Gold Price Analysis: XAU/USD to test key 50-DMA hurdle on its way to $2000

- Gold poised for a rally towards the $2000 mark in the week ahead.

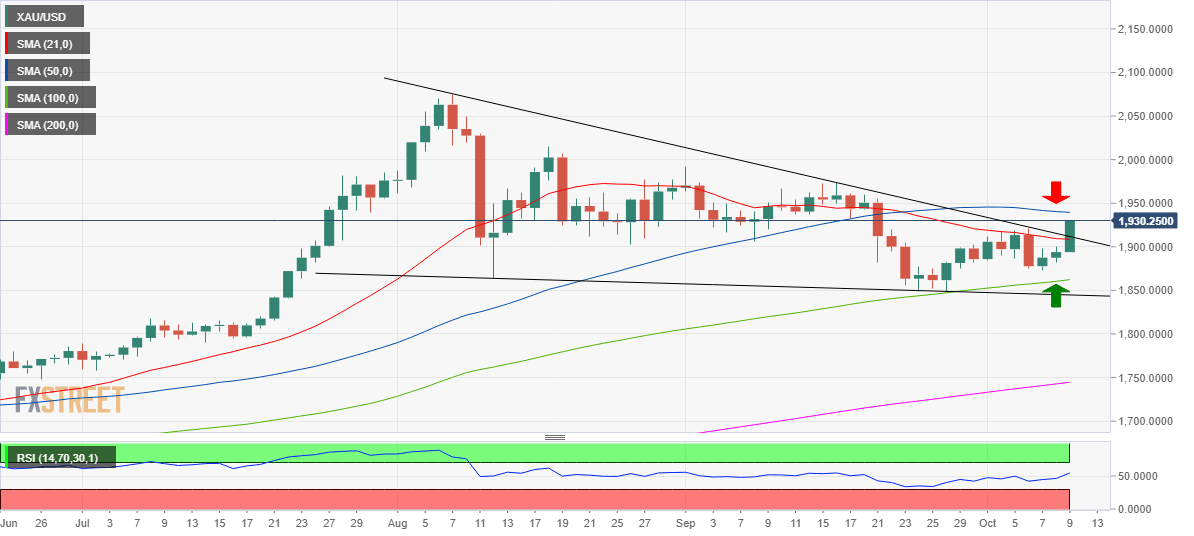

- Bulls charted a classic falling wedge breakdown on the daily chart.

- A break above 50-DMA resistance is critical to take on the further upside.

Following the settlement at two-week highs of $1930, Gold (XAU/USD) remains poised to extend the bullish momentum into a fresh week, courtesy of a classic technical breakout on the daily chart.

On Friday, the metal finally delivered a daily closing above the critical upside barrier at $1911, the confluence of the 21-daily moving average (DMA) and falling trendline resistance, yielding a falling wedge breakdown.

The technical breakout added credence to the bullish reversal from the two-month lows of $1849, opening doors for a retest of the $2000 mark in the coming week.

However, it's critical for the bulls to take out the fierce 50-DMA hurdle $1939.50. The 14-day Relative Strength Index (RSI) pierced above the midline, pointing north at 54.55, indicative of more scope to the upside.

Alternatively, any profit-taking declines could be limited by the initial support at the abovementioned resistance-turned-support at $1911, below which the 100-DMA cap at $1862 could come back into play ahead of the two-month troughs.

All in all, the path of least resistance is to the upside.

Gold: Daily chart

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.