growth forecast for this year to 1.5% from 2.2%, while S&P also downwardly revised it to 2.4% from 3.2% previously. The news has sent Wall Street diving, while demand for government bonds pushed yields sharply down.

Gold Price short-term technical outlook

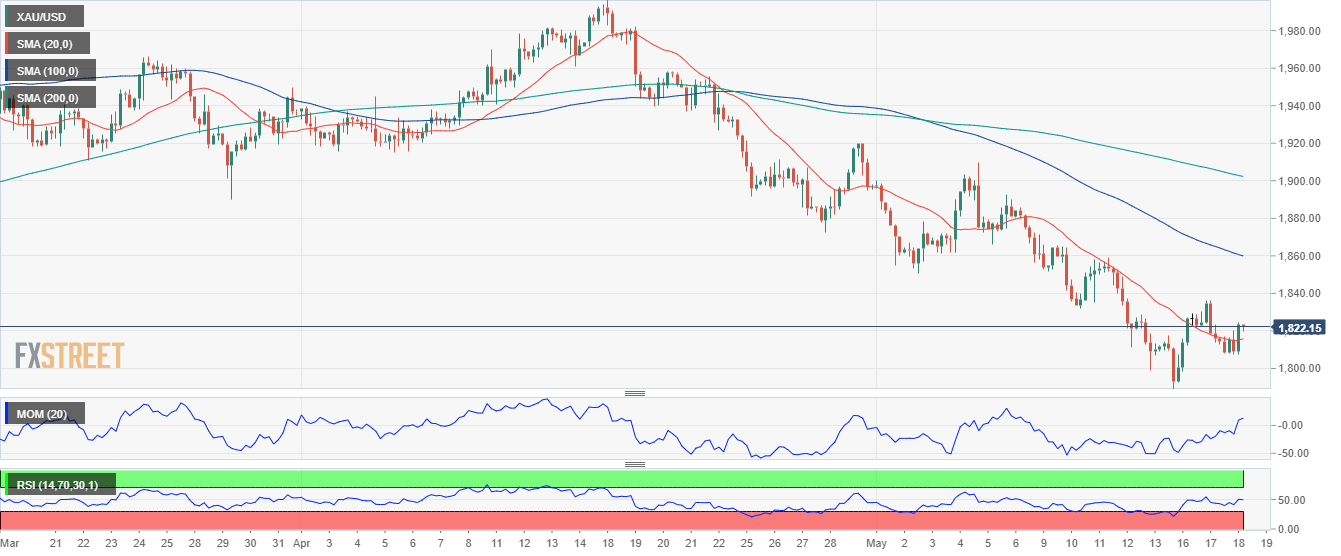

XAUUSD is technically bearish according to the daily chart. Price keeps developing below all of its moving averages, with the 200 SMA providing dynamic resistance at around $1,836.00, also the weekly high. Technical indicators, in the meantime, remain directionless within negative levels, hinting at absent buying interest.

The 4-hour chat shows that technical indicators advance, although only the Momentum stands within positive levels. Gold is currently seesawing around a flat 20 SMA, while the longer moving averages remain well above the current level, maintaining their bearish slopes. Bulls may have better chances if the pair breaks above the mentioned resistance level, but a substantial rally is off the table for now.

Support levels: 1,812.00 1,799.05 1,786.70

Resistance levels: 1,836.00 1,848.40 1,858.75

View Live Chart for the XAU/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.