Gold's upward swing continues as traders brace for US CPI

- Gold retreats slightly but remains bullish, balancing between risk sentiment and US Treasury yields.

- The decline in NFIB Small Business Optimism highlights cautious economic outlook.

- Federal Reserve's rate cut expectations and cautious stance underpin market sentiment.

Gold prices retreated on Tuesday after refreshing all-time highs reached $2,365 during the overnight session for North American traders. The yellow metal trimmed earlier gains amid a risk-on impulse and falling US Treasury yields, while the Greenback takes a breather after dropping 0.16% on Monday. The XAU/USD trades at $2,346, gaining some 0.35%

The US economic calendar was scarce, except for the poll of the National Federation of Independent Business (NFIB) Small Optimism Index for March fell for the third straight month from 89.4 to 88.5. Aside from this, market participants are awaiting Wednesday’s busy schedule with the release of the US Consumer Price Index (CPI) alongside the Federal Open Market Committee (FOMC) Minutes.

In the meantime, Fed officials remain optimistic that they will cut rates but emphasize the need to be patient.

Daily digest market movers: Gold trims gains amid high US yields

- The US Consumer Price Index (CPI) for March is expected to rise 0.3% MoM, below February’s 0.4%, but higher than the 0.17% pace needed to curb inflation to the 2% goal. On an annual basis, the CPI is expected to rise from 3.2% to 3.4%.

- Underlying inflation, also known as core CPI, is expected to dip from 0.4% to 0.3% MoM and from 3.8% to 3.7% YoY.

- Strong price pressure may dampen expectations for rate cuts in June, whereas softer inflation figures could fuel speculation for rate reductions.

- Last week’s stronger-than-expected jobs report kept interest rate investors skeptical of a Fed rate cut in June’s meeting, with odds tumbling from around 70%.

- The CME FedWatch Tool depicts traders remaining slightly more optimistic than Monday, with odds for a 25-basis-point rate cut in June up from 52% to 57.8%.

- World Gold Consortium reveals that the People’s Bank of China was the largest buyer of the yellow metal, increasing its reserves by 12 tonnes to 2,257 tonnes.

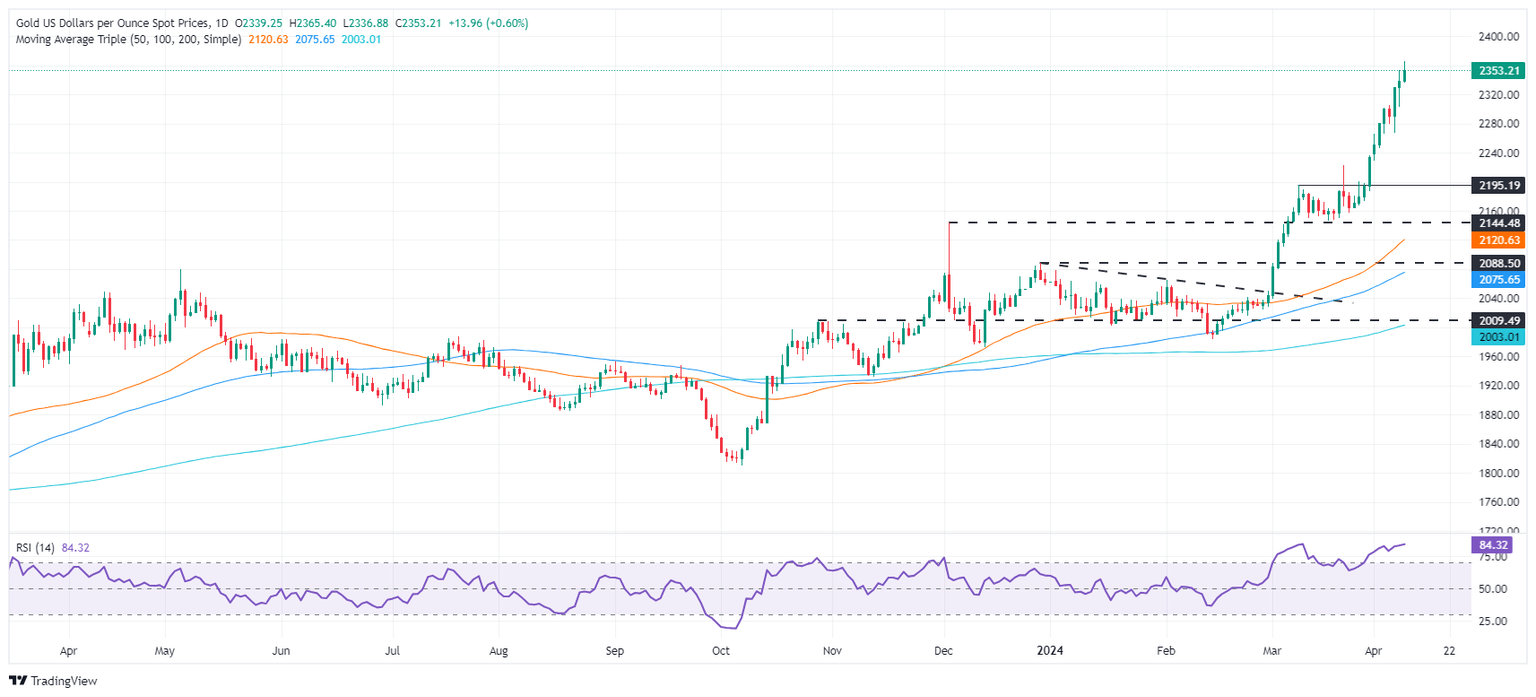

Technical analysis: Gold’s advance stalls near $2,350 as bulls take a breather

Gold’s rally paused close to $2,350 as the Relative Strength Index (RSI) hit 84.23, its highest level since March 8. This indicates that the RSI is overbought and that the yellow metal is getting less appealing to investors.

If Gold prices dip below the $2,350 area, that will expose the April 8 daily low of $2,303. Once surpassed, that could put downward pressure on the yellow metal and drive it to March’s 21-session high of $2,222. Further losses are seen at $2,200.

On the other hand, if XAU/USD resumes its rally, buyers are eyeing $2,400 and beyond.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.