Gold stays afloat despite high US yields as traders focus on Fed policy

- Gold sees a modest increase, as investors watch this week's central bank meetings.

- Focus remains on the Federal Reserve, where a hawkish stance could potentially impact Gold prices while bolstering the US Dollar.

- Recent US inflation data and Treasury yield resurgence, weighed on Gold prices.

Gold price registers modest gains on Monday amid a quiet session as investors brace for major central banks monetary policy decisions. Even though the Bank of Japan (BoJ), the Bank of England (BoE), and the Federal Reserve (Fed) would announce their decisions, the spotlight is on the latter. A Fed’s hawkish tilt could drive XAU/USD prices toward the $2,100.00 figure due to market participants' aggressive short positioning on the Greenback. At the time of writing, Gold trades at around $2,160.55, which is up 0.22%.

The price of the yellow metal remains underpinned by previous speculations that the Fed will begin to ease monetary policy sooner than expected. Nevertheless, during the last week, Bullion tumbled close to 1% as inflation in the consumer and the producer side on the United States (US) surprisingly reaccelerated, spurring a jump in US Treasury bond yields. Consequently, the Greenback posted gains of more than 0.69% last week, according to the US Dollar Index (DXY) and Gold’s slumped.

Daily digest market movers: Gold holds to modest gains as US yields rise

- On Monday, the US economic docket will featured housing data on the first two days of the week. Data from the National Association of Home Builders (NAHB) revealed that homebuilders' confidence rose in March to its highest level since July 2023, as mortgage rates dip, on expectations that the Fed might begin to ease policy. The NAHB Market Index came at 51, up from 48 in February.

- The US 10-year Treasury bond yield climbs two and a half basis points, up at 4.334%.

- The latest US economic data witnessed mixed readings in business activity, making it challenging to predict the pace of the economic deceleration in the US. The labor market has shown signs of cooling, though the economy added more people to the workforce than expected while fewer people applied for unemployment benefits.

- Given the backdrop, Fed Chairman Jerome Powell’s words in his testimony at the US Congress, suggesting that they would begin to cut borrowing costs, were justified. However, last week’s inflation figures and retail sales data triggered a repricing of Fed rate cut bets, aligning with the US central bank's view of 75 basis points of easing toward the end of 2024.

- The Fed’s next meeting is scheduled for March 19-20 next week. Given the latest inflation data, speculation is growing that Fed officials could eliminate one rate cut towards the end of the year, signaling they could cut rates twice in 2024.

- According to the CME FedWatch Tool, expectations for a June rate cut stand at 58%, down from 72% a week ago.

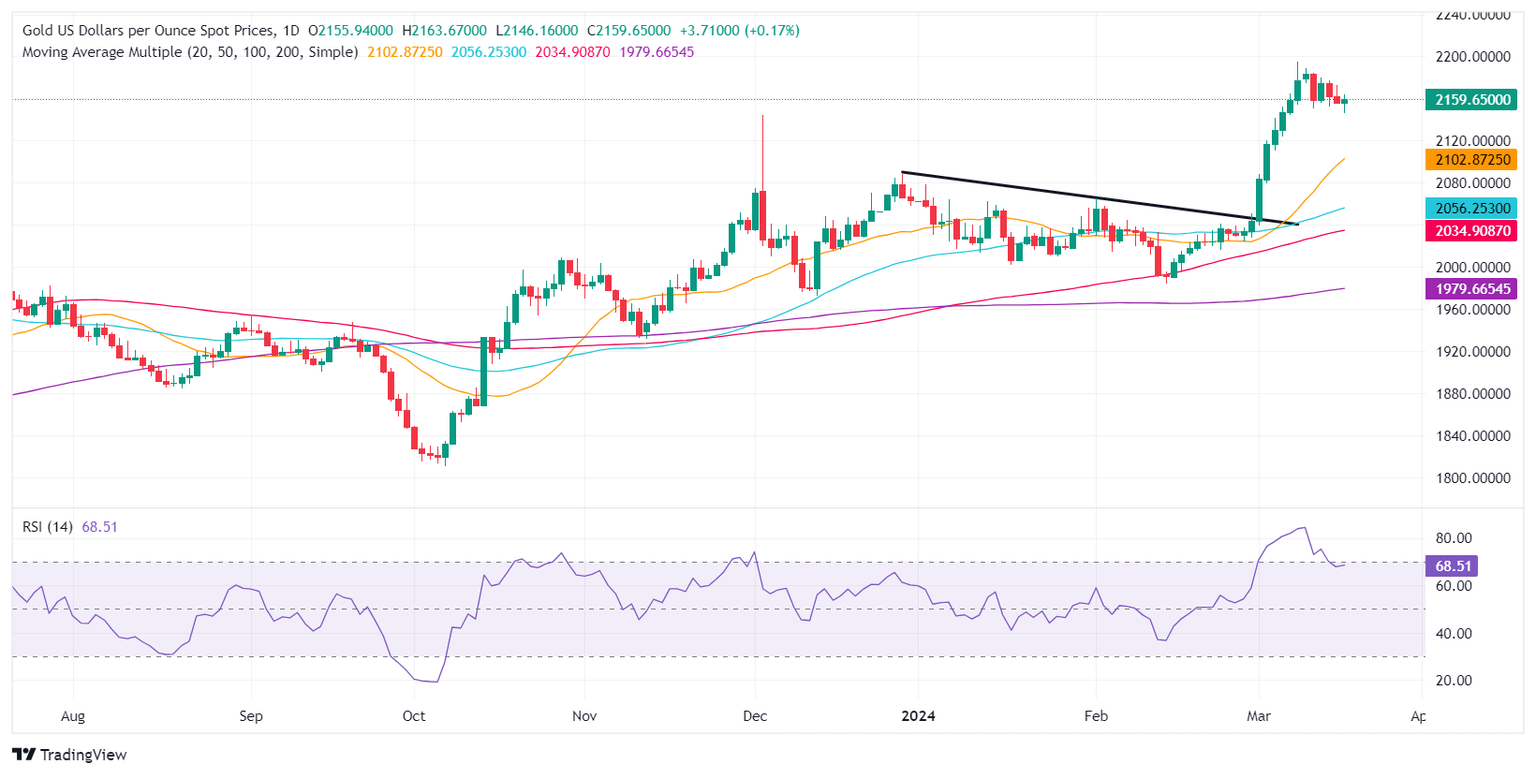

Technical analysis: Gold buyers take a breather below $2,170

Gold’s uptrend remains in place, though the non-yielding metal remains glued to the $2,160-$2,180 area. Market participants keep the XAU/USD spot price near the bottom of the previously mentioned range, which could suggest that buyers are in charge and could drive prices toward the year-to-date (YTD) high of $2,195.15, ahead of the $2,200.00 mark.

However, the Relative Strength Index (RSI) indicator exiting from overbought conditions suggests that buyers are taking a breather. If sellers stepped in, pulling Gold’s price below $2,160.00, that would pave the way to test the December 4 high of $2,146.79, followed by the March 6 low of $2,123.80, followed by $2,100.00.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.